Sugar #11 Oct’21

The significant losses incurred yesterday afternoon could easily have encouraged continuation selling however with move having been macro driven and a majority of the macro positioned positively this morning we duly found some light early support which against limited selling took Oct’21 to 17.45 before pausing. With softs and grains driving the move the only uncertainly from the macro was crude where we were little changed following its sharp decline yesterday due to increased production, and it was maybe this factor which led us to track sideways for the rest of the morning, awaiting the next signal before specs are prepared to buy again in any meaningful way. The market picked up a touch during the early afternoon with newswires reporting Wilmar’s latest Brazilian crop estimates showing far lower production for the current crop, though with the noises they are making being reminiscent of the early part of the year when they looked to talk the market higher any reaction soon faded and from 17.49 we saw the price fall back through the range to revisit opening lows a couple of hours later. Volume continued to be low but buying then returned to swing back up the range once more to record a new high at 17.53 but then again fading back into the range. The latter stages were dull with prices continuing sideways and though there was a little MOC buying present we settled at 17.41 to leave the market firmly ensconced within the broad recent range.

Sugar #5 Oct’21

A generally firmer macro picture had us being called in higher today and Oct’21 duly surged to $451.50 during the early stages before settling down to hold wither side of $450.00. While the gains were impressive on the surface the entire move was based on very limited buying with the specs not showing following yesterdays collapse, while there were also ongoing struggles for the spreads (Oct/Dec’21 trading to -$10.10) and the white premium (Oct/Oct’21 beneath $66) which were contrary to the flat price strength. Moving into the afternoon we saw the flat price continue broadly sideways without any sign that we could re-attain the earlier highs, and this being in contrast to the efforts of the No.11 led white premium values to slip by another couple of dollars. A brief mid afternoon dip to $447.00 was defended to return prices back to the established range and with little drive now being generated form either sides we continued to flit within the range through until the closing stages. There was little change during the final stages aside from MOC buying ensuring that we settled away from session lows, concluding a day which suggests little beside a continuation of recent quiet action within the broad range.

White premium values continued above their intra-day lows late on but that did not prevent them from settling lower with Oct/Oct’21 closing at $65.50, March/March’22 at $72.70 and May/May’22 at $86.60.

ICE Futures U.S. Sugar No.11 Contract

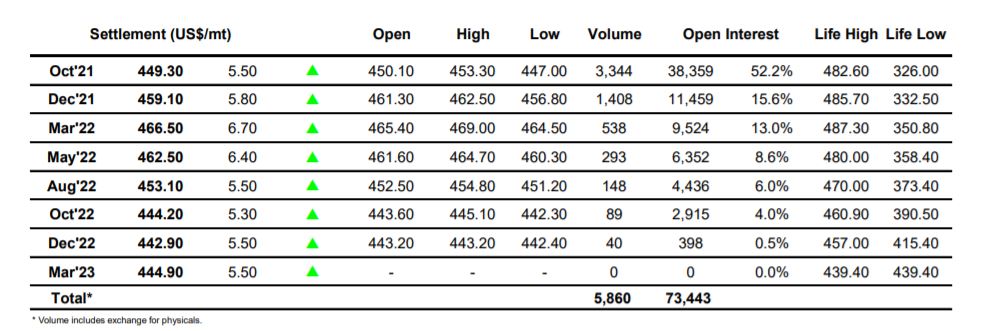

ICE Europe Whites Sugar Futures Contract