Insight Focus

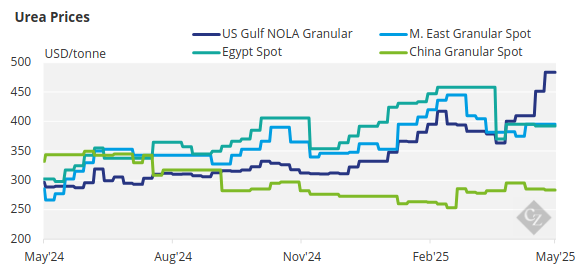

Urea prices fell globally last week as Chinese exports loom. Phosphate and potash prices are rising on tight supply, though Chinese phosphate exports expected in May may ease pressure. Ammonia markets remain oversupplied, with weak demand keeping prices under pressure.

Chinese Export Uncertainty Pressures Urea

The international urea market is in disarray, particularly due to the lack of an official directive from the Chinese government on export policy. On May 7, the Economic and Trade Department of the National Development and Reform Commission organised a special symposium on fertilizer exports. The meeting conducted an in-depth discussion on the orderly promotion of urea and phosphate fertilizer exports for 2025.

It appears that there will be a quota system, with products allocated to qualifying companies, and that the export period is tentatively set between May and September. The total export volume has not been decided, other than the stipulation that it cannot exceed the export scale of 2023. One particular note from the meeting states that “fertilizer export to India is prohibited this year.”

Again, it must be emphasized that the above information is not yet official, and that an official export program could take another week or two to be finalised.

However, following this meeting, it appears that granular urea is now being offered at USD 370/tonne FOB at major ports in China, with prilled urea priced lower. These prices are considerably below the going rate over the past couple of weeks, with Southeast Asian producers having sold at prices just above USD 400/tonne FOB.

Buyers in major import markets are now wary of what will happen and, as a result, are reluctant to engage. In Brazil, although it is out of season, liquidity is light, with products earlier in the week offered at USD 390/tonne CFR, then USD 380/tonne CFR, while buyers are bidding around USD 360/tonne CFR. January to April urea imports were 1.78 million tonnes, down 199,000 tonnes or 10% year over year. Nigeria was the main supplier, increasing volumes by 25% to 588,000 tonnes.

The US/NOLA is now at the tail end of the import season, with May barges trading at USD 475–480/short ton (USD 523.6–529.1/ tonne) FOB, down USD 20–25/short ton from the last done deal for May. Looking further ahead, full June barges are now on offer at below USD 400/short ton, equal to USD 432–435/tonne CFR duty paid.

Total urea imports to the US for the period July 2024 to May 2025 reached 3.6 million tonnes, up 150,000 tones year over year, with Russia being the largest supplier at 909,000 tonnes and Qatar at 802,000 tonnes. Exports totalled 733,000 tonnes, of which Canada took 503,000 tonnes. This means net imports to the US were 2.88 million tonnes.

Pupuk Indonesia’s attempt to agree on a long-term contract of 700,000 tonnes for the next few months appears to have failed, with one company bidding for 140,000 tonnes with a delta of USD 1.11/tonne based on a formula price referencing a published Southeast Asia midpoint FOB price.

Another participant bid for 250,000 tonnes, so the combined volume fell short of the desired 700,000 tonnes. What happens next remains to be decided. Furthermore, a late-week tender of 12,000 tonnes of prilled urea from producer Gresik appears to have attracted limited interest.

In summary, there is currently a great deal of uncertainty in the urea industry, with the long-anticipated Chinese exports beginning to emerge—albeit with no clarity at this point regarding terms and conditions. What is clear is that downward pressure on prices is building across the board.

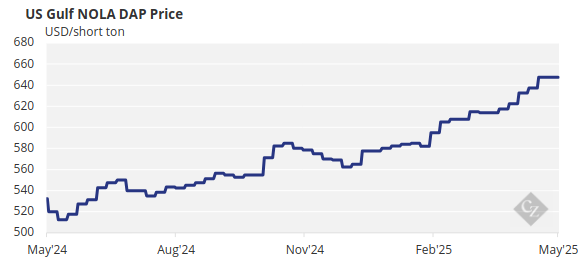

Phosphate Prices Surge on China Export Drop

Contrary to the urea industry, the availability of processed phosphates remains exceptionally tight, as exemplified by MAP in Brazil, now being offered by OCP of Morocco at USD 740/tonne. However, affordability remains a concern due to low soybean prices, and farmers are reluctant to engage at prices above the range of USD 700–710/tonne. This compares to a price of around USD 636/tonne CFR, which stood still for about eight months.

DAP in India has increased by USD 65/tonne from just a few weeks ago, with the latest deal—a 45,000 tonne cargo from Ma’aden—sold at USD 720/tonne CFR. This is up from the maximum price previously set by the government of India at USD 695/tonne CFR.

