Insight Focus

Urea markets remain uncertain as China signals limited exports. DAP and MAP prices climb on tight supply, with China offering reduced quotas of 2 million and 1 million tonnes, respectively. Potash remains firm amid pending contracts, while ammonia faces further price pressure due to weak demand and oversupply.

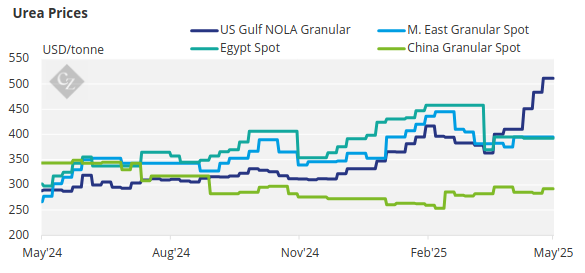

Urea Trade Slows as China Sets Terms

The fertilizer industry at large convened this week at the International Fertilizer Association annual meeting in Monaco. As a result, trading activity has been mostly absent, with the export situation for urea in China a focal point. Rumours have been flying left, right, and centre, with no official guidance from sources in China.

However, on May 15, the China Nitrogen Fertilizer Association (CNFA) held a meeting to discuss the urea export quota allocation. It has emerged that the application period for export inspection certificates to be submitted at the factory level is between May and September, with a deadline for customs declaration on October 15.

The validity period for export certificates will be one month after approval. The quota allocation is for 2 million tonnes, which is far below the initially reported 4 million tonnes. Whether an additional quota will be issued in the future will depend on the self-regulatory success of the current quota.

Further, another caveat is that ex-factory prices must not exceed those of May 6, when prices were approximately RMB 1,850/tonne (USD 255) ex-warehouse in northern China for both prilled and granular urea. The start date for the inspection application certificates has not yet been set, but it is expected to be as early as next week.

Another prohibition, yet to be officially confirmed, is that India destinations will not be allowed. The opinion in the industry is that if India is excluded, there are limited destinations for prilled urea, given limited Southeast Asian demand in the allocated export window. Three major state trading companies—SINOPEC, CNAMPGC, and CNCOO—have each been allocated 200,000 tonnes, with another 100 small state-owned companies sharing 1.4 million tonnes, for a total of 2 million tonnes.

In other news, Pupuk Indonesia will conduct an export tender on May 16 for 45,000 tonnes of granular urea, with expectations that it will export well in excess of 100,000 tonnes as per previous practice. With China in mind, it will be interesting to see the price at which traders will expose themselves unless there is back-to-back buying interest in Australia and Thailand. Both countries are in the middle of their buying season.

The last tender price was USD 402.50/tonne FOB, and with China reported to have sold at USD 355/tonne FOB earlier this week, we may reasonably expect a much lower FOB number this time compared to the last traded.

In other news, MOPCO of Egypt has sold 5,000 tonnes at USD 390/tonne FOB for end-May to early-June shipment to Europe. This price is up from last week’s assessed price of USD 385–390/tonne FOB.

The outlook for urea prices is bearish once the first exports from China come on stream—this until India re-enters the market with a new tender.

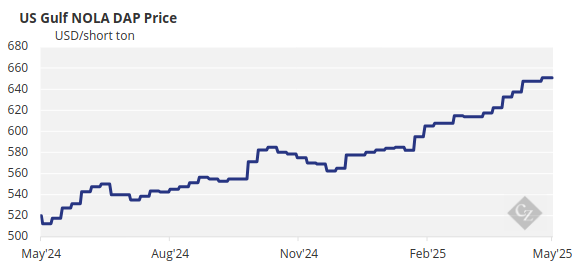

Phosphate Prices Keep Rising

The processed phosphate market is still plagued by limited supplies, with Chinese exports still absent. Prices keep going up despite concerns about demand destruction amid exceptionally poor farmer affordability. Relief may be coming, as it appears Chinese producers have been given quotas for the May–September period—DAP, albeit as low as 2 million tonnes, and MAP at 1 million tonnes.

If confirmed, this volume will be down from the 6.5 million tonne quota in 2024. In the full year of 2024, China exported 678,676 tonnes to India versus 3 million tonnes in 2023. China’s Q1 2025 exports of 111,046 tonnes represent a 23-year low and are 24% below the Q1 2024 level.

