Insight Focus

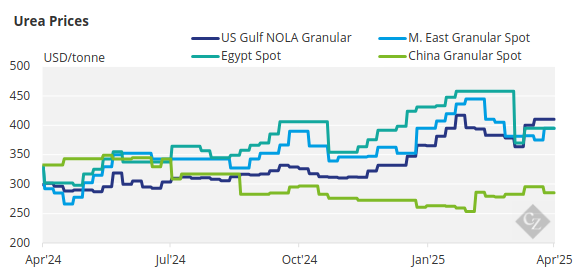

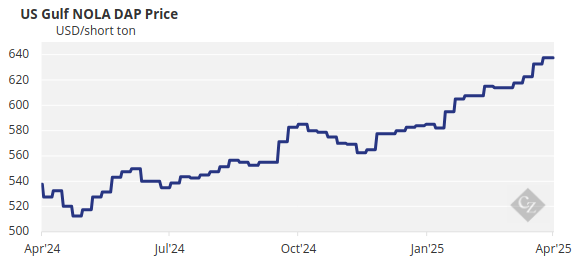

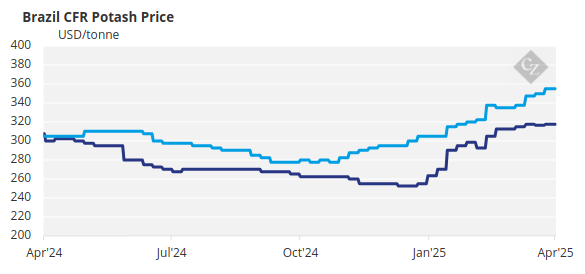

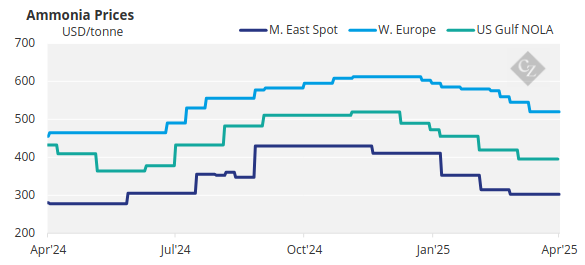

Urea prices rose on strong spring imports to the US/NOLA. Phosphate prices held steady overall, though US/NOLA values continued to climb. Potash saw modest gains in Brazil, while ammonia remained under pressure amid oversupply.

Urea Prices Surge on US Demand

Urea barge prices in the US escalated this week, with prompt shipments commanding the highest prices, although May values also rose. The perceived shortage of urea has finally encouraged buyers to step in daily and chase up the price. Imports were always down, but this had not been enough to spark a price rally—until now.

As the season gets underway and urea supply tightens further due to some switching from UAN, which is in short supply, the market has climbed. Increased corn acreage is also adding fuel to the fire.

This has supported North African values, which were expected to fade as European interest waned. However, there is still demand from Europe helping to fill out the Egyptian lineup. Combined with strong pull from North America, this has helped push prices to USD 395/tonne FOB. A general squeeze on supply persists for those seeking product both westbound and eastbound.

Nigeria has experienced production issues at Dangote, and the lack of fresh cargoes coming to market has shortened what traders saw as the supply availability for May. The Middle East remains comfortable, with a strong lineup for India and Australia continuing to pick off cargoes, adding to the achievable premiums.

No new Middle East prices have emerged, but Indonesia recorded a price of USD 402.50/tonne FOB for a May cargo—well above the owner’s estimate of just under USD 390/tonne FOB. The cargo is expected to go to Australia. There are reports of a second cargo that may have also traded, from an available volume of 140,000 tonnes.

Baltic producers appear comfortable with shipments to Latin America and India. Granular and prilled values are reported around USD 350–355/tonne FOB, with some exceptions both higher and lower. Brazil is largely remaining on the sidelines, avoiding the stampede in the US, which it hopes will be short-lived.

The outlook for prices is firm in the very short term. However, a prolonged absence of Indian buying could bring values under pressure as we move into May.

Phosphate Market Holds Firm Amid Tight Supply

Most price benchmarks for DAP and MAP remained stable this week, as activity slowed following sharp increases in recent weeks. However, further price climbs were evident in the US, and higher prices still seem likely globally in the coming weeks due to tight availability.

US NOLA barge prices rose again as buyers struggled to source product, with MAP now at its highest level since October 2022. Import options into the US are limited by countervailing duties (CVD) on Moroccan and Russian supply, while tariffs proposed under the Trump administration could further restrict imports or raise domestic prices. Midwest prices also increased despite poor affordability—now at its worst levels since 2008.

Hopes for China’s imminent return to the export market grew dimmer still this week, with no news on export quotas emerging from a CPFIA meeting in Hubei. The lack of Chinese supply is keeping global availability tight, with China’s Q1 DAP/MAP exports down to a 23-year low of 111,046 tonnes—a 54% drop from Q1 2024. This compares with 1.5 million tonnes in Q1 2021 and 1.17 million tonnes in Q1 2023.

India created confusion in the market after the Department of Fertilizers instructed importers not to purchase above USD 675/tonne CFR, even though three deals had already concluded in the USD 690–700/tonne CFR range. Business in India has paused, with NFL cancelling its MoU enquiry for 100,000 tonnes due to a price gap of over USD 30/tonne between the sole offer and the ‘ceiling price’.

