Insight Focus

Crude oil prices and upstream costs have strengthened. US-China trade war negotiations continue. Chinese PET resin export prices have firmed following higher feedstock costs and high export demand. Geopolitical drivers remain highly uncertain so expect volatile daily price swings across the PET value chain.

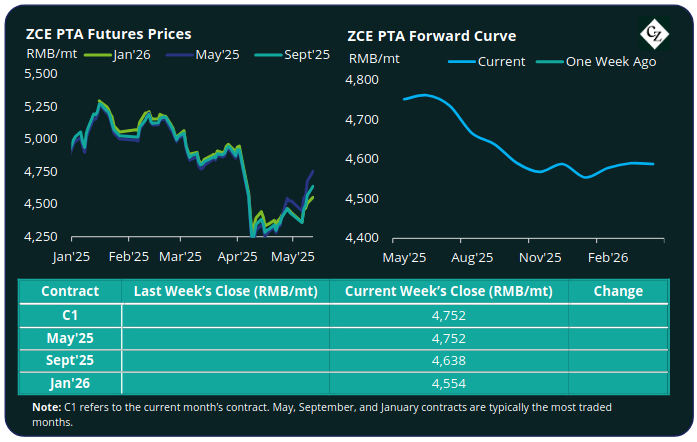

PTA Futures and Forward Curve

PTA Futures rebounded strongly through last week, with main month contracts up over 3% versus the pre-holiday close.

Crude oil prices were the main driver for higher PTA values, with Brent above USD 64/bbl on Friday. Early Monday, rumours that China and the US have decided to ease the tariff war fuelled bullish sentiment.

The PX-N CFR spread widened on tightening of PX supply despite a strengthening Naphtha market, with the average weekly spread up by around USD 24/tonne to average USD 185/tonne.

The PTA-PX CFR spread also improved further, averaging USD 185/tonne, up around USD 6/tonne last week. PTA supply and demand fundamentals strengthened as units went into maintenance and polyester operating rates increased.

Looking forward, PTA destocking is expected to continue at pace supported by high downstream demand within polyester and a tighter supply base due to planned and unplanned shutdowns.

The PTA forward curve drove further into backwardation. The Sept’25 contract is now at a RMB 114/tonne discount to the current contract, and Jan’26 holds just a RMB 198/tonne discount.

MEG Futures and Forward Curve

MEG Futures contracts were also buoyed by the rebound in global commodities, with main month contracts up by over 2%, versus pre-Labour Day holiday.

East China main port inventories fell back 4.8% to around 707,000 tonnes as import arrivals slowed. As a result, spot liquidity tightened, supported by higher-than-expected polyester operating rates, and domestic supply constraints.

MEG destocking is expected to continue at pace through the remained of May, remaining tight and potentially alleviating port inventories.

The MEG Futures forward curve remains relatively flat/in slight backwardation. The Sept’25 contract held a RMB 60/tonne discount over May’25 and the Jan’26 held a RMB 71/tonne discount.

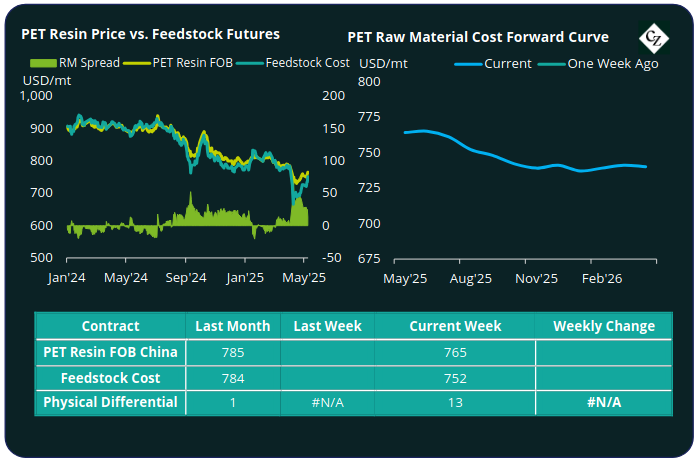

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET resin export prices strengthened following rising feedstock costs, to an average of USD 765/tonne FOB China by Friday, up USD 10/tonne versus the pre-holiday close.

The average weekly PET resin physical differential against raw material future costs continued to slide lower to a weekly average of positive USD 22/tonne last week, down USD 9/tonne. By Friday, the daily differential was back down to just positive USD 13/tonne.

The raw material cost forward curve moved further into backwardation, with Sept’25 at a USD 16/tonne discount over May’25, and Jan’25 holding a USD 26/tonne discount over May’25.

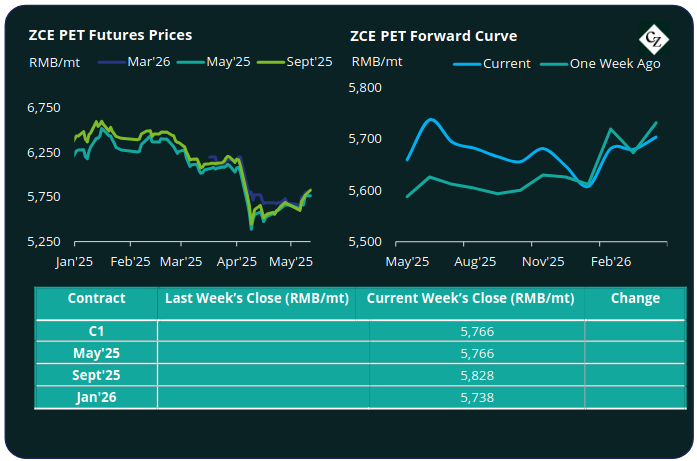

PET Resin Futures and Forward Curve

PET Resin Futures were also lifted by the more bullish upstream market, although prices were perhaps slower to respond, increasing by around 1.8% versus pre-holiday. May’25, the current main month with the highest liquidity increased to RMB 5,766/tonne (USD 797/tonne), up around USD 19/tonne on the previous week.

The average weekly premium of the May’25 PET Futures over May’25 Raw Material Futures decreased to USD 16/tonne, down USD 2/tonne.

The PET Resin Futures forward curve remains volatile, learning towards backwardation. Sept’25 held a RMB 62/tonne (USD 8/tonne) premium over May’25, and Jan’25 had RMB 28/tonne (USD 4/tonne) discount over May’25.

Concluding Thoughts

Due to recent low pricing, Chinese PET resin producers saw near-record level order in-take in April, around 690,000 tonnes for the month.

Over-stocking as well as firming of the price over the last week may see May orders slow. However, even with the physically differential retreating, profitability is still good. Producers are resistant to cut production and move units into maintenance at present.

Production is expected to remain high through May and into June, with any production increase as a result of line restarts expected to be offset by maintenance plans.

In the near-term, spot prices look set to firm, supported by rallying raw material costs. However, geopolitical drivers remain highly uncertain and will continue to see volatile daily price swings.

Close attention should also be paid to changes in ocean freight rates, and blank sailing levels. Any reprieve in US-China tariffs could also create a demand spike.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.