Adding to the tightness of DAP in the market is EABC of Ethiopia announcing a wave of DAP tenders, which soaks up any excess available volume.

India’s latest DAP sale is reported at USD 729/tonne CFR, up from the latest trade at USD 720/tonne CFR. India is in dire need of DAP for the Kharif season, and although buyers held out for a long time, they are now entering the market and paying up. In seven weeks, roughly 760,000 tonnes of DAP have been sold to the Indian market, with prices jumping an average of USD 83/tonne during the period.

MAP prices in Brazil are also moving up, with the latest price reported at USD 715/tonne CFR for Russian origin with June shipment. OCP of Morocco is still holding out for USD 740/tonne CFR.

The outlook for processed phosphate prices is bullish over the immediate couple of months until China enters the export market in earnest.

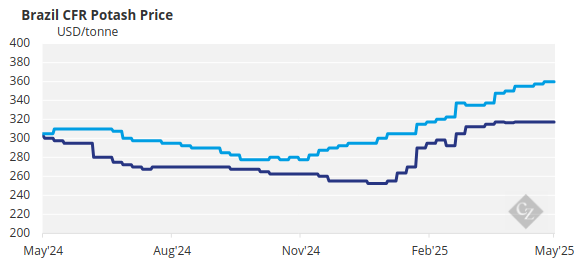

Potash Prices Hold Firm

Granular MOP benchmarks rose slightly this week in Brazil, Southeast Asia, Northwest Europe, and the US, as market players gathered for the annual International Fertilizer Association (IFA) conference. Potash took a backseat at the IFA event in Monte Carlo from May 12–14, with the focus shifting mainly to China’s urea and phosphate exports.

With little movement in prices week-on-week, all attention turned to the upcoming MOP import contracts for China and India, which are set to shape the market for the next six months.

The main focus this week was on China’s potash contract, where negotiations between importers and overseas suppliers continue. Rumours suggest a settlement range between USD 330–360/tonne CFR, marking a significant rise from the USD 273/tonne CFR agreed in July 2024. The country has been drawing down national reserves in response to strong domestic demand and tightening supply, exacerbated by production cuts from key suppliers. To mitigate this, the Chinese government stepped in, releasing 1.1 million tonnes via tenders from March 10 to April 15 to ease the supply pressure.

India’s potash contract is expected to settle after China’s, with prices likely between USD 340–360/tonne CFR. Current inventories of 225,000 tonnes offer short-term relief, but India will need to secure more supplies soon. Despite this, buyers are reportedly waiting for China’s settlement to set the benchmark.

In other regions, Southeast Asia is still awaiting an outcome for the Pupuk Indonesia tender, with market participants anxiously waiting for updates since the tender was floated on April 14. The tender is expected to be finalized by May 16, with awards anticipated at USD 360/tonne CFR. Rumours suggest the volume may have been reduced from the original amount, although this remains unconfirmed.

Brazilian potash prices have strengthened to USD 360–365/tonne CFR this week, though resistance to offers as high as USD 370/tonne CFR persists. Some market players have expressed concerns about a potential slowdown in price movement as the soybean buying season nears its end. Demand in the region from January through April has been record high, with roughly two-thirds of soybean potash needs already met.

The outlook for potash prices is stable to firm.

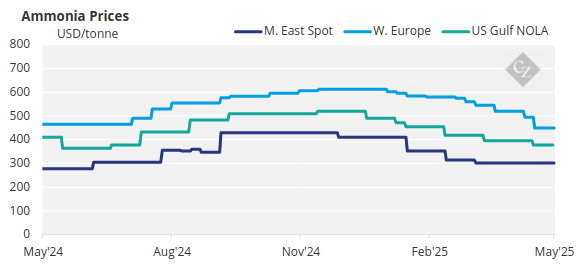

Ammonia Market Remains Cautious

Ammonia remains finely poised following the conclusion of this week’s industry gathering in Monaco, with little in the way of transparent business to firmly shape price direction. Still, sentiment remains largely oriented to the downside, with supply still largely outweighing demand on both sides of the Suez.

Prices should extend declines in the West moving into June, though it appears benchmarks east of Suez may soon find a floor, provided they have not done so already.