Contributing to the tightness in availability is the lack of exports from China. A decision on China’s export policy is expected in the coming week, as the policy is still under discussion. The lack of Chinese supply is the key driver of tight global availability, with the country’s Q1 DAP/MAP exports dropping to a 23-year low of 111,046 tonnes, marking a 54% decrease from Q1 2024. This volume compares to 1.5 million tonnes in Q1 2021 and 1.17 million tonnes in Q1 2023. However, it now appears that exports will resume sometime in the latter part of May.

Another factor contributing to the tight supply of DAP is the emergence of a new DAP tender in Ethiopia. In the past, Ethiopia used to purchase NPS from Morocco, but this relationship has now ended.

US fertilizer producer Mosaic is warning that trade flow changes, precipitated by on-again, off-again tariffs during the Trump administration, have led China to buy soybeans from Brazil rather than the US. Brazil is considered the largest exporter of soybeans, with expectations of total exports for 2024/2025 reaching 105 million tonnes, of which China will purchase 70%, as in previous years. As a result, fertilizer demand will also shift from one country or more to others.

Prices are expected to continue rising over the coming weeks, as demand picks up while supply remains exceptionally tight. Affordability concerns persist, but buyers have limited options. Any reversal in direction now seems unlikely until at least Q3, and that will depend on supply improvements and buyers becoming more comfortable.

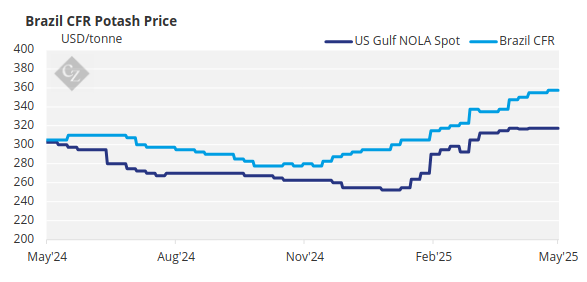

Potash Prices Edge Up

Potash prices have risen in Brazil, China and Europe, but momentum remains weak. The market is still on edge, awaiting the outcome of the Pupuk Indonesia tender, which closed nearly a month ago on April 14.

Another week has passed without the anticipated results from the Pupuk Indonesia tender. Fresh rumours emerged this week regarding cargo allocations, with some producers confirming details, while others dismissed or declined to comment. The new deadline is set for May 16, after an extension from the original May 11 date.

Producers in the region are becoming increasingly bullish, with expectations that Pupuk Indonesia will accept the lowest offer of USD 360/tonne CFR, although the tender remains unresolved. In response to this uncertainty and growing momentum, some producers have raised their price offers in the region, though no sales at these new levels have been confirmed. Prices in the region remained stable this week, averaging USD 345/tonne CFR for sMOP and USD 355/tonne CFR for gMOP, though upward price movement is expected.

Brazilian MOP prices climbed to USD 355–360/tonne CFR, reflecting previous deals for June deliveries, as May loading has been fully sold out for several weeks. While there is debate over whether June volumes remain available, the momentum for price increases has slowed for July offers.

Current offers are in the range of USD 360–370/tonne CFR, with the market showing resistance to the USD 370/tonne CFR levels. No offers for August have emerged yet, as producers remain focused on pushing prices higher for July shipments.

Global potash prices are expected to peak in Q3, driven by strong demand and tight supply constraints, before gradually declining thereafter.

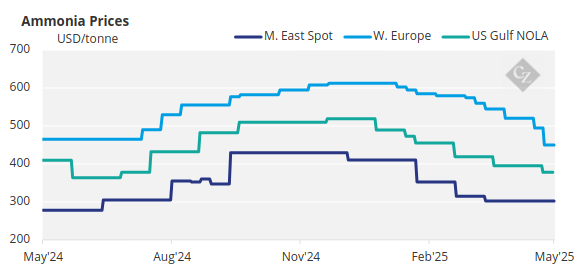

Ammonia Prices Hold

Ammonia markets on both sides of the Suez continue to be characterised by healthy supply and subdued demand, although some benchmarks appear to be on the verge of reaching a floor east of Suez.

The top news of the week emerged from the Middle East, where Japanese trader Mitsui moved to secure at least 25,000 tonnes of spot material from producer Sabic AN at USD 310/tonne FOB. The premium on that deal—around USD 40/tonne above recent notional indications—can likely be attributed to Mitsui securing a favourable freight rate for the newbuild set to load the cargo at the end of May. The tonnes will likely head west of Suez to either Europe or Morocco, from where the tanker is expected to move into the LPG market.

Elsewhere in the region, Ma’aden announced that a seven-week turnaround at its 1.1 tonne/year No.1 ammonia unit will commence as planned this weekend.

The general underlying price trend should remain bearish heading into the second half of May, although the price direction will likely be shaped by discussions at next week’s IFA conference in Monaco.