Insight Focus

The urea market is in flux amid Chinese exports and EU sanctions. Processed phosphate prices rose on limited Chinese supply but expected June exports may ease the pressure. Potash remains stable with China and India contracts guiding prices, while ammonia awaits June settlements in a bearish market.

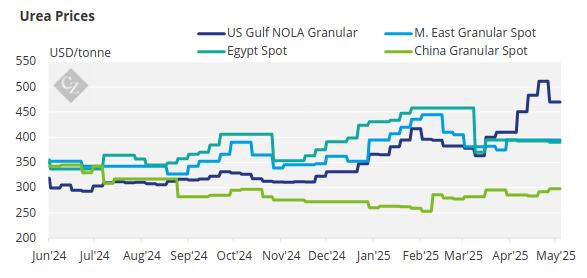

Urea Trade Stalls as Chinese Exports Delay

The urea spot market is remarkably quiet. The long-awaited Chinese export program has yet to come off with any meaningful activity, except for offers in the Ethiopian EABC tender. Rumours are plentiful, and the latest unofficial action plan is for CIQ processing to start Monday, May 26, at the earliest.

Processing time is expected to take another seven working days at best, with some inland production areas possibly taking up to 30 days to obtain certificates. What is clear is that traders are holding back on offering Chinese products due to the uncertainties involved.

On May 22, the European Parliament voted to impose tariffs on fertiliser imports from Russia and Belarus as the bloc seeks to increase pressure on the two countries following the full-scale invasion of Ukraine in February 2022. The Commission stated ahead of the vote that it may suspend the tariffs if there is a significant surge in fertiliser prices in the European market. It may also suspend import duties on other fertiliser suppliers to the EU.

The implication is that Russian producers will have to seek alternative markets. One solution could be for Nigeria and Algeria to supply Europe, with more volumes from Russia going to Brazil and the US. Interesting times indeed!

In other news, Pupuk Indonesia has apparently sold four trading companies one lot each of between 30,000 tonnes and 40,000 tonnes at USD 370.50/tonne FOB for shipment stretching into June. Both Petronas of Malaysia and BFI of Brunei appear to be sold out for the interim period. Furthermore, there is no news on Petronas’ Gurun urea plant, which has been or is under maintenance.

Iranian producers have also been active, with reports of sales of 90,000 tonnes of granular urea by producer Pardis at USD 338/tonne FOB Assaluyeh for June loading. In addition, Lordegan sold 20,000 tonnes at USD 334.30/tonne FOB, and MIS sold 26,000 tonnes at USD 334.20/tonnes FOB, both sales from BIK port. Kermanshah is the latest to sell, placing 30,000 tonnes at USD 335/tonne FOB BIK for June loading following its tender.

In comparison, SABIC is reported to have sold 50,000 tonnes at USD 380/tonne FOB with destination Ethiopia, down from USD 387/tonne FOB on the last sale. Egyptian urea output continues to decline due to gas supply issues. Apparently, only three granular urea lines remain operational among six producers, with rates reduced to 70%. With limited volumes in storage, the latest sale for a small parcel destined for Europe was sold at USD 402/tonne FOB.

US/NOLA values continue to edge lower, with loaded barges offered at USD 445/short ton (USD 490/tonne) FOB NOLA against bids USD 30/short ton (USD 457/tonne) lower. Brazil is nearing the main buying season, with some bids around the USD 395/tonne CFR mark, although liquidity remains low.

Argentina’s imports for the January–April period were 82,000 tonnes, down from the 240,000 tonnes imported in the same period last year. Fertiliser consumption in South Australia and Western Australia, including urea, is down due to dry weather conditions.

India appears to hold the key to maintaining urea prices at current levels. Since only one vessel is left to be nominated under the earlier IPL purchasing tender for shipments to June 12, rumours are again circulating that another tender may be imminent. Until that happens, and with major markets still emerging, urea prices may remain under pressure.

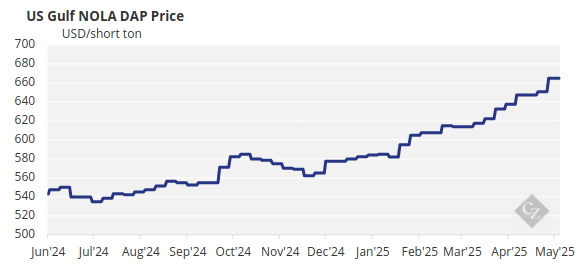

Phosphate Prices Climb on Tight Supply

Processed phosphate prices continue to rise due to limited supply. Chinese-origin DAP and MAP products should become available in June, so upward price pressure is expected to ease, with a distinct possibility of lower prices. However, for now, MAP prices in Argentina are pegged around USD 750/tonne CFR, while DAP prices are reported around the USD 750/tonne CFR mark, up from USD 730/tonne CFR last week.

In other news, EABC awarded 60,000 tonnes of Chinese diammonium phosphate at USD 690/tonne FOB. The deal included 30 days’ credit for May 25–30 loading, and two cargoes of 60,000 tonnes each of Saudi Arabian DAP to Midgulf at USD 712.52/tonne FOB Ras Al Khair for June 5–10 and June 15–20 loading, against its May 13 tender for 425,390 tonnes of DAP.

