Insight Focus

US ethanol exports continued to surge in early 2025. Strong global demand lifted Q1 volumes 19% year-over-year. A new UK trade deal and hopes for Indian market access point to continued export growth despite trade tensions.

Exports of US ethanol continued to increase in the first quarter of 2025, signalling a higher demand for corn – and the trend is likely to continue.

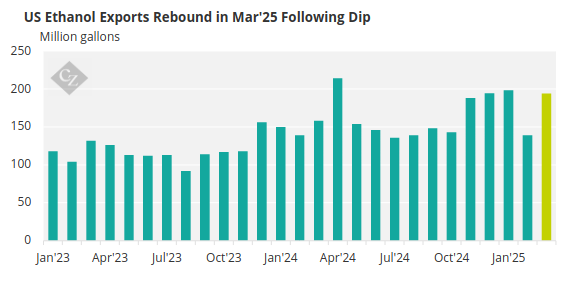

US ethanol exports rebounded sharply in March, surging 41% to 195.8 million gallons across most major markets.

Source: RFA

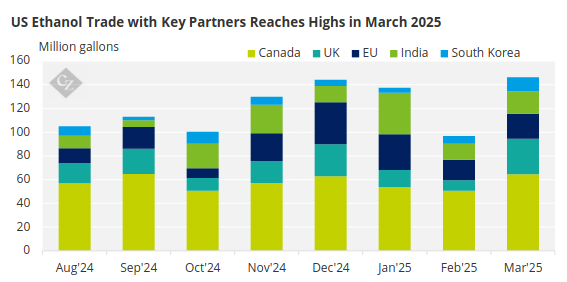

Canada continued as the top destination for ethanol in March, with exports climbing 27% to a six-month high of 64.5 million gallons. Exports to the UK more than tripled in March, reaching an 11-month high of 30 million gallons.

Exports to the EU rose 21% to 21.2 million gallons, while India’s imports increased 42% to 18.8 million gallons, and South Korea’s imports grew 80% to a 10-month high of 11.8 million gallons.

Source: USDA

Eleven foreign markets accounted for 98% of total March ethanol markets. US ethanol export markets for the first quarter reached 532.6 million gallons, a 19% increase over the same period a year earlier.

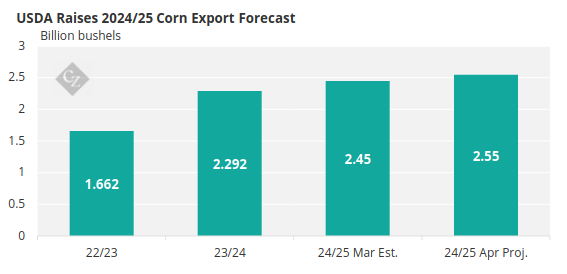

The strength in ethanol exports prompted the USDA to raise the projected corn exports for the 2024/25 marketing year by 100 million bushels in the April WASDE report. Amid the trade war, uncertainty about market access remains. Access to export markets will be crucial not only for the remaining 2024 crops but also for the 2025 crop that farmers are beginning to plant.

Source: USDA

Weekly export sales data from the USDA Foreign Agricultural Service indicate that accumulated corn exports for the current marketing year are well above the five-year average and exceed the high end of the recent five-year range.

Krista Swanson, economist with the National Corn Growers Association (NCGA), said that if corn exports continue to follow this trajectory, final corn exports will end even higher than the latest USDA projection. “The quick pace of sales is being driven primarily by year-to-date record high shipments to Mexico and higher volumes to other partners like Japan, Colombia, South Korea, and Spain,” she said.

UK Deal Opens USD 700 Million Ethanol Market

While the current US trade war with the world is bringing uncertainty to the agriculture industry and ethanol producers, a bright spot on the horizon appeared on May 8, when the UK and the Trump administration announced the framework of a trade agreement that includes big hopes for US ethanol exports.

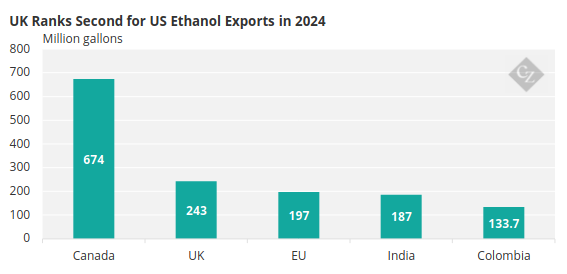

According to the White House, the deal includes new access to the UK market for USD 700 million in US ethanol exports. In 2024, the UK was the second-highest destination for US ethanol exports, after Canada, with a total of 243.8 million gallons, representing 13% of all ethanol exports.

Source: RFA

Renewable Fuels Association President and CEO Geoff Cooper responded, “We sincerely thank President Trump and his trade negotiators for ensuring that American-made ethanol is an important part of the trade agreement with the UK. While we are still awaiting the specific details of the agreement, we are excited about the prospects of expanded market access that will help boost our farm economy, while also delivering lower-cost, cleaner fuel to UK drivers.”

In the UK, though, critics argue that the future of the domestic bioethanol industry has been thrown into doubt by the trade deal, putting hundreds of jobs at risk. Ethanol is mainly supplied by the two leading manufacturers of the fuel, who reportedly fear they will be unable to compete with lower-cost US exports.

The deal is said to threaten the viability of the plants operated by Ensus UK, which is based in Redcar, and Vivergo Fuels, which is owned by Associated British Foods and operates at Saltend, near Hull. As part of Thursday’s trade deal with President Trump, the prime minister agreed to allow US ethanol exporters, who previously faced tariffs of about 20%, a duty-free quota of 370 million gallons a year.

Corn Industry Wants Ethanol Deal with India

The US corn industry is clamouring for the Trump administration to use trade talks to open the Indian market for corn and related products such as ethanol. NCGA President Kenneth Hartman Jr. said the opportunities the Indian market holds for US corn markets is huge. Around 94% of US corn is genetically modified, limiting exports to India.

“If the Indian government were to drop its restrictions on genetically modified corn, it could open the door to USD 235 million worth of US exports each year,” Hartman Jr. said. If India eased barriers on US sustainable aviation fuel, NCGA estimates it could create opportunities for the US corn sector of more than USD 400 million.

In the Long Term…

While current commodity corn prices are seasonably low, and corn future prices are weak based on a projected record 2025-26 US crop, demand for corn for ethanol use in the next several years is likely to explode.

If the promise of SAF fuel delivers, corn should continue to be a stable source US farm income for the foreseeable future.