Insight Focus

- COVID lockdowns hammer Chinese consumption

- New Zealand’s exports to China halve

- European exports to SE Asia growing

- US Exports to Asia, Central America on the rise

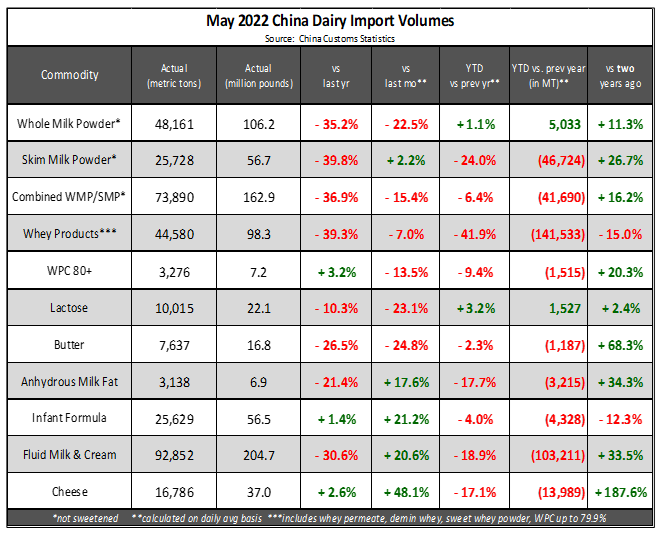

China:

On par with recent trend, China’s fluid milk, whole milk powder and whey imports fell sharply from the impressive volume last year, with millions of people locked down during the month, hampering domestic consumption. New Zealand and Germany felt the brunt of weaker imports while volume from the US grew.

Although butter imports are lower, China continues to show up at the Global Dairy Trade (GDT) events to lock in product, indicating that supplies are tight. Stronger cheese imports, paired with larger purchases of fat on GDT, are hinting at an inventory rebuild for the food-service sector, especially with May cheese imports moving counter-seasonally to the upside. Year-to-date volumes are well below 2021 levels, but it is still the second strongest year on record for whole milk powder, butter, casein, cheese, AMF, fluid milk and cream as well as lactose imports. Of the top ten suppliers, Uruguay is the only country that has observed growth this year as China’s dairy imports are at an all-time high from there through May. Growth has primarily been in the form of strong whole milk powder imports.

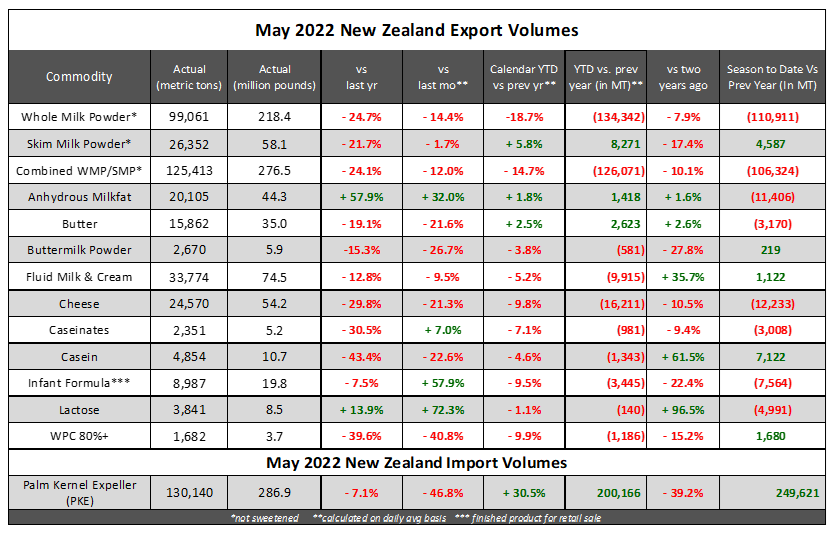

New Zealand:

New Zealand’s exports to China nearly halved from a year ago, down 46% from the historically strong volumes posted from China last year. At 22,884 tonnes, NZ’s WMP shipments to China were the lowest since last August and down 66% or 44,841 tones year on year at 22,884 tonnes. WMP exports to Algeria hit their highest since March 2020, with China falling back. Trade with Sri Lanka also continues to suffer. The economy is foundering under the weight of heavy debt, lost tourism revenue and other effects of the pandemic, as well as surging costs for commodities. Lactose exports reached 15-year highs with Singapore accounting for 27% market share. In Singapore, while costs are riding just like in the rest of the world, consumers are prioritizing dining out, groceries and utilities while putting recreation and travel on the backburner. AMF exports hit two-year highs given its discount to butter on a total butterfat equivalency. On an 82% fat basis, AMF is at a record discount to butter (C2 unsalted butter is now at a premium of $1,404/tonne). However, NZ-sourced butter is still priced well below the Northern hemisphere and a value-buy from a finished goods viewpoint for international buyers.

