Insight Focus

China export rumours hit the urea market, causing sharp price drops. Phosphate prices are holding steady due to tight Chinese supply. Potash remains stable, but ammonia is weak with no spot demand.

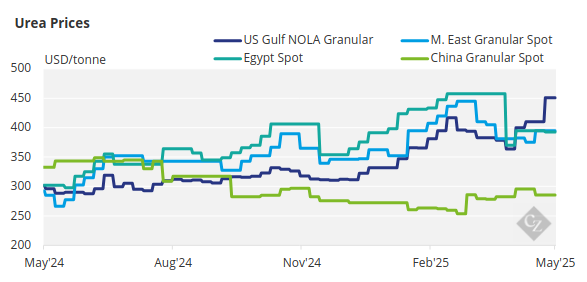

Urea Market Volatile on China Export Rumours

The international urea market, bar US/NOLA, which is still showing strong demand and robust prices for prompt deliveries, was jolted this week by persistent rumours of China entering the export market sometime in May. According to unconfirmed reports, the Chinese government agency NDRC and CNAMPGC have agreed on a quota system for exports starting in May and ending in September.

The quota allocation for urea exports will be given to companies that have undertaken commercial reserve commitments. The total volume is unclear, but it is expected that between 3–4 million tonnes will be made available for export.

The market reacted violently to this rumour, with paper positions liquidated. May Middle East urea paper is down USD 10/tonne and June Middle East paper is down just over USD 20/tonne. June Brazil CFR paper dropped USD 24/tonne and July Brazil CFR dropped USD 12.50/tonne.

On the physical side, it has been reported that Iran sold two or three large granular urea cargoes at USD 337.20/tonne FOB, down from USD 350/tonne FOB. US NOLA first-half May barge prices at USD 520/short ton (USD 573.22/tonne) FOB are 38% up since Trump signed the tariffs scheme on April 2.

The Ethiopian Agricultural Business Corporation (EABC) is understood to have bought four 52,000-tonne lots of granular urea under its April 23 tender. Samsung was awarded one lot at USD 416/tonne FOB Egypt, and Midgulf International one lot at USD 405/tonne from Sohar, Oman.

Middle Eastern producers are still trying to hold at USD 395–400/tonne FOB for next available exports, although this price is coming under pressure with the Chinese news on exports. Qatar Energy held a tender for 30,000 tonnes of prilled urea, and the price is said to be at USD 392/tonne FOB. The destination has yet to be announced but may be Sri Lanka or the Philippines.

On another note, Turkey’s Q1 2025 imports were 939,000 tonnes, down 13% or 135,000 tonnes year over year, impacted by production problems in Iran. Volumes from Oman/Iran declined by over half to 294,000 tonnes, down 321,000 tonnes year over year. Southeast Asia’s urea availability is now very limited, with the Pupuk Indonesia tender resulting in sales of 140,000 tonnes at USD 402.50/tonne FOB. Producers in both Brunei and Malaysia are said to be sold out until June.

The outlook for the urea market now hangs in the balance, pending confirmed news coming out of China after the May 1 celebrations, which will end on May 5. Obviously, regular prilled urea markets in Southeast Asia like the Philippines and South Korea may take great delight in China resuming urea export.

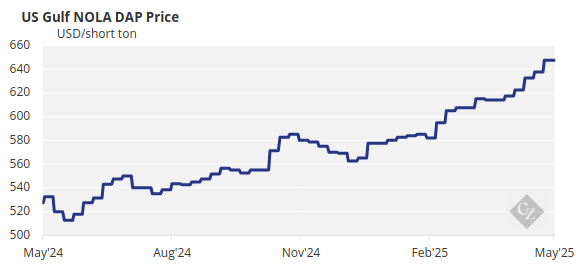

Phosphate Supply Tightens

Processed phosphate availability is still tight, and as a result, the MAP price in Brazil is now a touch above USD 700/tonne CFR. OCP of Morocco is said to have raised its MAP offer to USD 740/tonne CFR, with no apparent sale concluded at this point. Poor farmer affordability in Brazil due to low agricultural commodity prices is providing resistance.

Adding to the tight supply of processed phosphate, DAP/MAP/NPK/NPS exports from Saudi Arabia dropped 5.1% in the first two months of 2025 to 817,528 tonnes from 861,220 year over year. Exports of DAP dropped 21%, but MAP exports increased 27%.

