Insight Focus

- Economy is expected to grow just 0.8% this year, from 3% in 2022.

- Government spending should reach BRL 100 billion more compared to last year.

- Is currency devaluation inevitable?

Tenth largest economy in the world, Brazil started the year with a hazy scenario in the economic field. The forecast is for a timid growth of only 0.8% (compared to 3% last year and 5% in 2021) and inflation estimates that do not stop growing. It is true that these forecasts are not that different from those of other countries – the United States may even enter a recession this year and Europe should grow only 0.7%. Brazil, however, has an aggravating factor. The country has once again been haunted by a ghost that could drastically affect the economy.

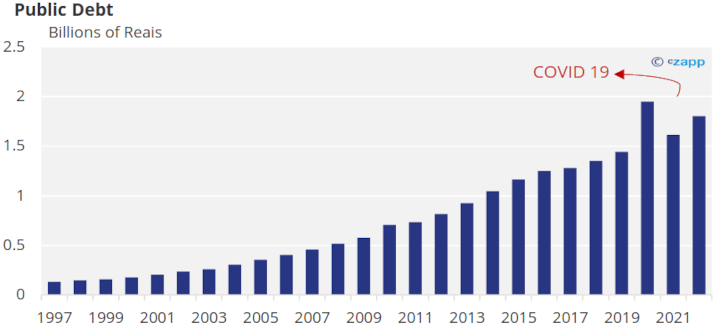

Unlike other countries, Brazil spends, for a long time, more than it collects. In the last decade, government expenditures increased by 155%, from BRL 707 million in 2010 to BRL 1,800 million in 2022. The payroll of civil servants represents about 13.5% of GDP, double (or even more) than in countries like Chile (6.6% of GDP) and Mexico (5.3%). To offset the growth in public spending, the country historically increased the tax burden.

Source: National Treasury

In recent years, efforts have begun to be made to change this scenario and allow for more sustainable economic growth. In 2017, the spending cap came into force, which prevented the government from spending more than the previous year’s total (in values corrected for inflation). It was also decided not to increase the tax burden and to freeze the salaries of civil servants, who no longer received raises. With these and other measures, Brazil managed to obtain a positive primary surplus (the difference between government expenditures and revenues) of BRL 54.1 billion, after eight consecutive years of a negative balance.

Now, spending should rise again. The new government, which took office on January 1, announced that it will not respect the spending cap. Public expenses should reach at least BRL 200 billion, twice as much as in 2022. It is no wonder that the market was surprised by the magnitude of the increase in expenses. The government would need to collect much more to cover the expenses, which is unlikely to happen. As a result, a picture of fiscal imbalance is drawn. And, in this regard, there is yet another aggravating factor. It is difficult to accurately estimate exactly how much the government will spend – it could be more than BRL 200 billion, as the final amount has not yet been defined.

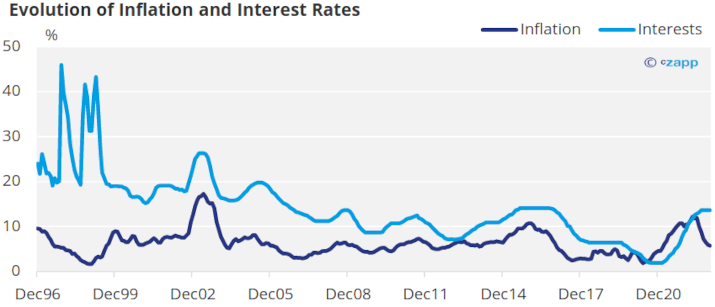

Source: BCB

The so-called fiscal risk, the perception that the government’s accounts could break down, returned to the pages of the press and the conversation circles of economists and market analysts. And why is this important? When there is a deficit in public accounts, as a result of spending greater than revenue, the government needs to borrow more money to pay its expenses. As with an individual or a family, government debt increases. The Union owes more money and, worse, is seen as an unreliable debtor, since it is spending more without saying how it will bear the extra expenses.

The government can issue bonds to help finance its debt. These are National Treasury bonds. Since the result of the presidential elections at the end of October, interest rates on these bonds have been rising. This means that investors are anticipating greater difficulty for the government to honour its commitments. At the same time, economists have been reviewing expectations about inflation and the economy’s basic interest rate.

