- Mills are looking to hold as much ethanol as possible.

- The rationale is to try and benefit from higher prices in the offseason.

- Is there enough storage available for them to do so?

- If you’d like us to answer one of your questions in an upcoming edition, please email will@czapp.com.

This article is in response to a question from a client concerned that with many mills looking to hold ethanol stocks, tankage could become a problem and force them to sell, pushing down ethanol prices.

Is there enough tankage available?

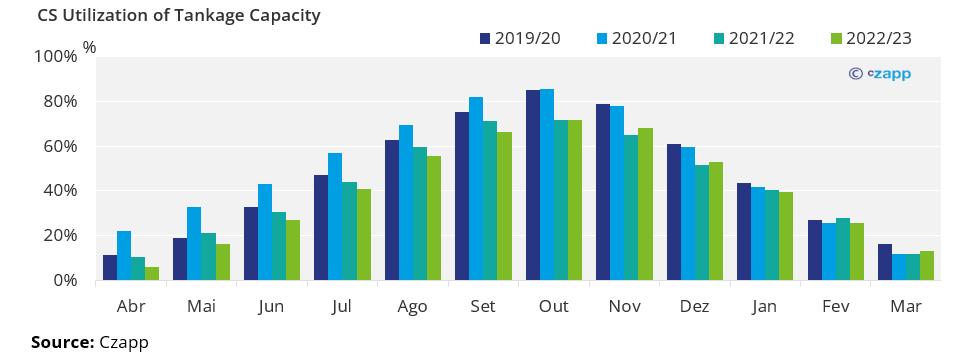

Tankage availability has been rising since 2019, according to ANP (National Oil Agency). Over the past three years, total tankage space rose around 5% and is estimated at around 14b litres in the Centre-South region.

Unlike 2019 and 2020, when the region used over 80% of its tank capacity, we don’t see storage becoming an issue this season.

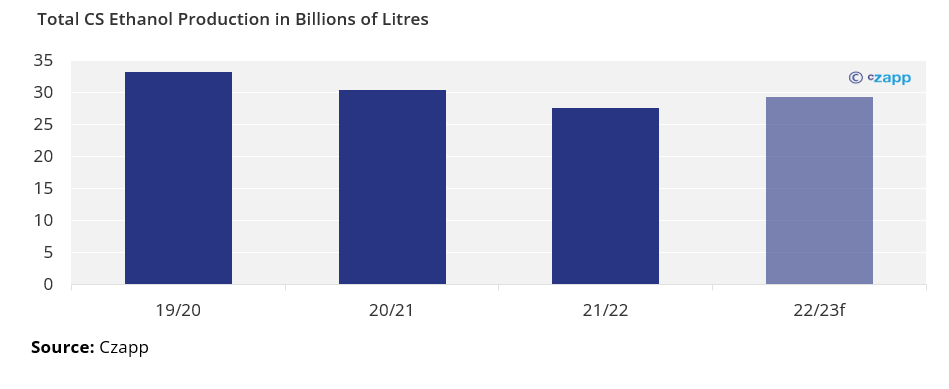

Fuel demand has recovered to pre pandemic levels, and production estimates point to total ethanol output of 29b litres, 12% less than in 2019/20