Insight Focus

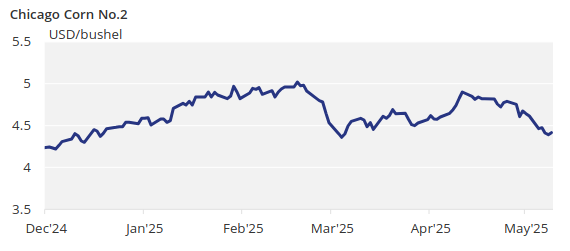

Grains fell again on strong planting progress and favourable weather. Monday’s May WASDE report is expected to show lower 2024/25 ending stocks but a sizable build in 2025/26 due to increased acreage. We maintain our 2024/25 Chicago corn forecast at USD 4.55/bushel, with downside risk tied to trade tensions.

There are no changes to our forecast for Chicago corn for the 2024/25 crop (September/August), which is expected to average USD 4.55/bushel, with some downside risk depending on the trade war. The average price since September 1 is running at USD 4.48/bushel.

Grains fell again across all geographies due to good planting progress and favourable weather. The May WASDE report is expected to show lower old crop stocks but a sizable increase for 2025/26.

Chicago Corn Plunges on Fast Planting

Corn in Chicago plummeted right at the opening last Monday, and again following very good planting progress, which is now above both last year and the five-year average.

Like the two previous weeks, the strong planting progress coincided with an improvement in US winter wheat conditions, pushing the entire complex down. Poor export sales also helped to support sales last week.

US corn is 40% planted, slightly higher than 35% last year and the five-year average of 39%. In Argentina, corn harvesting is 34.9% complete, with 80% of the area in normal to good condition, unchanged week-on-week.

French corn planting reached 79%, compared to 53% last year and the five-year average of 76%. Corn planting in Ukraine is 73% complete.

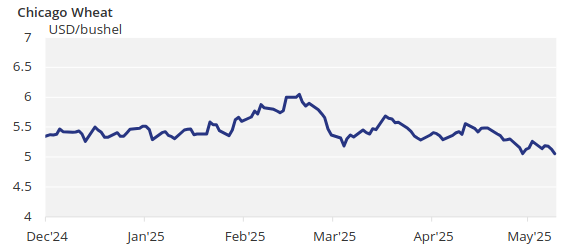

Wheat Slides on Crop Strength

US wheat conditions showed another improvement, which, coupled with poor export inspections, triggered a sell-off early last week.

French wheat conditions were 74% good or excellent, unchanged week-on-week and compared to 64% last year.

US wheat conditions were 51% good or excellent, up 2 points in the week and compared to 50% last year. Spring wheat planting is 44% complete versus 45% last year and the five-year average of 34%.

Weather Diverges Ahead of May WASDE

On the weather front, the US is expected to receive ample rains again in the Corn Belt and wheat areas. Brazil is expected to remain dry in the centre-south, while Argentina is forecast to receive ample rains. Northwestern Europe will remain dry, and the Black Sea region is expected to receive much-needed good rains.

The very good planting progress from last week was somewhat expected given the favourable weather, so the downside was not a surprise. However, two weeks of ample rains in the US will likely result in slower planting progress this week. That said, given the strong progress made so far, we don’t expect a major market impact.

Yesterday, the May WASDE Report was released, including the first estimate for 2025/26 supply and demand. For 2024/25, we expect an upward revision to the export number and to corn demand for ethanol—both leading to lower ending stocks and thus supporting prices.

However, the expected increase in planted acres for 2025/26 will result in a sizable stock build. The projected build-up should limit upside risk from the lower ending stocks expected for the old crop.