Insight Focus

Wheat prices have been falling since mid-February. Global production struggles due to adverse weather, with key regions facing reduced harvests. The 2025 outlook suggests continued stock declines, as production fails to keep up with rising demand.

Wheat prices have been on a downward trend since mid-February, with contract lows being renewed in both the Paris and US markets. Prices are hardly encouraging farmers to plant wall-to-wall wheat acres.

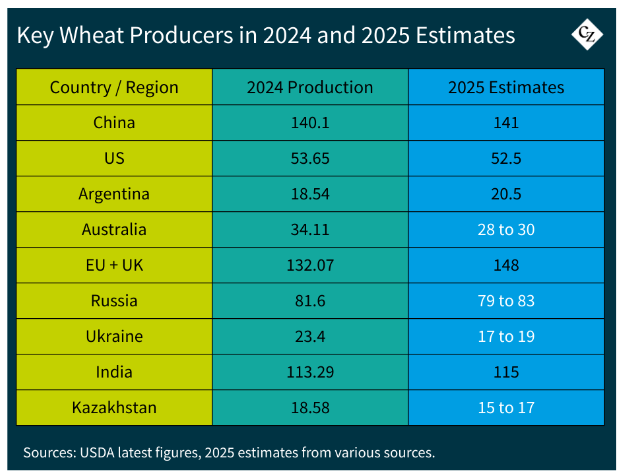

Weather struggles have been endured this growing season—from China to India, the Black Sea and the US. Crop forecasts will vary for months to come around the globe, but it is hard to see world stocks being replenished to any significant degree in the 2025/26 season.

Gloomy Outlook Ahead of WASDE

Next Monday, May 12, will see the release of the USDA’s monthly WASDE report. This will provide the USDA’s first ratings for the 2025/26 marketing season, with the start of Northern Hemisphere wheat harvests on the horizon.

The US has the second-lowest wheat acreage since records began in 1919, and the crop has been plagued by dry conditions. The Black Sea region—particularly Russia and Ukraine—has also experienced a dry season, with crop estimates unsurprisingly on the low side. Rain has recently fallen, and farmers in both the US and the Black Sea are hoping for significant improvement, though neither region is expected to produce bumper crops.

China’s Northern Plains, a major wheat-producing region, is experiencing very hot and dry conditions, leading many to question what impact the world’s largest producer, consumer, stockholder and importer will have on the market.

India is perhaps one of the few bright lights, as reports suggest a bumper crop. If realised, this could help rebuild their previously dwindling stocks.

Europe has not had an easy year, but almost anything would be an improvement on 2024’s poor performance.

Argentina and Australia are still a long way from any harvest, which won’t arrive until the end of the calendar year. Nevertheless, forecasts in Argentina are already predicting an uptick—potentially its second-largest harvest on record.

Putting numbers to some of the most significant players in the wheat market may help us form a clearer picture of what the year might bring.

Geopolitics to Influence Demand?

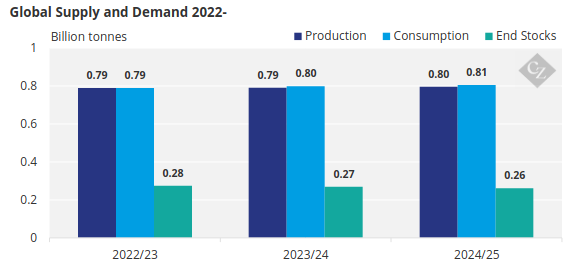

The chart below shows how production over the past three years has failed to keep pace with demand, as the world population continues to grow.

Source: USDA

There is some talk that the economic climate—marked by trade wars and global conflicts—may result in populations having less money, leading them to spend less on food and thus reducing demand.

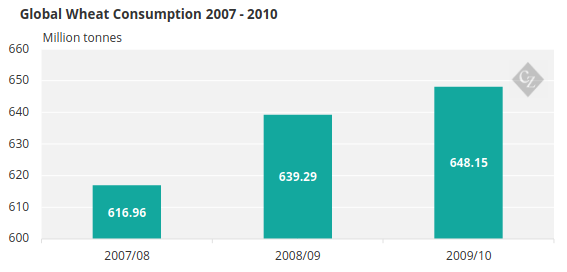

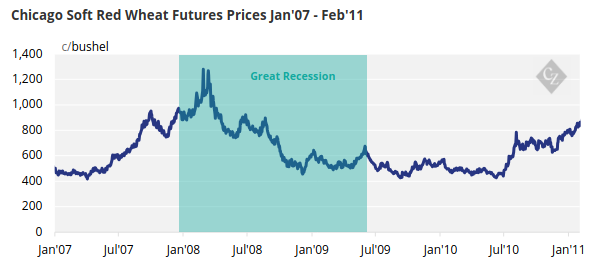

We have seen similar, though slightly different, scenarios in the past that did not appear to significantly affect demand.

From 2007 to 2009, we saw a massive spike in wheat prices to record levels, while the world faced its greatest financial crisis in many decades. Interestingly, wheat demand year-on-year seemed largely unaffected and continued to grow throughout this period.

Source: USDA

The Road Ahead

It is difficult to see how the global 2025 harvest will radically surpass the 2024 crop, although some increase will be needed to stem the large fall in global stocks.

The outlook suggests that production will likely not keep pace with consumption, leading to a further fall in stocks.

China will continue to dominate global production, consumption and stocks. Imports will remain uncertain for now.

The Black Sea region, particularly Russia, will likely continue to aggressively sell wheat post-harvest, as it did this past year, despite a smaller crop.

Europe is expected to return to a more typical year in terms of production and exports, looking to play its part in global trade.

The USDA WASDE report will be interesting to watch and read. Any impact on prices will depend on how bold it wishes to be, but it’s hard to see it releasing anything too upending at this stage of the season.

Another year of low prices and dwindling stocks may be the wish of the market bears, who have been quite comfortable in recent months.

However, prices will eventually have to move at some point to encourage more wheat acreage in the future and halt the continuous decline in stocks.