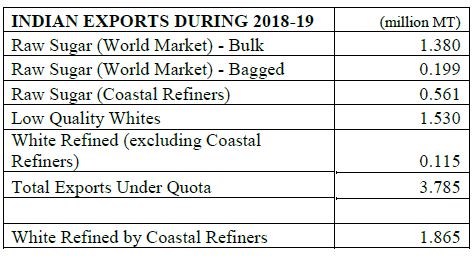

- Final Export figure for 2018-19 from India against and Export Quota of 5 mln MT.

- Export Subsidy of Rs 10,448 PMT (about USD 147 PMT) was announced in Aug. 2019 w.e.f. 1st Oct. 2019 on a quantity of 6 million MT. However, unlike in the past there were no strings attached to adhering to the local Sales Quota or selling above Minimum Selling Price (MSP), and is now available to the Mills on the export of 50% of their individual Quotas. Technically this means that Mills are not under any obligation to export their full Quota or even any Sugar. In our opinion exports from India will be much lower than discounted by the World Market.

- Low Quality Whites (LQW) will be shipped to the usual destinations of Sri Lanka, Afghanistan and East Africa & the Middle East. About 50kMT of LQW’s have traded to destination. Raws will be shipped to Iran, the Coastal Refiners and then to Bangladesh, Malaysia, Indonesia (if they change their import specs) and China. About 250kMT Raws have traded to Iran and about 150kMT Raws have traded to the Coastal Refiners.

- The Oil Marketing Companies (OMC) have invited bids for supply of 5.11 bln ltrs of Ethanol for the 2019-20 (Dec-Nov) campaign compared to the previous year’s tender of 3.29 bln ltrs. Although fewer Distilleries have participated in the tender, more sugar is expected to be diverted to Ethanol through “B-Heavy” Molasses and Cane Juice compared to last year (about 400 kMT of Sugar). Full tender details are awaited.