Insight Focus

Brazil is expected to produce a record of around 300 million tonnes of soybeans and corn. However, transportation and storage logistics have not kept up with the increase in production, which poses competitiveness challenges.

Record Soybean and Corn Harvest

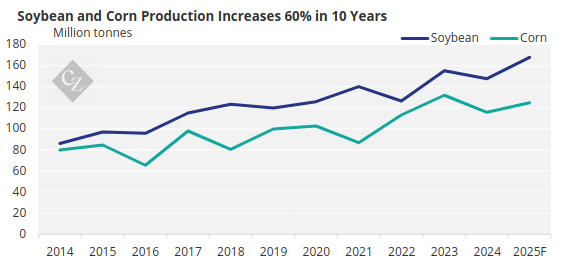

Brazil will break another record in its grain harvest this year. Soybean production is expected to reach around 167.8 million tonnes, 13.6% more than the previous season, and the corn harvest, estimated at approximately 124.7 million tonnes, is expected to be 7.8% higher than last season, according to Conab.

Despite being a record, this result is the latest in a long line of impressive production figures. In the past decade, Brazil has positioned itself as one of the global leaders in agricultural production.

Source: Conab

However, with each record harvest—driven by increased international demand, growing investments in technology and higher productivity—the limitations of the transportation infrastructure become more apparent.

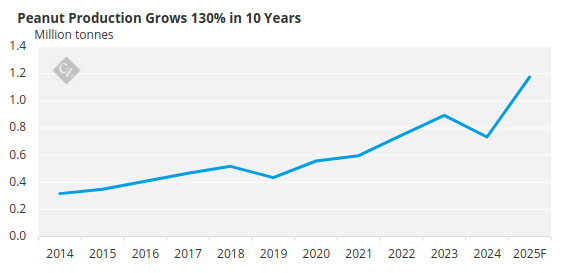

The starting point for understanding this scenario is the remarkable growth in agricultural production, marked by annual expansion rates. Over the last decade, the production of several crops has doubled, with cotton, wheat, and peanuts—previously reliant on imports—being prime examples.

Source: Conab

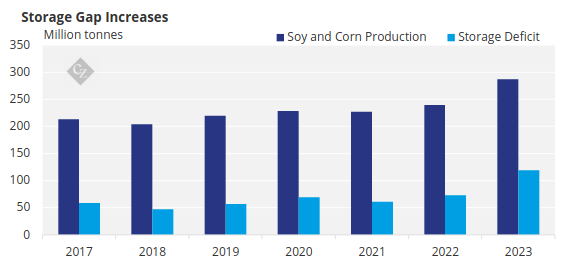

Insufficient Storage Capacity

Storage capacity, however, has not kept pace with the increase in production, creating a logistical bottleneck—particularly regarding the flow of grains, which are harvested on a large scale at certain times of the year.

The storage deficit has been growing. In 2022, it reached approximately 30% of soybean and corn production, and in 2023, it increased to 40%, totalling 119 million tonnes. These figures are based on data from Conab and the Sector Chamber of Equipment for Grain Storage of the Brazilian Association of Machinery and Equipment Industry.

This deficit means that a significant portion of the grains must be sent quickly to the ports, which overloads the logistics system during harvest peaks. To give an idea, 538 shipments (long-haul shipping operations) were made late in 2024, in the country’s main ports, as shown in a study by Solve Shipping and the National Transport Confederation. Delays at ports typically exceed eight days during loading periods for widely exported commodities such as grains, coffee and sugar.

Highways Create Bottlenecks

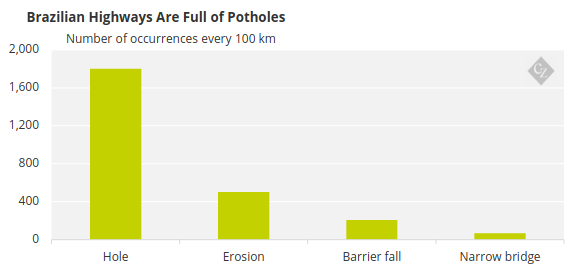

At the heart of this mechanism is the road transport system, which accounts for more than 60% of the country’s grain transportation. The predominance of highways is not due to logistical excellence, but rather to the lack of effective alternatives—and this is precisely where another major bottleneck lies.

A large portion of the roads that connect grain-producing centres to ports are unpaved and poorly maintained. Brazil has more than 1.5 million kilometres of highways, but only 13% are paved, according to the Ministry of Transportation and the National Department of Transportation Infrastructure (DNIT). In addition, there are numerous problems on the road, from potholes to landslides.

Source: National Transport Confederation.

These deficiencies are especially evident in strategic corridors, such as BR-163, which runs through the heart of agribusiness in the Centre-West and North of the country. Kilometre-long queues are not uncommon during rainy seasons, when access to ports in the so-called Northern Arc, such as Itaqui, in Maranhão, becomes more difficult.

The creation of a new reality in transportation infrastructure invariably requires investments. The restoration of roads alone requires billions in investments.

PPPs Could Provide Respite

Although there are no ready-made solutions to resolve Brazilian transportation logistics woes, there have been increasing numbers of auctions of infrastructure assets and public-private partnerships. Since 2020, more than 20 highway concession tenders have been held, raising investments of more than BRL 110 billion (USD 19.3 billion).

Railways have also attracted attention. The government intends to encourage public-private investments in networks such as the Leste-Oeste, which will connect Ilhéus in Bahia to Figueirópolis in Tocantins. They also plan the completion of the Transnordestina Railway, which will connect the interior of Piauí to the ports of Pecém (in Ceará) and Suape in Pernambuco.

It is still too early to assess the degree of effectiveness of initiatives of this nature, but the country has a mission. The challenge is not only to harvest more, but to ensure that each grain reaches the right destination, at the right time and with the greatest possible efficiency.