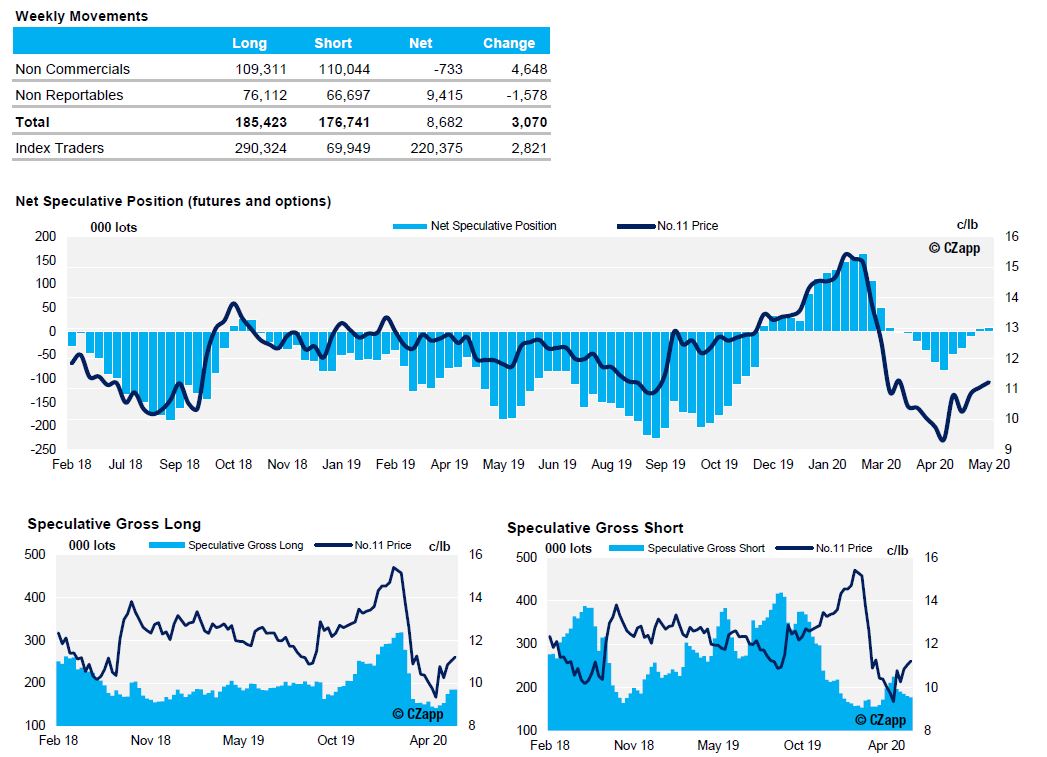

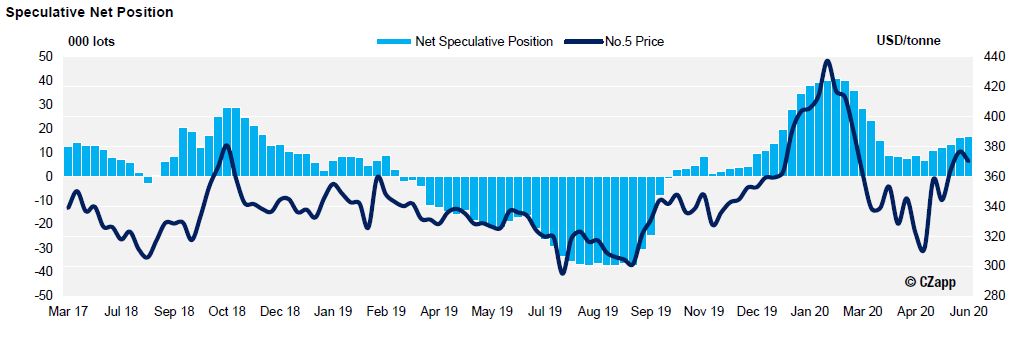

- Specs had a quiet week in Raw Sugar as price hovered around 11c, with the net long position growing by only 3k lots to remain effectively neutral.

- There was a similar story in White Sugar where the relatively stable price meant a small change in net spec position.

- However, since the data was collected there has been a rally to 12c in the No. 11 – which was likely driven by specs buying back short positions that were opened

below 11c.

ICE No.11 Futures Speculative Positioning (values as of 2nd June 2020)

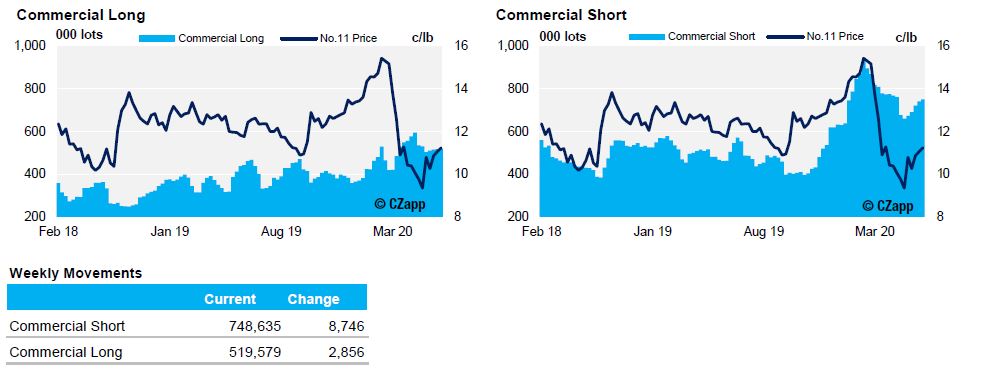

ICE No.11 Futures Commerical Positioning (values as of 2nd June 2020)

