Insight Focus

- The clamour for high quality recycled plastic is driving research into new technologies.

- Despite current high recycled plastic prices brands continue to announce new commitments.

- The plastic credits market continues to evolve with a new marketplace.

This Month’s Top Trends

1. Search for New Plastics Recycling Technologies Heats Up

The number of plastic recycling patents being filed has hit a record high, according to Mathys & Squire, an intellectual property firm. Over 2,149 patents for plastic recycling were filed in 2021, up 7% from the previous year and an eightfold increase since 2016.

Global brands are currently in an arms race to fulfil sustainability commitments and meet local recycled content mandates. Most corporate and regional targets have a near-term 2025 goal of at least 25% recycled content, with both Coca-Cola and Pepsi committing to use at least 50% recycled PET globally by 2030.

Mathys & Squire estimates that “Whoever can develop a cost-effective method of producing clear recycled plastic will be able to tap into what some major players estimate to be a potential $120 billion market.” Following previous reports on Czapp covering new enzymatic technologies, including Microbes Make Recycling Breakthroughs, several other new emerging plastic recycling technologies hit the press in August:

- VTT Technical Research Centre of Finland announced plans to spin out a new company, Olefy Technologies, which is developing a gasification technology capable of breaking plastic waste back down into chemical raw materials.

The molecules created can then be used in the same manner as petrochemical feedstock to produce new food-grade resins comparable in quality to virgin resin. According to VTT, Olefy’s technology can yield more than 70% chemical raw materials from plastic waste.

- Scientists from the Manchester Institute of Biotechnology (MIB) have developed a new enzyme, called HotPETase capable of breaking down PET waste at higher temperatures.

Using a new screening system, the Manchester scientists were able to analyse around 1,000 enzymes a day, assessing their ability to breakdown plastic waste.

Starting with a naturally occurring enzyme found to degrade PET, they were able to evolve the enzyme to survive at temperatures of up to an optimal temperature of 70°C. The research was published in the journal Nature Catalysis.

- Technip Energies and Agilyx announced the launch of the Tru Styrenyx brand, a recycled polystyrene material created using Agilyx conversion technology and Technip Energies purification process.

2. Brands Continue to Stretch for Higher Recycled Content

Source: Unilever

- Despite current high recycled plastic prices and premium over virgin resin, over the last month the following brands have announced new strategies to increase recycled content within their packaging:

- Unilever announced in August a roll-out of 50% recycled plastic bottles across its core Domestos bleach range. Its new 750ml bottles will now include 50% rHDPE in a move it claimed would save 1,505 tonnes of virgin plastic per year.

- Fiji Water, a division of The Wonderful Company, announced the transition of its 500 mL and 330 mL bottles to 100% rPET in the US, equivalent to around 65% of its US bottle volume.

- Dasani also announced that it is rolling out bottles made from 100% recycled PET plastic across the US, following previous trials of 100% recycled plastic bottles in New York, California, and Texas. Most Dasani bottles in North America will now be available in 100% rPET.

- And Müller UK & Ireland announced that it had converted 75% of its cream volume to rPET pots.

In addition, Keurig Dr Pepper has recently published its latest annual sustainability report. According to the report, Keurig Dr Pepper averaged 11% post-consumer resin (PCR) across its plastic packaging portfolio in 2021, an increase of 2% on the previous year.

However, time pressure is now slowly ratcheting up if the company is to reach its goal of 25% by 2025.

3. The Rise or Plastic Credits

Another trend that has arisen from the continued drive for corporate sustainability, is the emergence of a plastic credits market.

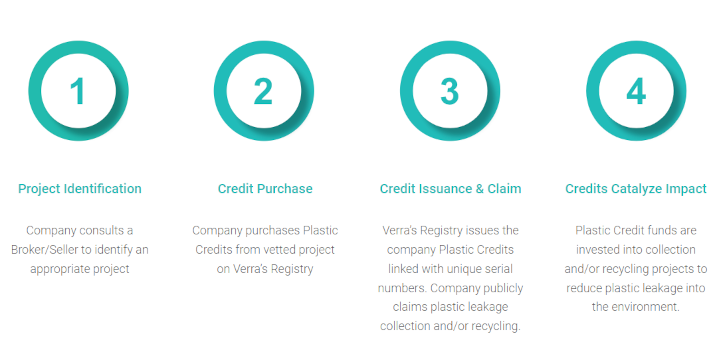

A plastic credit represents one tonne of plastic collected or recycled in addition to that which would happen under existing conditions, and like carbon credits, can be purchased by an organisation as a way of offsetting their footprint, in this case plastic footprint.

The credits go to fund collection programs, finance new recycling infrastructure, and boost recycling rates, particularly within developing nation impacted by plastic waste.

These projects and the generation of plastic credits are verified against globally accepted plastic credit standards, such as the Plastic Credit Exchange’s (PCX) Plastic Pollution Reduction Standard (PPRS) and Verra’s Plastic Waste Reduction Standard (PWRS).

The Plastic Credit Lifecyle

Source: Plastic Collective

Various unregulated and informal plastic credit programs have existed for some time. However, the launch of the Plastic Waste Reduction Standard in February 2021, developed and manged by Verra, set a benchmark for future regulation.

Many unofficial programs have already sought to align with the Standard’s strict requirements to access a burgeoning market, and over the last year the pace has quickened.

In June, Singapore-based PCX Markets launched an online marketplace, the first major one of its type, for purchasing certified plastic credits, bringing together a host of global partners, from large multinational beverage groups to community-based and institutional recycling projects.

Plastic credits have the potential to become a key part of the overall solution to tackling the global plastic waste crisis. However, without a set of international plastic market rules defined by a UN treaty agreement, like the carbon market, participation may continue to be all but a voluntary exercise.

Read more on the UN resolution for a draft treaty on plastic waste here.

Other Insights That May Interest You…

Plastics and Sustainability Trends in July 2022

Plastics and Sustainability Trends in June 2022

Plastics and Sustainability Trends in May 2022

Explainers That May Interest You…