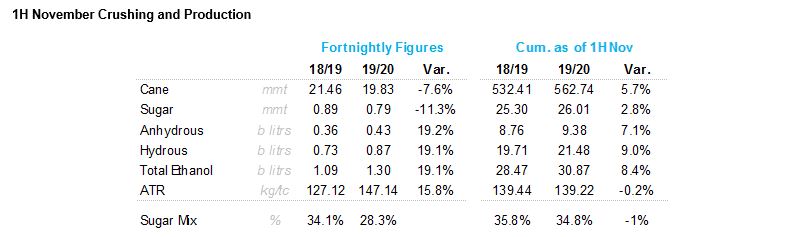

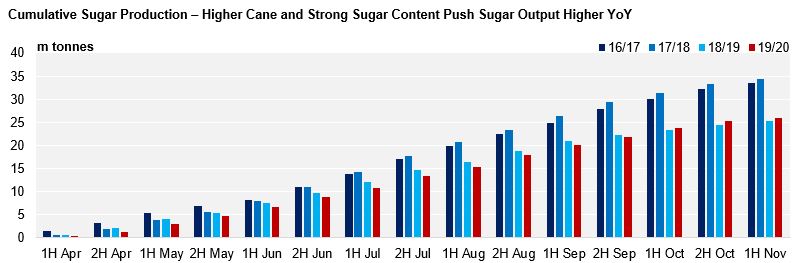

- Brazil’s sugar output is at 26m tonnes.

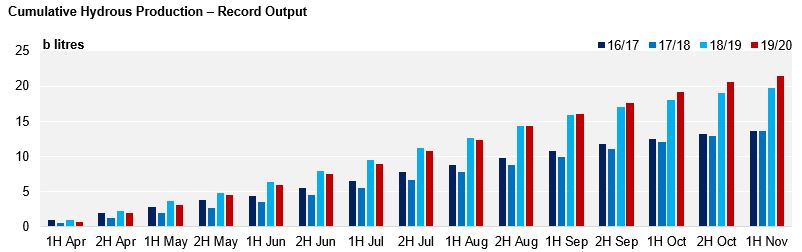

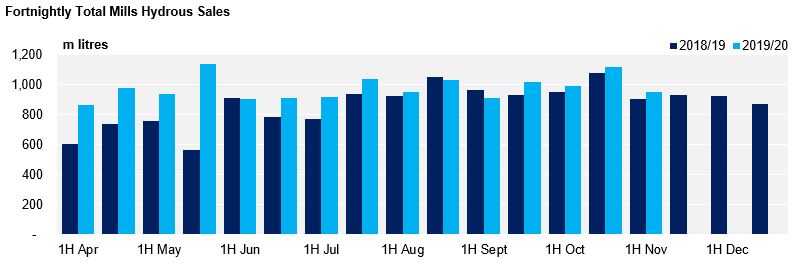

- Their hydrous output is also at a record high due to the max cane allocation going into ethanol.

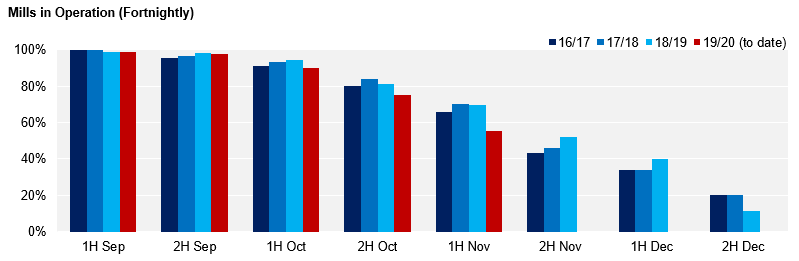

- More mills will be closing over the coming weeks.

Closing Early…

- This season mills are closing earlier than usual.

- During the 1H of November, only 56% of CS mills where in operation compared to 70% last season.

- This is the lowest percentage seen over the past seven crops.

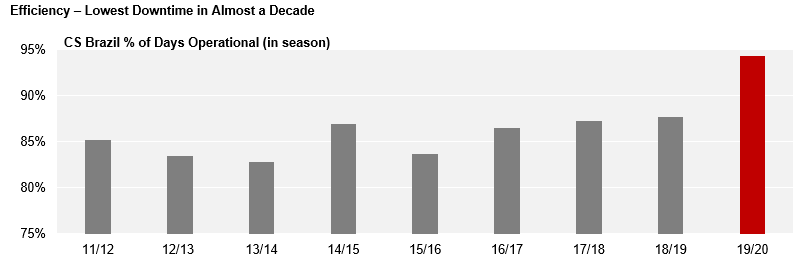

- It is not due to cane availability, which is expected to end around 3% higher year on year, but due to excellent time efficiency.

- According to UNICA, another 74 mills should end the season in 2H November and only 71 mills should still be operating in December.

…but higher output

- Record hydrous production has seen cumulative volume reach 21.5b litres until 1H November.

- Due to excellent demand, prices have been on the rise and reached BRL1.9/litre (14.3c/lb) last week.

- Over the next fortnights, the mills that are still operating will continue to focus on ethanol output.

- However, this will not prevent the final figure of the season for sugar production from surpassing last year’s.

Hydrous Sales

- Hydrous sales at 1H November reached 949m litres.

- Consumers continue to respond favourably to hydrous due to price parity.

- Price parity has increased to 66%, but this has not affected consumer preference.

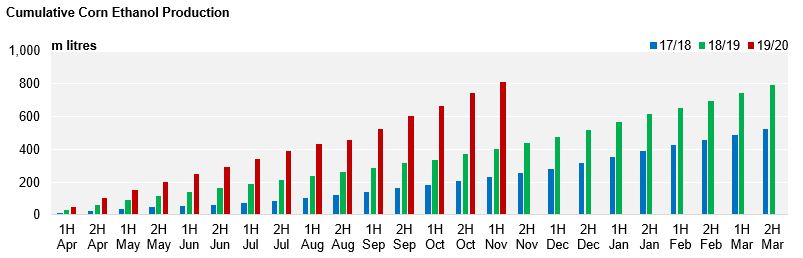

Corn Ethanol Production

- Total corn ethanol production was up 102% YoY at 810m litres in 1H November.

- The majority of output remains focussed on hydrous, with 557m litres of production until 1H November.

- At the current pace, corn output could surpass 1.4b litres this season.