Additional demand from Ethiopia’s EABC has further tightened DAP availability. The latest EABC tender closed this week with offers significantly higher than in the previous round. Over recent months, the importer has pivoted from NPS to DAP, issuing multiple tenders and absorbing supply in an already tight market.

EABC typically imports more than 1 million tonnes/year of NPS from Morocco. It is believed to have secured 660,000–720,000 tonnes of DAP so far, including a 55,000-tonne cargo from China in Q4 2024 and the rest this year.

Morocco’s FOB price for DAP rose again this week on new business with Europe, reaching its highest level since March 2023, although the number of fresh deals was fewer than in recent weeks. Global NPK prices also remained stable-to-higher this month, with rising DAP/MAP prices lending support and Indian demand remaining strong ahead of the Kharif season.

Prices are expected to increase further over the coming weeks as demand picks up and supply remains exceptionally tight. Affordability concerns persist, but buyers have limited options. Any reversal in direction now seems unlikely before at least mid-Q2 and will depend on improved supply and greater buyer confidence.

Tight Supply Supports Potash Outlook

Potash prices remained largely unchanged this week, with modest increases in Brazil and China. The global market retains bullish momentum, primarily supported by tight supply and strong demand.

Brazilian potash prices saw a modest increase, rising by USD 5/tonne to USD 350/tonne CFR, supported by increased June sales. Though volumes were limited, June sales were reported at USD 355–360/tonne CFR, up from the previous week’s USD350–360/tonne range.

July offers were even higher at USD 360–370/tonne CFR, though producers appear to be holding back, anticipating further gains. Strong demand for the 2025–2026 soybean season continues to support the market, though some expect a slowdown in July when buying winds down.

Pupuk Indonesia drew attention this week after its USD 330/tonne CFR counteroffer on its MOP tender was rejected by all suppliers, whose offers ranged from USD 360–400/tonne CFR. The price gap may result in the tender being scrapped, though this remains unconfirmed.

In Southeast Asia, potash prices remained flat for the second consecutive week, despite suggestions of upward movement. Standard MOP prices held at their highest since June 2023, while granular prices remained at their highest since January 2024. Given the limited offers and tight supply amid strong demand, prices are expected to continue rising in the weeks ahead.

Granular MOP prices in the US showed limited movement, though field activity picked up later in the week. At NOLA, prices dropped USD 3/short ton to USD 312–320/short ton FOB (283-290/tonne) FOB.

In China, domestic prices rose slightly following the halt of the national potash reserve release. However, the price increase was tempered by the limited demand, with the spring application having recently concluded. Although approximately 1.1 million tonnes have been released in recent months, overall availability remains tight.

The market is now awaiting China’s next potash contract, which is expected to return consistent volumes to circulation. In the interim, the current corn planting season requires only minimal application of MOP, contributing to the subdued demand.

India’s 180-day potash contract remains pending, with negotiations yet to begin. Most expect China to settle its contract first, which would then guide India’s discussions. Meanwhile, the Indian market remains well-stocked, with no immediate buying pressure.

Despite the approaching application season, buyers are comfortable drawing down existing inventories in the absence of a new contract. Other key markets are closely monitoring the progression of the contracts, as it is expected to provide a fresh input into the market and establish the floor price in a bullish environment.

Potash prices are expected to rise further in the coming weeks, particularly in Brazil and Southeast Asia, supported by tight supply from production cuts in H2 and continued strong demand in key regions.

Ammonia Under Pressure Amid Oversupply

Ammonia prices on both sides of the Suez remained under pressure, with regional and global supply continuing to exceed limited demand in Europe and Morocco.

Attention now turns to Tampa, where Yara and Mosaic are expected to settle the May contract within the next week—likely at another discount to the previous month. Uncertainty remains over whether 10% duties on Trinidadian ammonia will be factored into the settlement, with clarification awaited. The Caribbean FOB price, adjusted downward last week to reflect tariffs, remains in place.

Regional availability remains steady, with cargoes continuing to flow from both Trinidad and the US Gulf. However, a second lifting from the 1.3 million tonne/year Gulf Coast Ammonia (GCA) facility in Texas has not yet been reported.

Across the Atlantic, Trammo sold a June cargo to OCP at USD 400/tonne CFR Morocco—USD 15/tonne below the last business with the phosphate major—highlighting growing bearish sentiment west of Suez. in Algeria, no new spot business was heard, though FOBs continue to inch downward with producers seemingly facing difficulties in maintaining current price targets. Algerian prices continue to shape – and erode – delivered values into NW Europe, where CF remains a prominent spot buyer. In Poland, Grupa Azoty is set to receive an Algerian consignment via Trammo early next week.

East of Suez, Middle Eastern supply remains solid, with steady production from the major regional producers. However, availability will be partially impacted by a seven-week turnaround starting in early May at Ma’aden, which has cut May exports to 125,000 tonnes. Around 40% of this volume will go to India, where demand appears to have paused. The market is awaiting the outcome—if any—of FACT’s April 22 tender for 1H June material.

Further east, Fertiglobe purchased a Kaltim cargo from Mitsui for delivery to Europe, while Mitsui picked up spot material in Malaysia for delivery to Morocco. In North Asia, spot demand remains absent in South Korea and Taiwan, although contract prices have not yet declined further.

A recent influx of cargoes into China has led to a few re-export shipments from Zhanjiang, though overall activity remains subdued.

Ammonia prices are unlikely to gain support going into May. The upcoming Tampa settlement is expected to guide the extent of any further declines in the coming weeks.