Insight Focus

- Sugar exports are currently prohibited.

- At today’s prices, processors continue to favour B-molasses to produce ethanol.

- Rumours of a potential duty on molasses exports in light of poor crop outlook.

Introduction

India, the world’s second-largest producer of sugar, aims blend 20% ethanol in gasoline by 2025.

This ethanol will be made from sugar cane and various grain feedstocks, which means many Indian mills now have a choice about how they use the sucrose in the cane. We will show the choices they are making in this report.

But if you want to learn more about the challenges associated with the ethanol program, please click here.

Maharashtra Sugar Imports/Exports

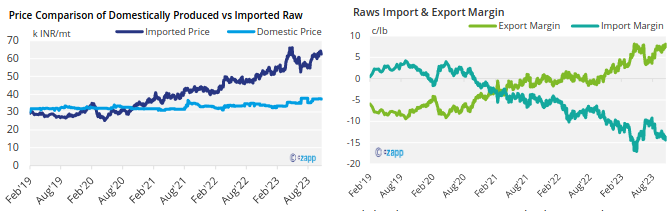

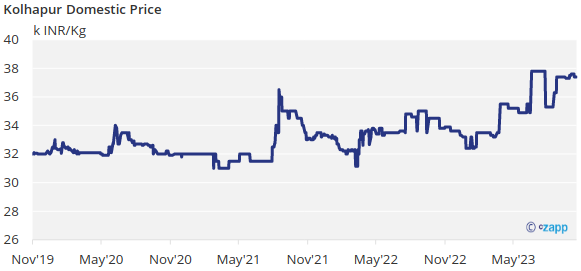

Domestic sugar prices in Maharashtra remains fairly unchanged at 37.4INR/kg. That said, prices are still 8% higher than what they were this time last year.

Whilst domestic returns are looking good, India could theoretically earn large margins over domestic sales if it exported its sugar. But what’s the problem?

India’s 2023/24 cane crop isn’t looking promising, and the government won’t approve any new sugar exports until after it has a better understanding of how large its upcoming cane crop will be. This may mean exports are only allowed from May’24 onwards, if at all.

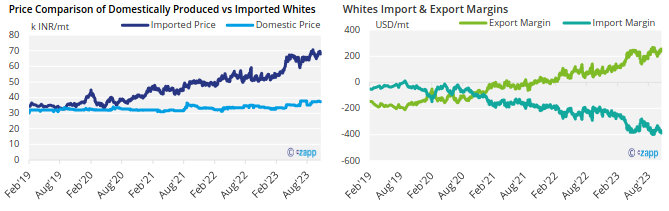

Raw sugar imports would only be workable at a local sugar price of INR 62/kg. Sugar prices are unlikely to rise this high, especially with a general election in May 2024, so raw sugar imports for domestic consumption would require some form of subsidy.

It’s a similar story for white sugar trade.

Ethanol vs Sugar

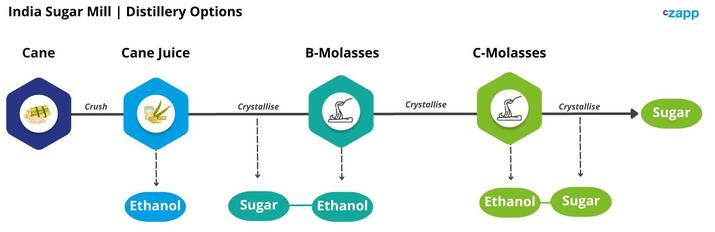

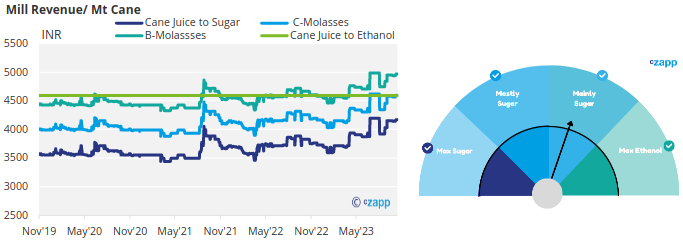

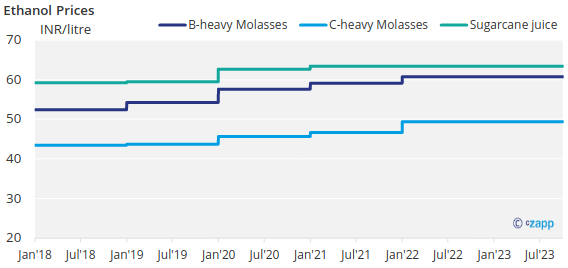

Many mills/distilleries have a choice over which feedstocks they use to make sugar or ethanol based on the relative prices of ethanol paid by the oil marketing companies.

At today’s prices, processors are most likely to choose to make ethanol from B molasses, which yields mainly sugar.

This means around 4-5m tonnes of Indian sucrose is being diverted to make ethanol currently, out of a total sucrose availability of around 33m tonnes.

In the event of a cane crop shortfall, the government can change the ethanol prices paid to incentivise mills to use C-molasses, or to use cane juice exclusively for sugar production, reducing the ethanol diversion. Here are the current prices paid for ethanol by feedstock:

Appendix

If you have any questions, please get in touch with us at Jack@czapp.com.