Insight Focus

Grain prices fell globally on strong planting and weather. Near-term downside risk persists due to expected rain and trade tensions, though a supportive WASDE report may offer relief. We maintain our outlook for Chicago corn, with no changes to the 2024/25 forecast.

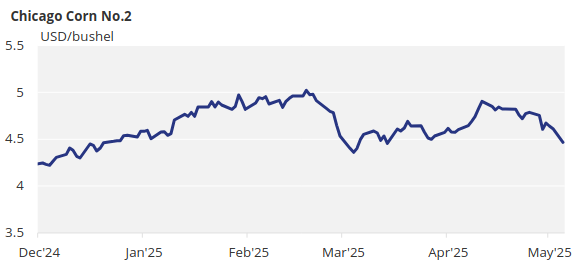

There are no changes to our forecast for Chicago corn for the 24/25 crop (September/August), which is expected to average USD 4.55/bushel, with some downside risk depending on the trade war. The average price since September 1 is USD 4.48/bushel.

Grains fell again across all regions due to good planting progress and favourable weather. In addition to good planting progress for US corn and favourable wheat conditions, plummeting crude oil prices, which pressured the soybean complex, helped the negative week.

Grain Prices Fall on Planting Progress

Good planting progress for US corn and US spring wheat, along with a significant improvement in US winter wheat conditions last week, triggered a selloff last Tuesday.

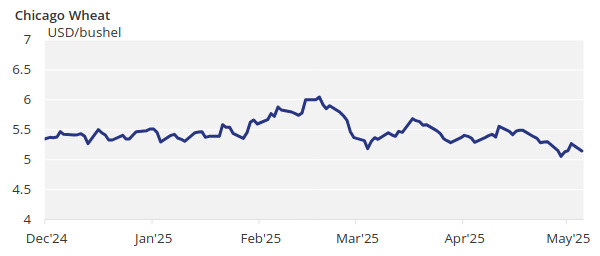

Bargain buying emerged on Wednesday, erasing some of the losses, but selling continued during the second half of the week, with weekly losses exceeding 3% for corn in Chicago and slightly lower for wheat. European grains saw losses of around 1%, and Euronext corn broke the EUR 200/tonne level.

US corn is 24% planted, compared to 25% last year and the five-year average of 22%. In Brazil, the summer corn crop was 71.9% harvested, compared to 63.1% last year. In Argentina, corn harvesting is 31.3% complete, with 80% of the area in normal to good condition, unchanged from the previous week.

French corn planting reached 62%, compared to 42% last year and the five-year average of 63%. Corn planting in Ukraine is 48% complete, and Russian corn planting is 32.6% complete.

Wheat Falls as Weather Improves

US wheat prices fell sharply last Tuesday after winter wheat conditions improved significantly, well above market expectations, and spring wheat planting made significant progress. Monday’s price action had already been negative following favourable weather over the previous weekend.

In Europe, the German Farmers’ Association projected German wheat production at 21.4 million tonnes, up 15.7% year-on-year, which put further downside pressure on Euronext wheat. However, the association is concerned about low soil moisture due to a drier and warmer-than-average April. French wheat conditions were 74% good or excellent, unchanged from the previous week and up from 63% last year.

US wheat conditions were 49% good or excellent, up 4 percentage points from the previous week, and in line with last year’s 49%. Spring wheat planting is 30% complete, compared to 31% last year and the five-year average of 21%. In Argentina, BAGE projected a 6.3% increase in wheat area for the 2025/26 season, resulting in 20.5 million tonnes of wheat production, which would be a 10.2% year-on-year increase.

Weather Drives Volatility Ahead of May WASDE

On the weather front, the US is expected to experience a storm with heavy rains through the middle of the week, which could delay corn planting progress. Brazil and Argentina are expected to have dry weather. Northwestern Europe is expected to receive rains and cooler temperatures after last week’s high temperatures. The Black Sea region is expected to receive some rain, with warm temperatures.

Overall, favourable weather, good planting progress in corn and spring wheat, and US winter wheat conditions matching last year’s — which had been well below average until now — pressured all grains lower. It is a weather market.

The favourable planting weather in the US last week could show strong numbers in today’s report, but the heavy rains expected this week will cause some planting delays, which will be reflected in next week’s data.

The May WASDE Report will be released next Monday, and as we’ve been saying for some time, we expect higher corn usage for ethanol sooner or later. Expect continued volatility, with some downside risk this week as we anticipate good numbers in corn planting and wheat conditions, but also a supportive WASDE next week.