Insight Focus

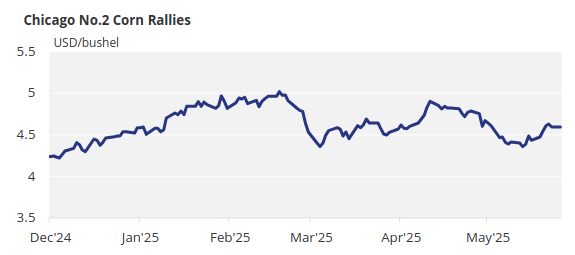

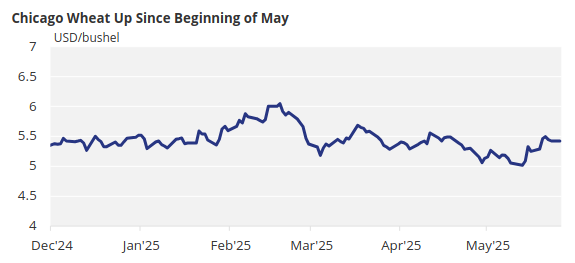

There was an uptick in corn and wheat prices amid dry weather across Europe. However, we believe most of the downside risk for grains has already been priced in by the market. As old US corn stocks tighten, we do expect more volatility, though.

Corn and wheat have rallied in all geographies on weather worries, which has created a race for short cover. Fears of lower yields in Europe due to dry weather in Europe has finally emerged as we had also suggested. But as mentioned in last week’s report, all the negative news has been priced in already.

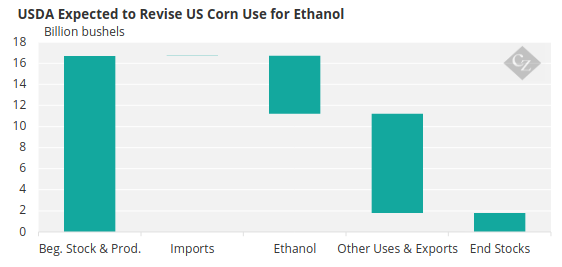

Higher corn demand for ethanol in the US is yet to be reflected in any of the coming WASDE reports, but the Chicago basis rallied USD 0.25/bushel last week, a sign that old crop corn stocks are getting tighter. In the coming few weeks, we should expect further weather volatility but consolidation of last week’s gains.

Source: USDA

There is no change to our forecast for Chicago corn for the 2024/25 crop (September/August) to average USD 4.55/bushel with some downside risk depending on the trade war. The average price since September 1 is running at USD 4.48/bushel.

Corn Trends Positive

Corn started positive last week in Chicago with strong export inspection data that came in above market expectations. This combined with slower-than-expected planting progress, heat in Europe and China and spec funds holding a huge net short to trigger a short covering rally through Thursday, with Friday being the only negative day.

The slower planting progress was less of a worry due to the very quick US corn planting pace since the beginning of the season. US levels are currently very much above both last year’s level and the five-year average. US corn is 78% planted, ahead of the 67% recorded last year and the five-year average of 73%.

We should see another slow advance in corn planting in the US as ample rains continue to impact field work negatively. The US will experience ample rains again for a fourth week in a row. This should be reflected in this week’s planting progress report.

But persistent dry weather in Northern Europe and very hot weather in China last week sparked fears of lower yields. Despite European grains not showing any damage yet, persistent dry weather in Northern Europe is at risk of causing the dryest spring on record for some regions. The forecast for this week is dry again, which means we could see a quick deterioration in the coming weeks.

In Argentina, corn harvesting is 38.8% complete with 80% of the area in normal to good condition, unchanged week on week. In Brazil the summer corn harvesting is 82.3% complete, about four percentage points ahead of last year and around three percentage points ahead of the five-year average.

French corn planting reached 95%, compared with 77% last year and even exceeded the five-year average of 92%. Conditions were 87% good or excellent versus 83% last year. Corn planting in Ukraine is 93% complete. Corn planting in Russia is 78.5% complete.

Wheat Crops Still Progressing Well

Wheat rallied too as US wheat conditions deteriorated, although they remain fairly good. The US wheat condition was 52% good or excellent, down two points on the week but still above the 49% recorded last year. Spring wheat planting is 82% complete, ahead of 76% last year and 17 percentage points ahead of the five-year average.

French wheat condition was 71% good or excellent, down two points week on week and an improvement of eight percentage points on last year.

CS Brazil is expected to remain dry again, which is normal for this time of the year, while Argentina is expected to receive ample rains again. Warm and dry weather is expected in Northwest Europe while the Black Sea region should receive some rains.