When the government spends more, demand for products and services increases. Considering that the offer does not grow at the same pace, since companies have their planning and in general do not make short-term bets, everything is more expensive. In other words, inflation increases. This is what economists predict will happen in Brazil.

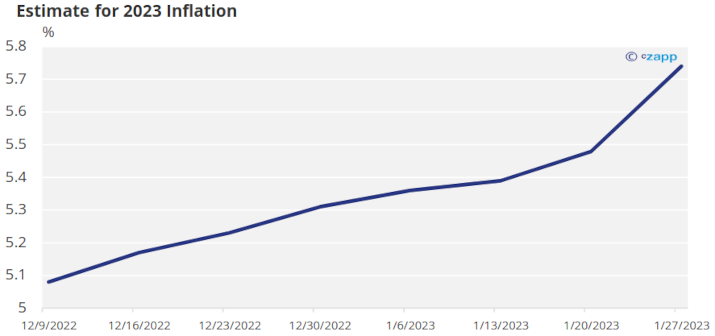

Source: Central Bank (Brazil)

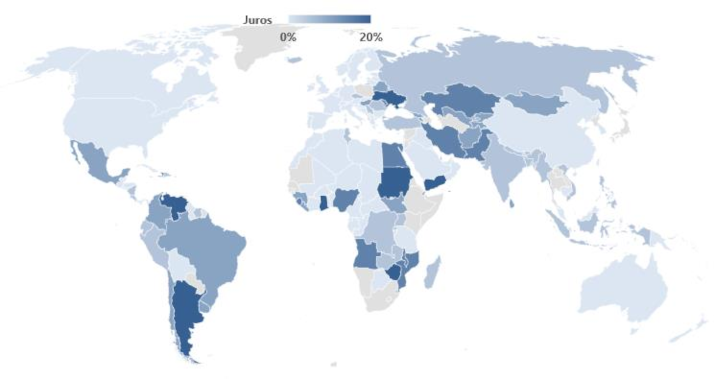

On January 30th, specialists who are part of the Monetary Policy Committee, of the Central Bank, predicted an inflation of 5.74% for this year, the seventh consecutive weekly increase. In the same week, the Central Bank announced that it should maintain the interest rate at 13.75%, one of the highest in the world, to contain the effects of inflation.

Interest Rates Around the World

Source: IMF

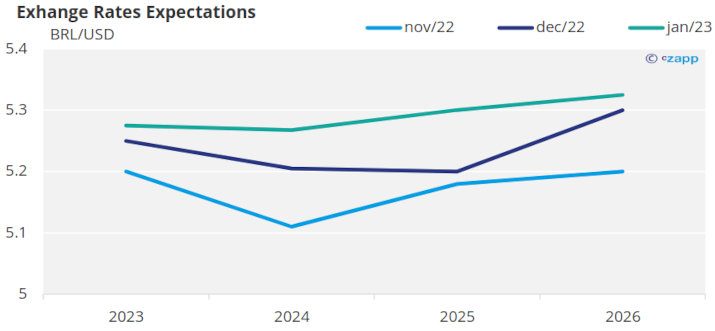

There is yet another fear. With the increase in fiscal risk – and insecurity in relation to the conduct of the economy –, the dollar can be considered a safer asset. The big question is when and how much the dollar can rise. For the time being, the exchange rate is around BRL 5. The biggest banks in the country forecast that the exchange rate should be around BRL 5.35 by the end of the year. But it is not a unanimous opinion.

“It is reasonable to expect the dollar to reach a level close to BRL 6 and an interest rate that should exceed the current 13.75% due to the deterioration of the macroeconomic scenario”, analyses economist Marcos Lisboa, founder and president of Insper. “The lack of confidence in monetary and fiscal policy is behind the forecast for the Brazilian economy”, says Lisboa.

Source: Brazil Central Bank Expectations System

Gabriel Barros, partner and chief economist at Ryo Asset, shares the same view. “With the government insisting on a loose fiscal agenda and rising inflation, the dynamic is one of devaluation of the real. It should reach BRL 5.5 in the middle of the year”.

If these predictions are confirmed, inflation could increase even more, a snowball effect. Brazil is dependent on imports, from machine parts to tractors used in agriculture, and any increase in the dollar generates an increase in prices.