Insight Focus

- PTA and MEG futures chase upstream costs higher, as WTI recovers above $100/barrel.

- Downstream polyester demand remains weak, may pick up through to October.

- PET resin export margins ease, but still high on thin supply.

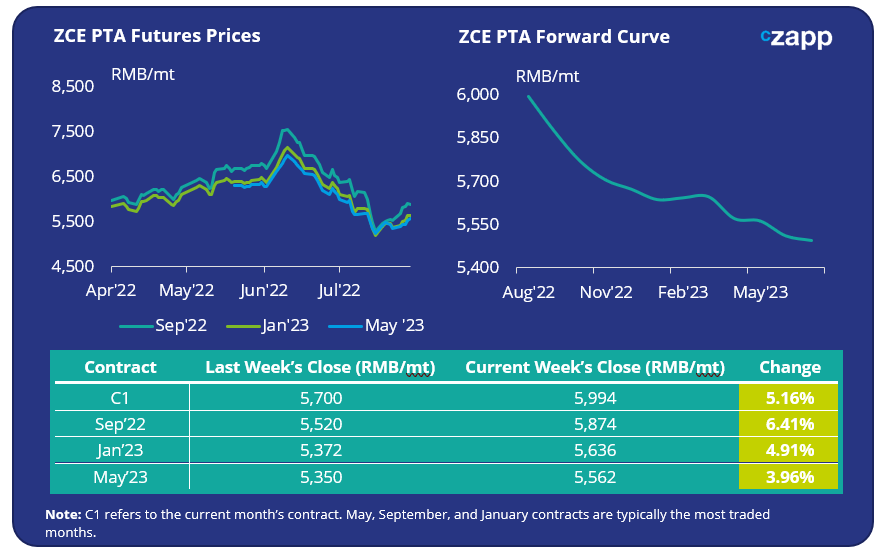

PTA Futures and Forward Curve

- PTA futures rose last week tracking higher PX and upstream costs, with WTI back above $100/barrel.

- Downstream demand remains weak. However, with more PTA producers moving into maintenance in August, supply is except to be reduced, improving fundamentals slightly.

- Although polyester production has been threatened by electricity curbs and COVID outbreaks in recent weeks, operating rates are expected to increase steadily through to October, supporting PTA demand.

- However, the PTA forward curve remains in steep backwardation through Q3.

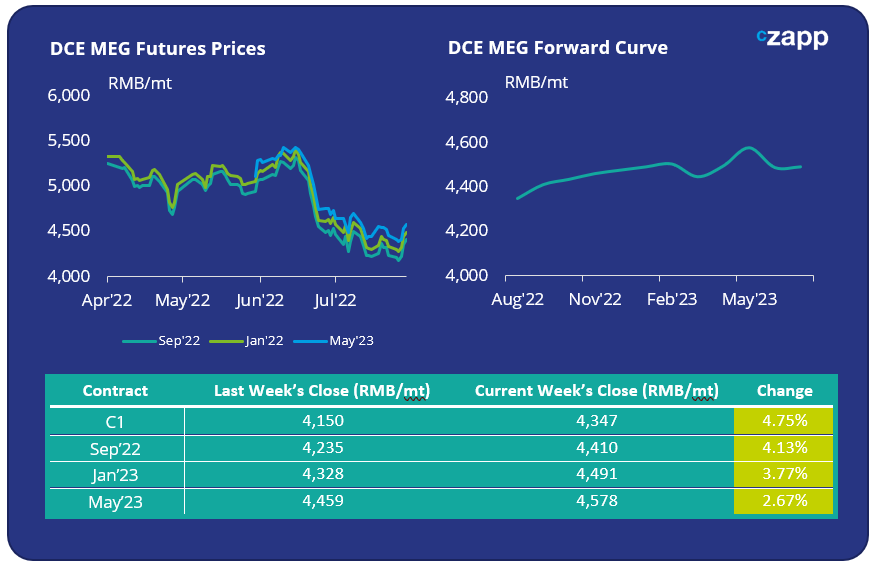

MEG Futures and Forward Curve

- For MEG, the main September futures contract increased by nearly 5% last week, although traders were seemingly reluctant to chase prices higher.

- MEG market continues to struggle between high costs and weak fundamentals.

- Despite production cuts, any reduction in the current high port inventories and oversupply is unlikely before September.

- Future MEG contracts continue to trade at a premium to current prices, although the forward curve has flattened in recent weeks.

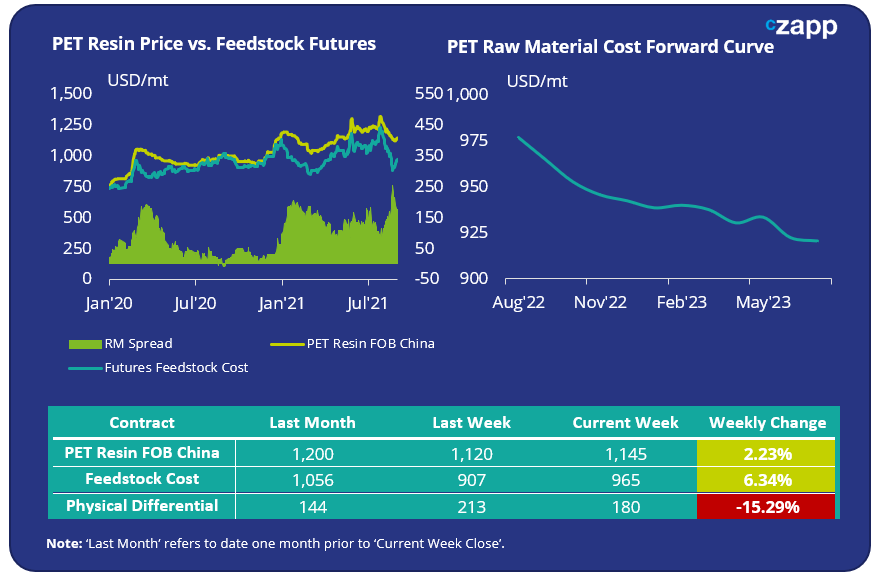

PET Resin Export – Raw Material Spread and Forward Curve

- Chinese PET resin export prices rose slightly through the week reaching USD 1145/tonne by last Friday, an average weekly increase of USD 25.

- The weekly average PET resin – raw material physical differential narrowed to USD 184/tonne, down USD 31 from the previous week’s average. By Friday, the daily spread had risen to USD 180/tonne.

- The PET resin raw material forward curve remains slightly backwardated through Q3, before flattening out through Q4 and into 2023.

Concluding Thoughts

- Both PET resin domestic and export margins have retreated from recent highs as the surge in post-lockdown restocking begins to subside.

- Although the physical differential between the raw material futures costs and PET export prices has dropped sharply over the last week, the spread remains significantly above values seen since January.

- Producers continue to maintain high forward orders. Tight supply and added interest in Chinese exports from buyers in Europe and the Americas is expected to continue to support wide spreads.

- However, despite the recent rise, PET resin export prices are expected to fall back through Q3 due to backwardated raw materials costs.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.

Other Insights That May Be of Interest…

PET Supply Chains Groan Under Global Heatwaves

Plastics and Sustainability Trends in July 2022

European PET Market Stumbles as Producers Left Blind on Costs

PET Resin Trade Flows: China’s PET Exports Surge as Logistics Ease Post-COVID