Insight Focus

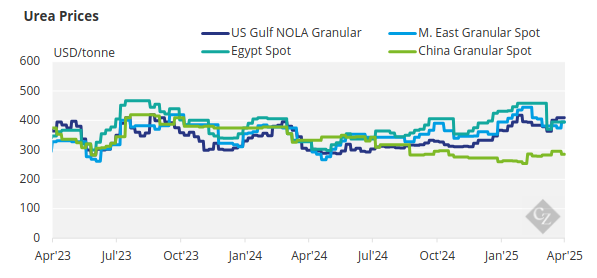

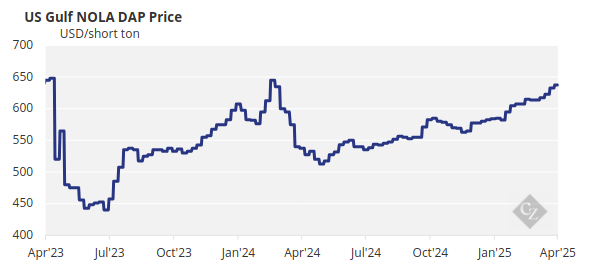

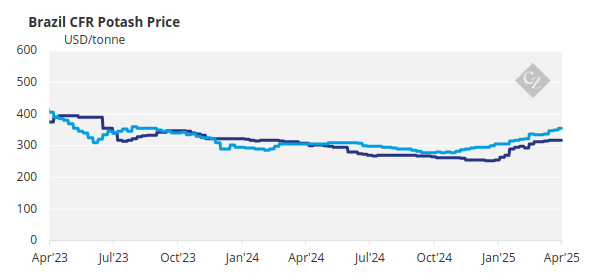

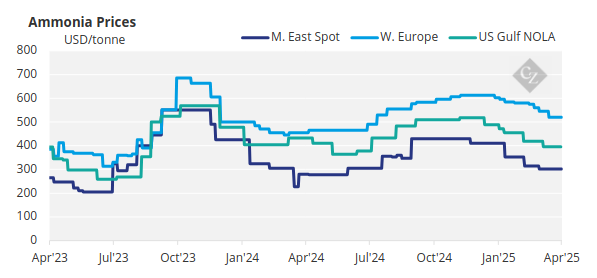

Urea prices have weakened after India’s lacklustre tender. Phosphate prices soar to USD 700/tonne on tight supply. Potash rises in Southeast Asia, while ammonia falls on oversupply.

India Urea Tender Falls Short

The international urea market is rather slow, with signs of weakening prices, with only the US river system driving prices up. The Middle East is marginally up but will be busy shipping to India. Europe is very slow, while both Australia and Thailand are entering the main importing season, primarily with contract cargoes.

Prilled urea is being positioned by traders in Southeast Asia (Indonesia) for the Philippine season starting in May. In the run up to Easter holidays in most of the world last week, it appears that market participants are taking a breather.

The India tender resulted in only around 900,000 tonnes secured versus the requested 1.5 million tonnes by the government agency IPL. It is expected that it will return to tendering by the end of May or the beginning of June. If this happens at the beginning of June, the urea market could retract, since the domestic import seasons in both Europe and the US will be over, and it will be too early for imports to Brazil.

Both Australia and Thailand will enter their main import season, although the majority of cargoes shipped are contract cargoes, leaving little opportunity for traders in spot deals. Additionally, weather in the southern part of Australia has not been conducive to fertiliser application, so farmers appear to be delaying or deferring procurement.

Deals this week include a recent USD 380/tonne FOB Egypt sale for first-half May shipment—USD 10/tonne higher than the last deal done. Algerian sales to Brazil would potentially net back to around USD 350/tonne, with the latest CFR sales falling to USD 375–378/tonne.

Pupuk Indonesia conducted a couple of prilled urea tenders this week, with numbers in the mid-to-high USD 390s/tonne FOB. These cargoes seem destined for the Philippines, whose season will begin in earnest in May.

Of interest, TCF in Taiwan has opted to tender for granular urea this time due to a lack of prilled urea, as Chinese material is still absent from the international market.

