Insight Focus

- European gas prices surge to their highest since March as Russia cuts flows.

- PET margins will be squeezed this winter by soaring production costs on rising gas, power prices.

- What might this mean for European PET resin contracts in 2023?

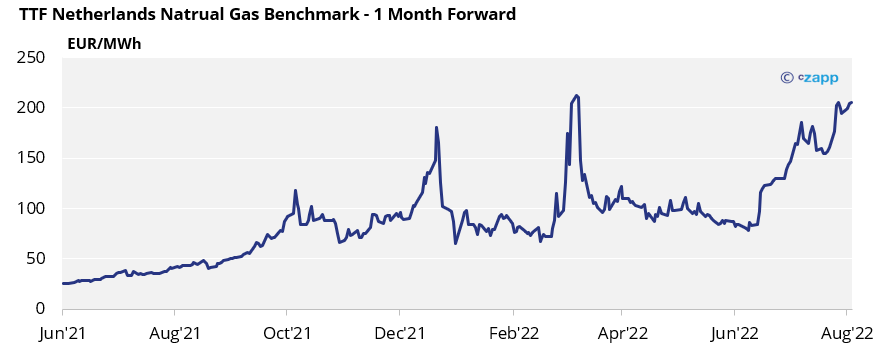

Over the last year, European natural gas, coal and power prices have surged because of disruption to fuel supply from Russia, which provides around 40% of the region’s gas needs alone.

Following the initial spike on Russia’s invasion of Ukraine, prices had begun to stabilise in recent months.

However, since the beginning of June, natural gas forward prices have surged by over 150%, hitting their highest since March.

Although many countries are rushing to cut their reliance on Russian gas, President Vladimir Putin has been exerting a death-like grip on European energy supplies in a bid to weaken European resolve on Ukraine.

Russia’s Gazprom has slashed gas flows over the past month, restricting the continent’s ability to build gas reserves for the coming winter, resulting in sharp price hikes.

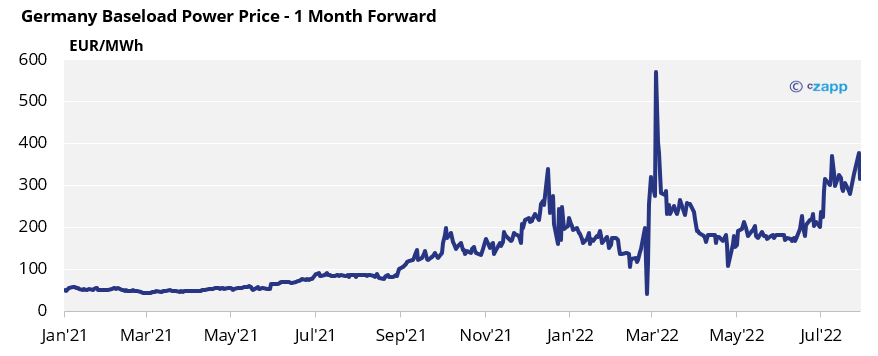

Rising gas prices have also been pushing the cost of electricity up across Europe. German power prices have surged by as much as 37% over the last month alone.

Summer Heatwave Contributing to Rise in Power Costs

Recent European heatwaves and droughts have also exacerbated the energy crisis.

Low river levels particularly in France, have meant nuclear plants can’t take as much water for cooling leading to lower output or shutdowns.

Whilst in Germany, a lack of water in the Rhine has contributed to oil and coal supply issues, making it difficult to transport coal to German coal-fired power stations.

Droughts have also lowered the amount of stored hydropower energy, such as in Northern Italy.

And things are set to get worse as winter approaches, with forward contracts for both natural gas and power in Europe already showing a steep premium over the current month.

Looking beyond even the winter ahead, some financial institutions are already suggesting that markets need to prepare for the long haul.

According to Goldman Sachs, Europe’s “energy crisis could drag on until 2025”.

What this means for PET Resin Producers in Europe?

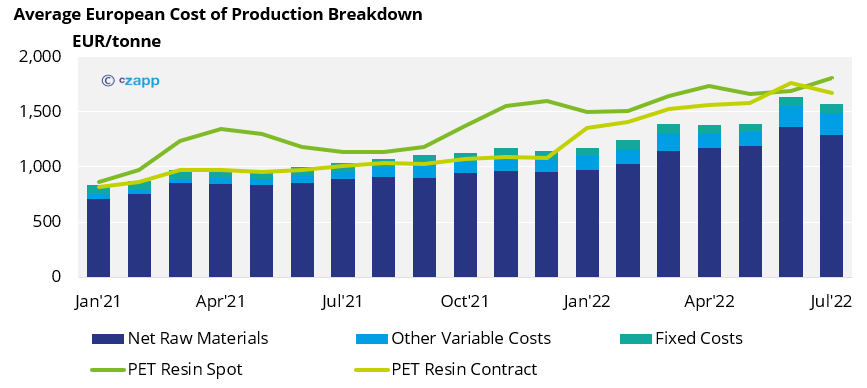

Over the last 12-months, the energy crisis has caused European PET resin producers’ costs to skyrocket.

Following a detailed assessment of the European production base, the average European cost of production was estimated to be EUR 1,568/tonne in July 2022.

Whilst raw materials account for around 80% of PET’s total production costs, producers’ margins have been eroded by increased power, fuel, and utilities costs.

Coming into August, energy costs for PET resin production have leapt once again. Based on current forward power and gas prices, utilities costs could rise a further 27% between July and December.

Whilst experiencing strong margins on spot sales for most of 2022, margins on raw material formula contracts have fallen sharply since May.

Current forward gas and power contract prices could add an extra EUR 52/tonne in costs by the end of the year. As a result, some producers could face losses on contracts despite large increases in this year’s fixed contract adder.

Might contract surcharges stage a comeback this winter?

What could this mean for 2023 contracts?

- Although still five months away, many within the PET industry are already looking towards year-end and what 2023 European contracts might look like.

- One possibility is that producers may attempt to recoup contract margins through a higher 2023 contract adder.

- This would lessen the gap between raw-material-based contracts and spot pricing, potentially setting up another substantive move towards market-based contracts next year.

- Given the current large price gap between domestic spot and imported resin, some buyers are already indicating potential lower European volumes next year.

- Larger buyers are also likely to place greater emphasis on breakbulk deliveries from Asia, providing further savings as well as clarity on next year’s costs.

Other Insights That May Be of Interest…

PET Supply Chains Groan Under Global Heatwaves

Plastics and Sustainability Trends in July 2022

European PET Market Stumbles as Producers Left Blind on Costs

PET Resin Trade Flows: China’s PET Exports Surge as Logistics Ease Post-COVID