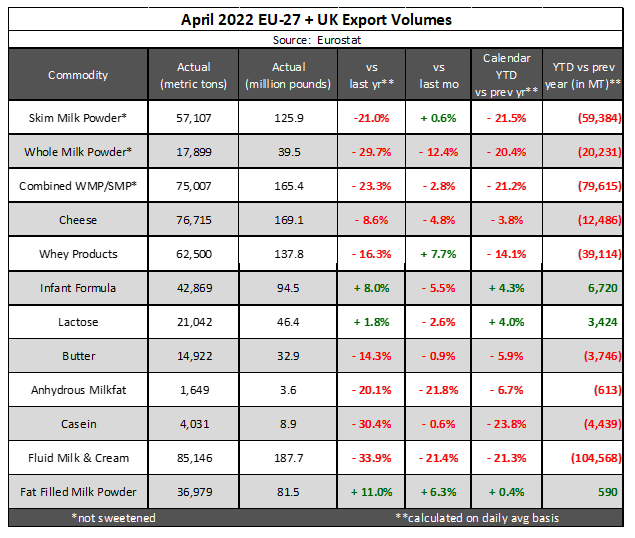

EU27+UK:

Fluid milk & cream exports continued their plunge in April, hitting December 2019 lows. The primary culprit for weaker demand is China with shipments amounting to 36,192MT, a loss of 51% or 37,700 tonnes from a year earlier. Lower shipments to Libya were also notable, down 92% or 6,558 tonnes on the year to 561 tonnes. Conversely, exports into Southeast Asia grew 49% or 3,045 tonnes on the year to 9,287 tonnes – the highest on record into the region. Skim milk powder (SMP) shipments remain at historical lows this year, sitting at eight-year lows. Once again, this is being driven by lower demand from China, but also Algeria as they source less and less powder from the EU each year. The EU shipped 24,563 tonnes to China in January-April, down 13,672 tonnes on the year, the lowest since 2018 while volume to Algeria (21,108 tonnes, down 10,629 tonnes on the year) is the lowest since 2007. The destination market to record the most year-on-year growth in April was Egypt, which only accounted for 2.9% of total market share (commodities listed above) and primarily in the form of SMP (6,107MT, up,500 tonnes). United Arab Emirates recorded the second strongest growth as shipments of whey (1,262 tonnes, up 985 tonnes on the year) and fat-filled milk powders (3,180 tonnes, up 656 tonnes) grew slightly.

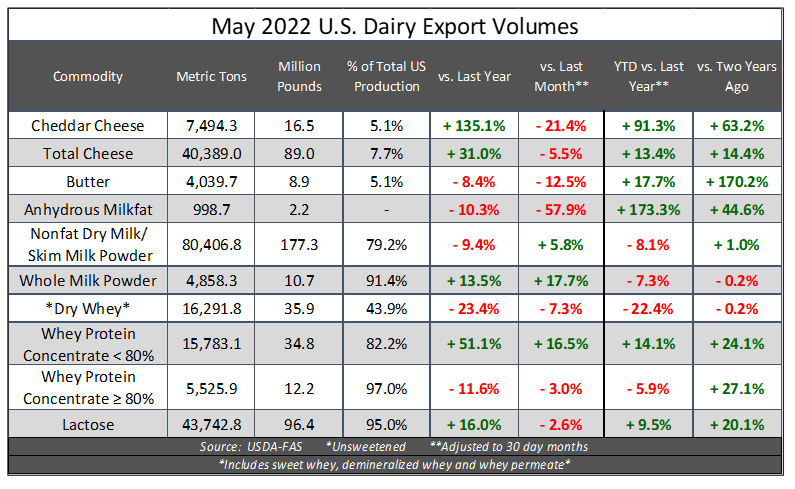

United States:

May marked the strongest export month on record to three regions: East Asia (driven by growth into Japan), Southeast Asia (driven by growth into Indonesia and Malaysia), and Central America, with nonfat dry milk and cheese shipments at an all-time high into the region. Total dairy shipments to Indonesia reached two-year highs with May the third strongest month on record to the country. The bulk of volume continues to be in the form of nonfat dry milk, which also reached two-year highs. Lactose exports were the strongest since April 2007 as demand from New Zealand (Sept 2015) and Japan (Feb 2007) jumped to multi-year highs. Additionally, exports to China have remained strong nine of the last ten months. Total WPC<80% shipments were the highest recorded in four years (April 2018). Shipments to China the strongest, up 64% or 3,120 tonnes from a year earlier to 7,984 tonnes. Of the products that reported notable gains in May, which was the fourth consecutive month this year to break monthly records, the US remains heavily discounted against its primary export competitor this time of year, the EU.

For additional dairy market analysis, request a free trial at highgrounddairy.com/free-trial