Insight Focus

Some Brazilian soybean producers are delaying sales. The US-China trade war and a record harvest have contributed to this decision. However, potential risks to this strategy include pricing pressure and competition from Argentina’s harvest.

Soybean Producers Adjust Commercial Strategy

Some of Brazil’s most capitalized soybean producers are adjusting their commercial strategy, opting not to sell all of their production in the first half of the year. This decision, however, is limited to a small portion of stocks and does not affect export volumes, although it may indicate a trend toward changing commercial behaviour.

What is new, however, is that more producers are now willing to store part of their production, especially those with less need for immediate liquidity and those who have their own storage facilities, such as silos installed on their farms.

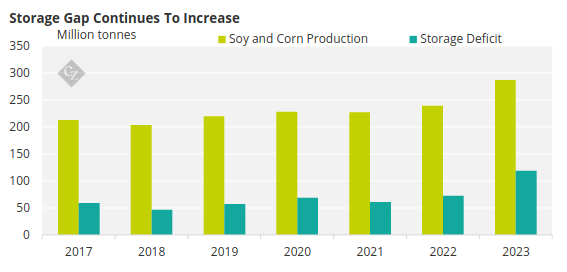

It is worth noting that Brazil is facing a chronic deficit in storage capacity, with clear signs of worsening. This structural limitation forces many producers to quickly sell their production.

Trade War on the Radar

But what has led the most capitalised producers to postpone the sale of part of their harvest?

One of the key elements driving this dynamic is the ongoing trade war between the US and China. There is widespread consensus that this could create bigger commercial opportunities for Brazilian soybean as the Chinese market tries to diversify from its US suppliers.

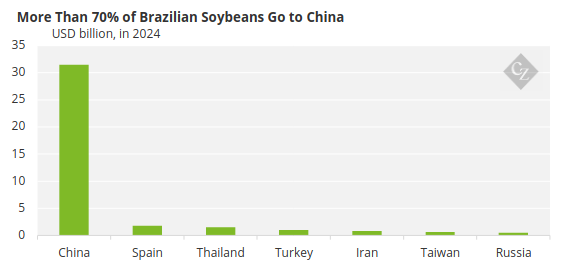

Today, Brazil exports more than 70% of its harvest to China. China is the world’s biggest soybean buyer, importing about 100 million tonnes per year primarily for animal feed and cooking oil.

Source: Comex

The precedent set during Donald Trump’s first term also plays a role in this equation. Between 2018 and 2019, during the first major trade dispute between the two countries, the Brazilian soybean export premium — an additional amount paid in relation to the international price —increases significantly to reach 148%. This was largely due to China concentrating its soybean purchases in Brazil.

During that period, the Brazilian soybean premium jumped from USD 1/bag to USD 2.50/bag, according to a survey by the consultancy Cogo Inteligência. Although a movement of such magnitude is unlikely in the current scenario — especially given signs of easing relations between Washington and Beijing — Brazilian producers maintain moderately optimistic expectations.

After all, the Chinese will pay an additional 10% tax to purchase US soybeans, while the Brazilian product remains exempt from tariffs.

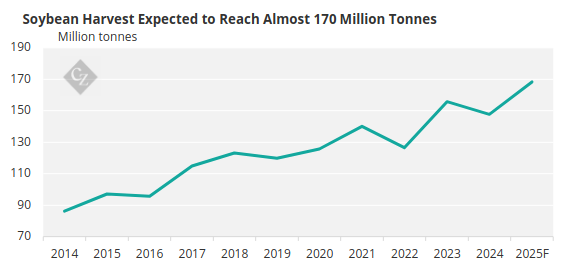

The expectation of record soybean harvests this year provides an additional reason for producers to postpone part of their sales to the second half of the year. Brazilian production is expected to reach nearly 170 million tonnes, ensuring a good supply of soybeans throughout the year.

Source: Conab

Postponing Sales Attract Risk

Despite the promising outlook, it is important to consider the risks associated with the strategy of postponing the sale of the harvest. One of the most apparent risks is the so-called “herd effect”: if a significant number of producers decide to withhold their product at the same time, the resulting joint release of supply could put downward pressure on prices.

Another key factor to watch is the recovery of Argentina’s harvest, which directly competes with Brazilian soybeans in the international market. According to estimates from the Buenos Aires Grain Exchange, Argentina is expected to harvest around 50 million tonnes in this cycle — a volume approximately 4% higher than the previous harvest.

Given this set of variables, the coming months will be crucial in assessing market developments and the effectiveness of the strategies adopted by producers.