Insight Focus

Indian sugar prices have hit a high of INR 38,800/mt in recent weeks. Raw sugar and refined sugar export margins are negative today. The monsoon rains have come early this year.

Maharashtra Sugar Imports/Exports

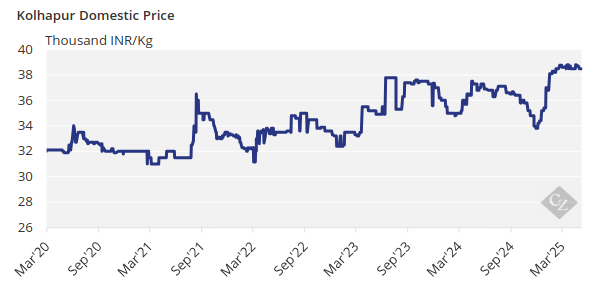

Domestic sugar prices hit another 6-year high of INR 38,800/tonne during the month before drifting lower to INR 38,700/tonne and are now trading at INR 38,500/tonne.

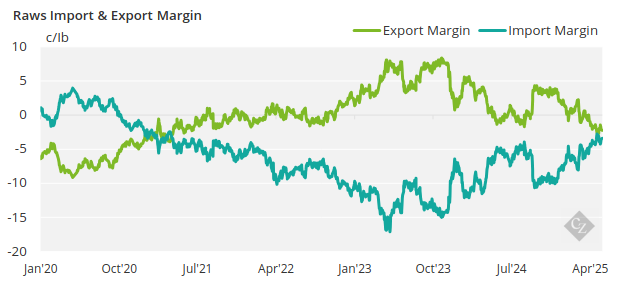

Export margins are still negative as the world sugar market remains weak. Mills would earn 2.4c/lb below the domestic market if they were to export their sugar today.

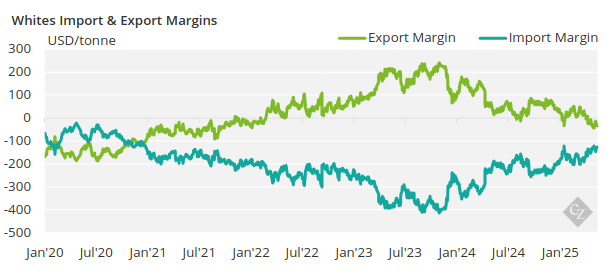

The white sugar export margin also remains negative today as mills would earn USD 40/tonne less than what they would if they were to sell in the domestic market.

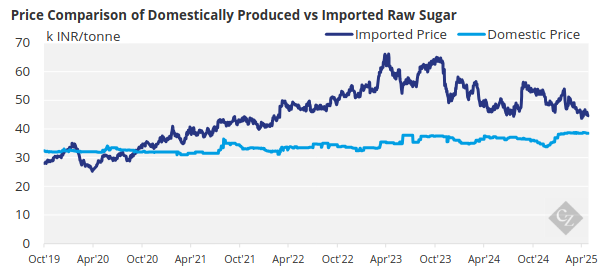

Indian sugar production in 2024/25 has rounded up to be below domestic consumption levels. Most local observers believe stocks are sufficient to meet consumption in 2025. If prices were to keep rising, the government may come under increasing pressure to allow and/or incentivise imports.

Prospects for next season will be heavily dependent on the monsoon which usually starts around the beginning of June. The monsoon has come early this year across the southern states especially.

Ethanol vs Sugar

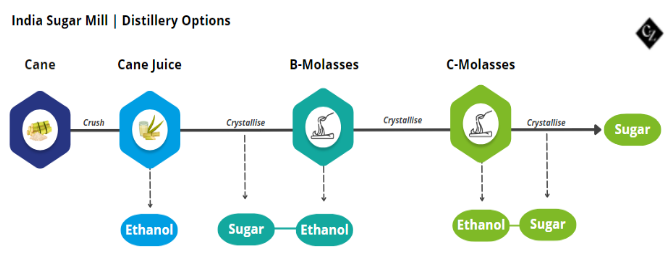

Many mills/distilleries have a choice over which feedstocks they use to make sugar or ethanol based on the relative prices of ethanol paid by the oil marketing companies.

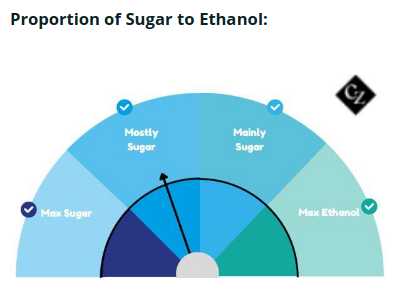

The Indian government has raised prices for C-molasses by 3% for the 2024/25 season to ensure that there is enough ethanol for the Ethanol Blending Program (EBP), as the 20% ethanol blending target is due this year.

Like the current season, the government had incentivised C-molasses production in the previous season to ensure that there was enough sugar supply for domestic consumption as food security was a priority for the government at the time.

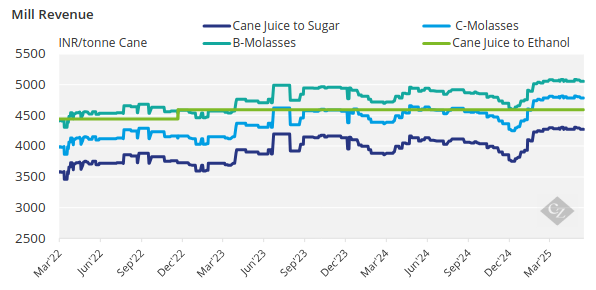

The revenue generated by the mills based on the type of feedstock used can be seen in the chart below:

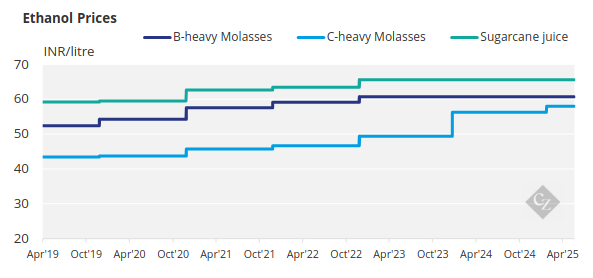

Here are the current prices paid for ethanol by feedstock:

Appendix