Adding to this are reports from China that the government has banned exports of DAP/MAP from May 1 with no end date announced. Uncertainty over when China might return to the export market persisted, though the outlook appeared more positive this week, with sources suggesting the DAP and MAP export quota allocation is under discussion and expected to be released by the middle of May, with further details expected to be confirmed after China’s Labour Day holidays.

The lack of Chinese supply is the key driver of tight global availability, with the country’s Q1 DAP/MAP exports down to a 23-year low at 111,046 tonnes, marking a 54% decrease from Q1 2024. The volume compares with 1.5 million tonnes as recently as Q1 2021 and 1.17 million tonnes in Q1 2023.

Market sources also reported China is planning to reduce the export inspection time for TSP and NP from at least 40 working days to 10 working days. Previously, local sources suggested that the strong exports of NP and SSP in Q1 2025 had been noticed by the government and that control of NP exports was under consideration.

From January to March, China exported around 676,000 tonnes of SSP, up 52% year on year, with 81% of this volume going to Brazil. NP fertilizer exports were around 615,000 tonnes, which was eight times higher than in the same period in 2024, with 51% going to Brazil. This comes after SSP and NP exports reached record highs in 2024.

Prices are expected to increase further over the coming weeks, as demand picks up while supply remains exceptionally tight. Affordability concerns persist, but buyers have limited options. Any reversal in direction now seems unlikely until at least June, and that will depend on supply improving and buyers becoming more comfortable.

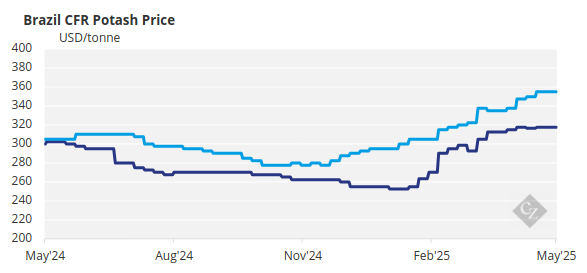

Potash Market Steady

Potash prices remained largely stable across key global spot markets this week, with sentiment and fundamentals still supportive as the market awaits the outcome of Pupuk Indonesia’s tender. Southeast Asia continues to be a key focus in the potash market this week, as Pupuk Indonesia has yet to award its MOP tender, which closed on April 14.

Offers from suppliers were considered too high, ranging from USD 360–363/tonne CFR, with one reaching USD 400/tonne CFR. Pupuk has since submitted two counterbids at USD 330/tonne CFR and USD 338/tonne CFR, both of which were rejected. This is a critical moment for the market, as the outcome could impact both Southeast Asian prices and the ongoing China contract negotiations. If the tender is awarded at this level, it could reinforce the bullish sentiment.

The Brazilian MOP market saw little price movement this week, although June volumes became tighter, with another producer sold out for this delivery period. Offers for June were reported between USD 355–360/tonne CFR, with one producer offering as high as USD 370/tonne CFR. Prices are expected to continue rising in the coming months as demand remains strong for the 2025–2026 soybean season.

The potash market is expected to remain firm, especially in Brazil and Southeast Asia. The market awaits Pupuk Indonesia’s tender results, which are anticipated by market players to either be awarded at USD 360/tonne CFR or scrapped.

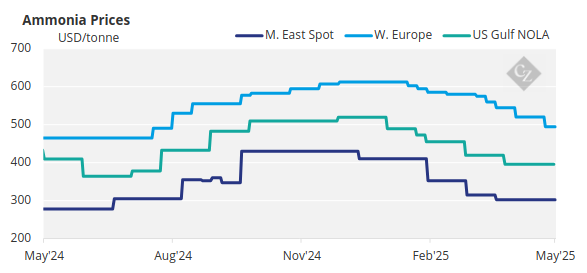

Ammonia Dips on Low Spot Activity

In a quiet market week, devoid of much other major business and characterised by a continued lack of spot appetite on both sides of the Suez, it was little surprise to see the Tampa settlement price for May decline by another USD 20/tonne. The USD 415/tonne CFR figure agreed by Yara and Mosaic means the benchmark has now declined by USD 155/tonne from the 2024 high of USD 570/tonne CFR fixed in December.

Sources also confirmed that the May price was agreed on a duty-free basis, meaning the buy-side is responsible for incurring the 10% duty on US imports of Trinidadian ammonia, with Mosaic expected to settle this in a separate transaction with the US government, assuming it continues to source sporadic cargoes from the Caribbean. Prices there were also revised this week to reflect the latest news from Tampa.

Prices should continue to trend to the downside, with little demand-side support envisaged for May. The rate of decline may be mitigated by planned curtailments east of Suez.