Insight Focus

The fund shorts in the Paris and US wheat markets are extraordinarily large. As the Northern Hemisphere harvest begins, the seasonal appetite for selling short may be less than in past years, despite some fundamental bearish supply headlines being peddled by the bears.

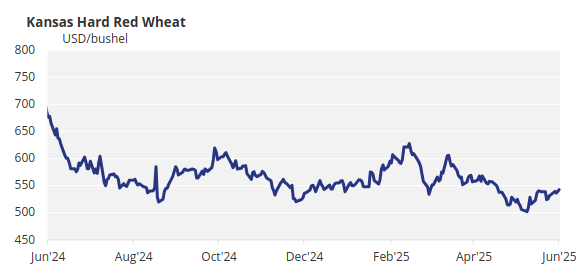

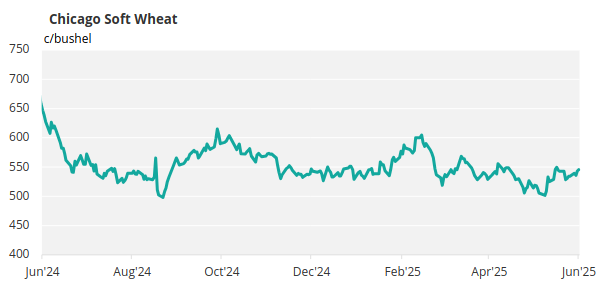

Wheat Markets Struggles Near Lows

Wheat prices across the world are struggling to raise themselves from at or near contract lows, as seen in the charts below. Any rally is sold into by the funds, comfortable with their work over previous months.

Funds Hold Massive Short Positions

A basic explanation for the funds in the wheat markets is that they trade the futures markets but do not take delivery of, or trade physical wheat. As a result, they are obliged to close out their positions prior to delivery execution and are, in essence, financial rather than agricultural institutions.

Currently, they have sold a huge amount of wheat futures contracts, meaning they are ‘short’ in the Paris and US wheat markets. Current estimates stand at:

- Nearly 300,000 lots short in Paris.

- Circa 94,000 lots short in Chicago.

- Kansas has seen a slight bounce off the all-time record but is still short 74,000 lots.

Putting these numbers in perspective, funds are short the equivalent of nearly 40 million tonnes of wheat in these three markets combined. That is larger than the total wheat production in any individual country except the US, Russia, India and China. Alternatively, it is nearly 5% of projected global wheat production for 2025!

Uncertainty Looms in Months Ahead

As the longer-term fund shorts see good profits in their positions, understandably there is little incentive for them to buy these contracts while the likes of the USDA project increasing supply and stocks for the year ahead.

Nonetheless, there are some interesting fundamentals at play in the world’s largest wheat producer, consumer, importer and stockholder, China. News reports suggest a potential shortfall of between 3.5 million tonnes to 10 million tonnes as the harvest continues. This is due to significant dryness and would flip world stocks from a year-on-year increase to yet another year of decline.

In addition, weather has been less than ideal through much of the Northern Hemisphere winter for most major wheat growers. Conditions have generally improved, and optimism reigns as upcoming harvest forecasts have recently improved.

For many months, buyers around the world have seen a market where buying hand to mouth has proven rewarding, as willing sellers at lower prices have been commonplace.

Buyers have been lacklustre over recent weeks and even months.

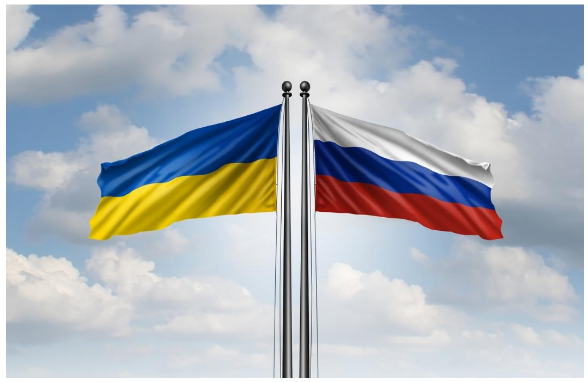

Russia’s continued war on Ukraine is more in focus currently, as Ukraine increases pressure on the Kremlin with military strikes many thousands of kilometres inside the heart of Russia.

Takeaway Thoughts on Funds

Funds have huge shorts in wheat markets, with the structured long-term fund shorts not appearing concerned at present.

Many factors could derail the supply versus demand and global stocks outlook estimated in last month’s USDA WASDE Report.

The usual seasonal fund selling of wheat throughout the Northern Hemisphere harvests would require the funds to go even more short of contracts than their current record. This is theoretically possible, but how much further can they really go?

With markets showing hourly volatility on both the upside and downside of previous closes, there appears to be a lack of genuine commitment on the part of market participants as they await further harvest and geopolitical news.

The market may seem relaxed and comfortable near the lows, with funds hugely short, buyers not eager to purchase and farmers not keen on selling without some margin of profit. There is much to be wary of.

A fund short of nearly 40 million tonnes across markets could not be bought in swiftly. However, anything that triggers such enthusiasm could spark extreme price movements over a matter of days.

Another day, another dollar—but exposure to the current market could prove to be make or break for profit!