In other news, BFI of Brunei has announced on social media that its ammonia and urea facility will be down for maintenance between July 28 and August 23, with production resuming on September 1. In addition, the Petronas Gurun plant, which has been down since March, appears to remain offline for an unspecified period.

Phosphate Reaches Milestone

The processed phosphate market reached the USD 700/tonne milestone in various markets this week, driven by limited supply. Indian DAP is now being sold and bought at USD 700/tonne CFR, up USD 52/tonne over the past three weeks. However, unconfirmed reports of an OCP Morocco sale at USD 750/tonne CFR would overshadow the previously assessed prices of USD 668–675/tonne CFR.

The long-anticipated OCP-India formula price agreement is expected to be announced next week, calling for a volume of 2 million tonnes—1.2 million tonnes of DAP and 800,000 tonnes of TSP. Shipments are scheduled for the Kharif season (May–June).

India is significantly short of DAP now that China remains absent from the market. So far, India has imported 1.23 million tonnes of NPK/NPS versus 960,000 tonnes at the same time last year, in response to the tight availability of DAP. Importers are managing to profit on MRP versus DAP, despite losses of around USD 100/tonne.

The Chinese Fertilizer Association is reportedly meeting on April 23 to discuss potential infringements of export restrictions, with DAP reportedly being exported from China under the umbrella of NPK/NPS. However, it is expected that DAP will resume international trade sometime in late May or early June, once the domestic season in China is over.

Meanwhile, MAP has been sold in smaller quantities in Brazil at USD 700/tonne CFR by Russian producers, despite the unfavourable barter rate between soybeans and MAP. For months, the MAP price in Brazil had remained unchanged at USD 636/tonne CFR.

Potash Prices Surge

Potash prices in Southeast Asia surged as tight supply continued to grip the market. However, some confusion remains around pricing clarity, with market participants looking to Pupuk Indonesia’s latest tender and an upcoming conference in Asia next week for clearer insights into current levels.

Standard MOP prices have reached their highest levels since June 2023, while granular MOP prices are at their highest since January 2024. Pupuk Indonesia is said to have counter-offered USD 330/tonne CFR in its latest standard MOP tender, against supplier offers ranging from USD 360–400/tonne CFR. While there are rumours that the tender was scrapped due to the pricing disagreement, some producers have dismissed these claims.

Import prices in Brazil remained at USD 345–350/tonne CFR in the absence of May deals. Sales for June were reported at USD 355–360/tonne CFR, with offers ranging from USD 350–370/tonne CFR. Volumes for June remain limited, with most attention already shifting to July.

This level of advanced buying is atypical, with some suggesting the increased purchasing is due to relatively favourable current prices compared to other fertilizers—especially phosphates—and expectations of declining affordability and rising prices globally.

Ammonia Continue Decline

Ammonia prices extended their decline west of Suez amid more-than-ample supply, while declines east of Suez paused, although spot demand in the region remains weak. The global ammonia market is oversupplied. While no further declines were recorded in Asia this week, it is unclear how much further prices might slip before producers in the region begin to shutter output.

The delivered ammonia price assessment slumped in northwest Europe based on the latest export business from Algeria, and netbacks to Trinidad were cut sharply given the 10% tariff imposed by the Trump administration, while US domestic prices firmed.

European ammonia production is still out of the money, although European spot gas prices have declined since early February. The delivered ammonia price into northwest Europe is now at its lowest since June 13 of last year, having fallen USD 167/tonne, or 27%, since the start of the calendar year.

East of Suez, Ma’aden will be taking its 1.1 million tonne/year No.1 unit offline for seven weeks as of early May, as reported last week, likely removing around 120,000 tonnes from the market—although most expect this to have little impact on Middle East fundamentals.

The new 1.3 million tonne/year Gulf Coast Ammonia facility in Texas, which loaded its first export cargo three weeks ago, is still said to be experiencing problems. Production in Trinidad is also reportedly struggling again, likely due to the well-known gas supply situation. None of these factors appears to be arresting the current decline in ammonia values.