An Indian importer bought 30,000 tonnes of Russian DAP at USD 738/tonne CFR for June loading in the Baltic. Also, Australian Incitec Pivot sold a duty-free DAP cargo to India at USD 752/tonne CFR. NFL received no offers against its re-tender for two cargoes of 50,000 tonnes, plus/minus 10%, of black/dark brown/dark grey DAP for shipment by June 15.

Chinese MAP 11-52 has been offered at USD 715/tonne CFR Brazil for June loading. DAP prices in Southeast Asia are reported to have firmed further this week to around USD 740/tonne CFR, with offers at even higher levels.

A Chinese producer is suggested to have sold DAP to Thailand at USD 720/tonne FOB, or around USD 740/tonne CFR, though further details remain unclear. Offers to Thailand had been reported by local sources at USD 740–745/tonne CFR. Offers to the broader Southeast Asia region are suggested to range from as low as USD 730/tonne CFR to as high as USD 755/tonne CFR.

Southeast Asia’s DAP prices were assessed last week up USD 12–13/tonne at USD 725–735/tonne CFR, with bids at the lower end of the range and offers at the upper end.

Demand at current prices has declined in the region, and buyers are hoping that an imminent increase in Chinese export availability will provide some DAP price relief in the short term.

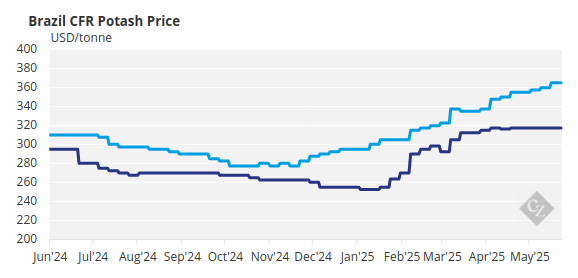

Potash Prices Steady, Contracts Pending

Potash prices remained largely unchanged this week, as market momentum slowed across most key regions following the IFA conference.

The main story this week has been the outcome—or rather, the lack of clarity—surrounding the Pupuk Indonesia tender, which finally concluded on May 9 after a month-long wait. Rumours suggest the tender volumes have been reduced, with only BPC confirming an award at USD 360/tonne CFR for 25,000 tonnes of firm cargo and 25,000 tonnes of optional cargo of red standard MOP.

Two out of the five remaining producers in the tender have confirmed they did not receive volumes. Overall, producers are relieved that the tender concluded at the initial offer level of USD 360/tonne, especially after Pupuk Indonesia counterbid twice—first at USD 330/tonne CFR and then at USD 338/tonne CFR. At one point, the tender was at risk of being scrapped.

Despite this, the Southeast Asian market remains quiet, with attention focused on the final results of the tender and the upcoming potash contracts. These events are expected to provide a fresh benchmark for the region and support ongoing bullish market sentiment.

Attention has fully shifted to the upcoming potash contracts for China and India, with market participants closely monitoring developments. The Chinese MOP contract remains under negotiation, with no new settlement or price agreement yet. At the IFA conference in Monaco, discussions reportedly centred on a range of USD 330–360/tonne CFR.

Meanwhile, in the domestic market, traders are still trying to push prices higher. Port wholesale prices have firmed slightly to an average of RMB 3,100/tonne FCA (USD 431/tonne), despite supply and demand being well balanced. Demand in the region has eased significantly with the end of the spring application season and limited potash needs for the upcoming summer corn season.

In India, contract negotiations remain stalled, with neither Indian importers nor overseas producers engaging yet. India is reportedly waiting for a new benchmark from China before proceeding with its own settlement. In the meantime, estimated stock levels have declined by 13% week-on-week to 195,000 tonnes.

The drop is attributed to demand from the Kharif season and the lack of fresh cargoes arriving. While India is not currently in a rush, this may put pressure on them to come to the table sooner rather than later.

The Brazilian market remained unchanged this week, with no sales reported at the USD 370/tonne CFR level for July—a price producers have been pushing for over the past month. Market activity has been limited, with some suggesting that buyers are already fairly well-covered for the 2025–2026 soybean crop compared to this time last year.

Potash prices are likely to firm slightly in the coming weeks as the market awaits the settlement of the China and India contracts.

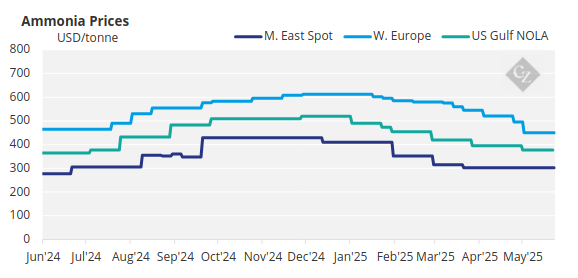

Ammonia Prices Seek Direction

With new spot business continuing to be concluded on undisclosed terms, ammonia markets on both sides of the Suez are searching for firm price direction for June. General supply-demand fundamentals suggest that most benchmarks are positioned toward the downside.

While no fresh deals were concluded out of Algeria this week, market players are divided on where current prices are, with a wide differential between buy- and sell-side targets. The Algerian range continues to influence delivered price ideas into NW Europe, where LAT Nitrogen will soon receive a second Russian spot cargo in as many weeks from EuroChem.

This comes despite the same buyer supporting EU measures to impose tariffs on Russo-Belarusian fertiliser imports, in an effort to reduce the bloc’s reliance on “regimes actively undermining European security and democracy.”

Prices are expected to remain stable-to-soft moving into June, with Tampa likely to serve as a helpful barometer for just how bearish the market—particularly west of Suez—currently is.