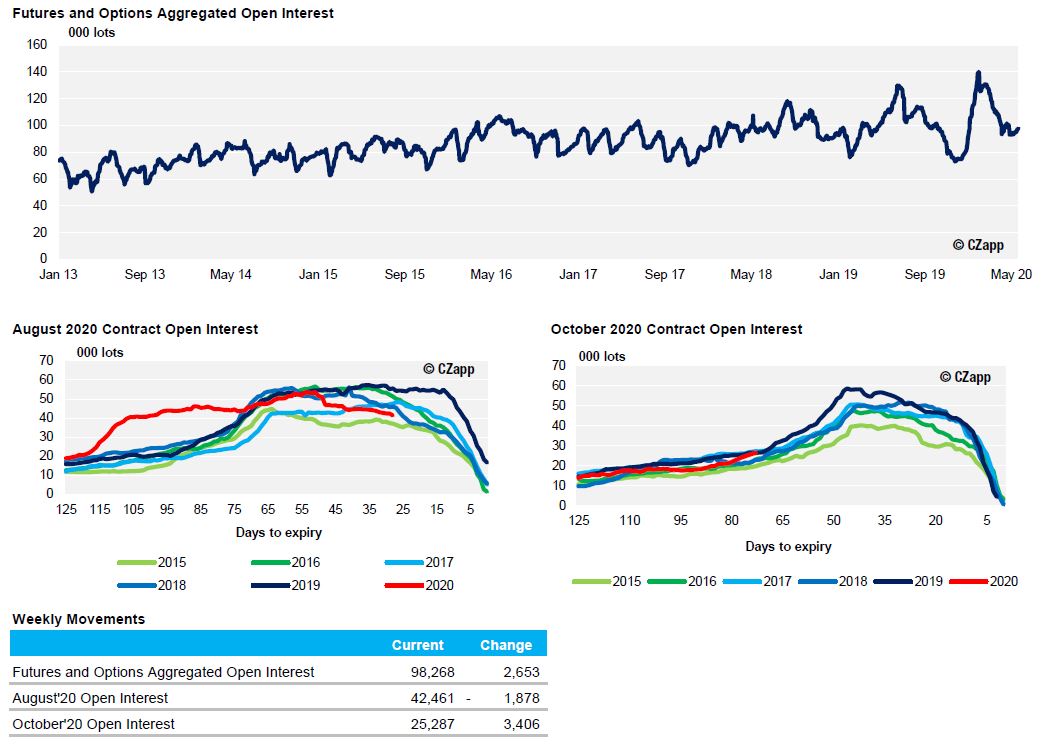

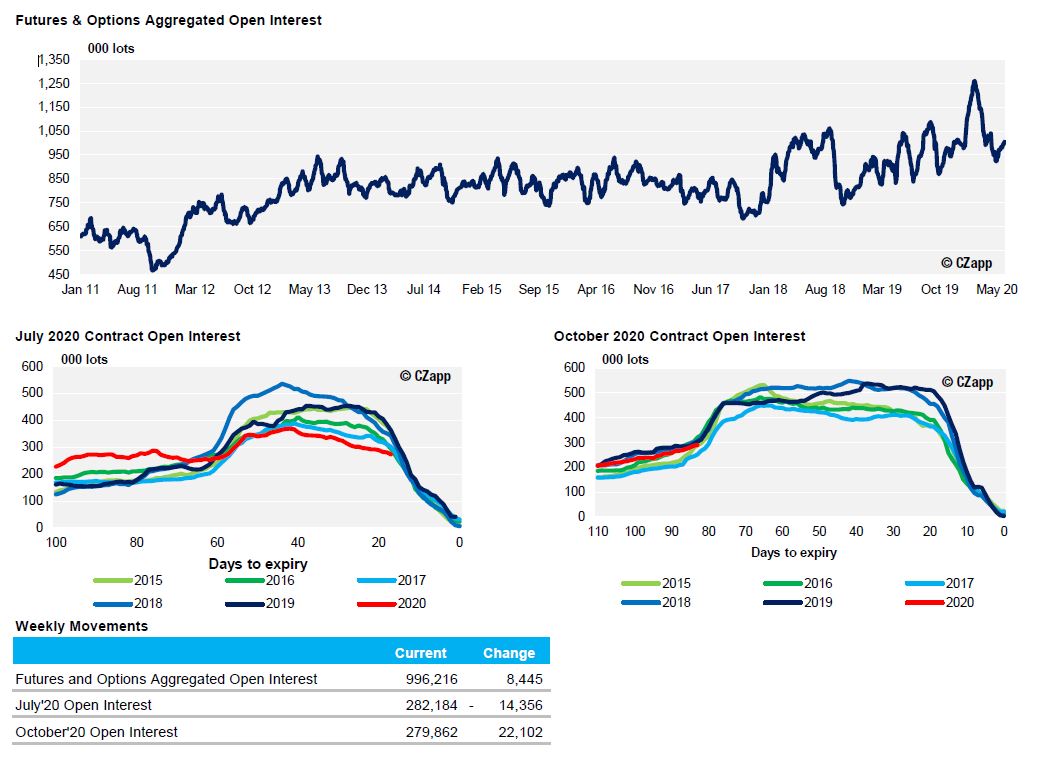

ICE No.11 Futures Open Interest (values as of 2nd June 2020)

ICE Futures Europe (No.5) Speculative Positioning (values as of 2nd June 2020)

ICE Futures Europe Open Interest (values as of 2nd June 2020)