Insight Focus

President Trump’s bill extends clean fuel credits, aiding ethanol producers. The bill also supports SAF and Canadian canola farmers. However, senate opposition over debt and incentives may delay its passage.

Trump Bill Delivers Win for Ethanol Producers

President Donald Trump’s ‘One Big, Beautiful Bill’ (H.R. 1) passed in the US House of Representatives on May 28 with a vote of 215-214, with all Democrats and two Republicans voting against it. The bill includes several measures important to ethanol producers and farmers.

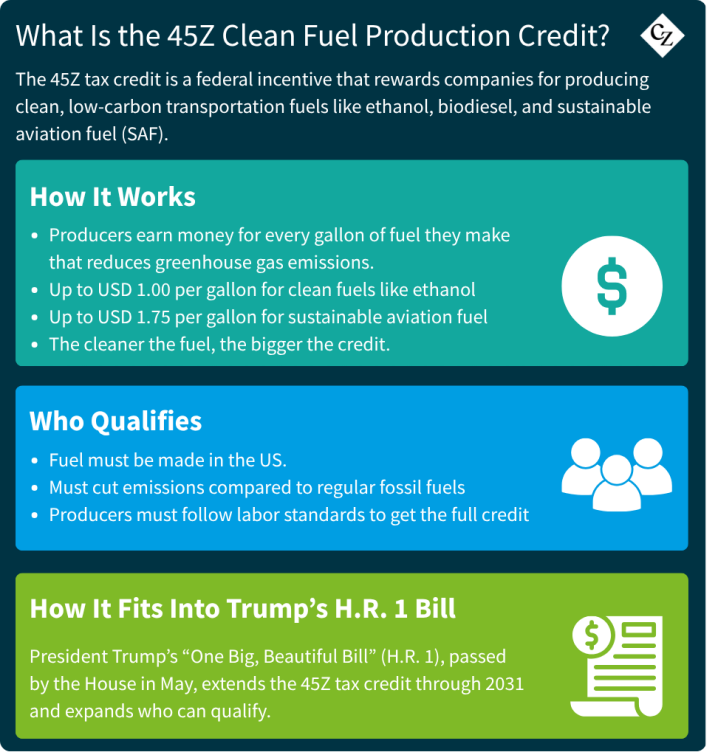

The biggest item in the bill for ethanol producers is the extension of the 45Z Clean Fuel Production Credit by four years. The 45Z tax credit, officially known as the Clean Fuel Production Credit, is a federal tax incentive designed to encourage the production of low-carbon fuels in the US. It provides a credit per gallon to producers of qualifying transportation fuels, with the goal of reducing greenhouse gas emissions.

On Friday, the US Energy Department expanded the range of companies and producers that can claim the Clean Fuel Production Tax Credit, delivering a win for biofuels proponents on a tax incentive that was the subject of intense debate under the Biden administration. The Trump administration announced it was updating the modelling tool used to determine eligibility to claim the credit, which it said would account for new feedstocks and methods of production, such as ethanol from corn wet-milling and natural gas from coal mine methane.

A deputy assistant secretary for energy efficiency and renewable energy said in a recent statement that the latest version of the modelling tool will allow more farmers to reap the benefits of a rapidly expanding market for alternative transportation fuels. The department also released an updated user manual that provides guidelines for how to determine life-cycle greenhouse gas emissions of certain production pathways.

“H.R. 1 also reinstates crucial tax benefits that will stimulate research, experimentation, and innovation across the ethanol supply chain,” said Renewable Fuels Association President and CEO Geoff Cooper. “As the bill has now moved to the Senate, we hope additional improvements can be made to ensure these tax policies truly drive demand growth for American-made renewable fuels.”

SAF, Canola Producers Also Stand to Benefit

Sustainable Aviation Fuel (SAF) Coalition Executive Director Alison Graab says the bill extends the Clean Fuel Production Credit (45Z) through 2031. “This legislation provides the long-term certainty SAF producers need to scale operations, drive private sector investment, and benefits American farmers and rural economies. Sustainable aviation fuel is a vital solution for advancing US energy dominance, driving rural economic growth, and establishing the US as a global frontrunner in SAF production.”

Meanwhile, Canada’s canola farmers stand to gain from US tax breaks for clean fuel. The 45Z tax credit came into force in January as part of former President Joe Biden’s Inflation Reduction Act. But certain stipulations made feedstock from Canadian canola ineligible. The Republican bill slashes those requirements.

Canola Field, Canada

Should the expansion pass through the Senate, it could drive increased demand for Canadian canola—a boost much needed by a sector that recently faced new tariffs, resulting in a steep decrease in sales to the US. Political uncertainty on both sides of the border has also depressed investment in what was once a booming domestic processing sector.

Senators Challenge Budget Bill Amid Debt Concerns

The 1,116-page bill—which might increase US debt by USD 2–4 trillion over the next two years—faces a number of objections from Senate Republicans, who are calling for a rewrite to address concerns ranging from Medicaid reforms to the phase-out of clean energy incentives.

House Ways and Means Committee Chairman Jason Smith (R-MO) believes that the overwhelming majority of the GOP tax and spending legislation will survive the Senate with only marginal changes.

The baseline for most bills getting through the Senate requires overcoming the filibuster through a motion for “cloture”—a term meaning “we’re done debating this issue and ready to vote.” Cloture requires 60 senators to vote yes; otherwise, the assumption is that more debate is needed before a vote can occur. Once that hurdle is cleared, a simple majority will suffice to approve whatever is on the agenda—be it bringing a bill to the floor, amending it, or simply passing it.

Legislative leaders and the Trump administration are hoping to pass the budget bill by July 4. However, opposition to portions of the bill by Republican senators may push passage well beyond July.