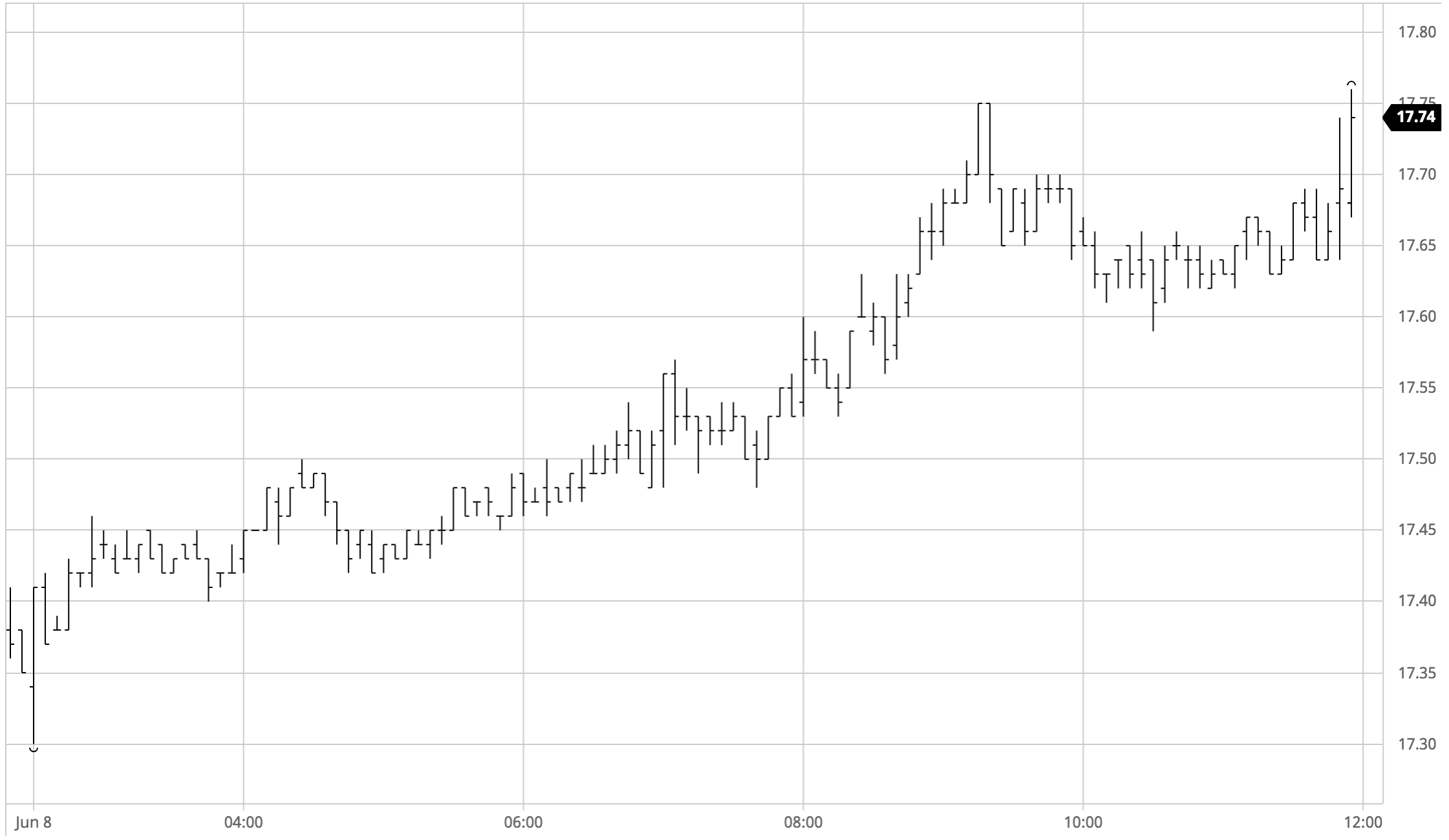

Sugar #11 Jul’21

A choppy opening for Jul’21 saw the value initially swing between 17.30 and 17.41 and with some light support showing we soon settled down to consolidate within the 17.40’s. Volume remained light throughout the morning leading values to hold a narrow band, the continuation within the same range proving counterproductive to hopes of any significant movement with many potential participants having remained stood aside for several weeks now. The early afternoon saw a little more buying emerge from specs/algo’s to further retrace yesterdays losses and momentum gathered so that by mid afternoon the price spiked up to 17.74. This flat price movement had a positive impact upon the spreads with Jul/Oct’21 moving all the way to a daily high at -0.01 point as trade buyers pushed into the index selling, going against the expected direction during the index roll window. From these high’s the flat price settled down into a narrow consolidation band which was maintained through the final couple of hours, the only change coming during the final minutes as MOC buying ensured a settlement value at 17.71 with a new daily high of 17.75 recorded on the post close. This constituted a fourth consecutive day or similar ranges with the bulls no doubt hoping that tomorrow’s UNICA data could provide a catalyst to mount a challenge of the 18c area.

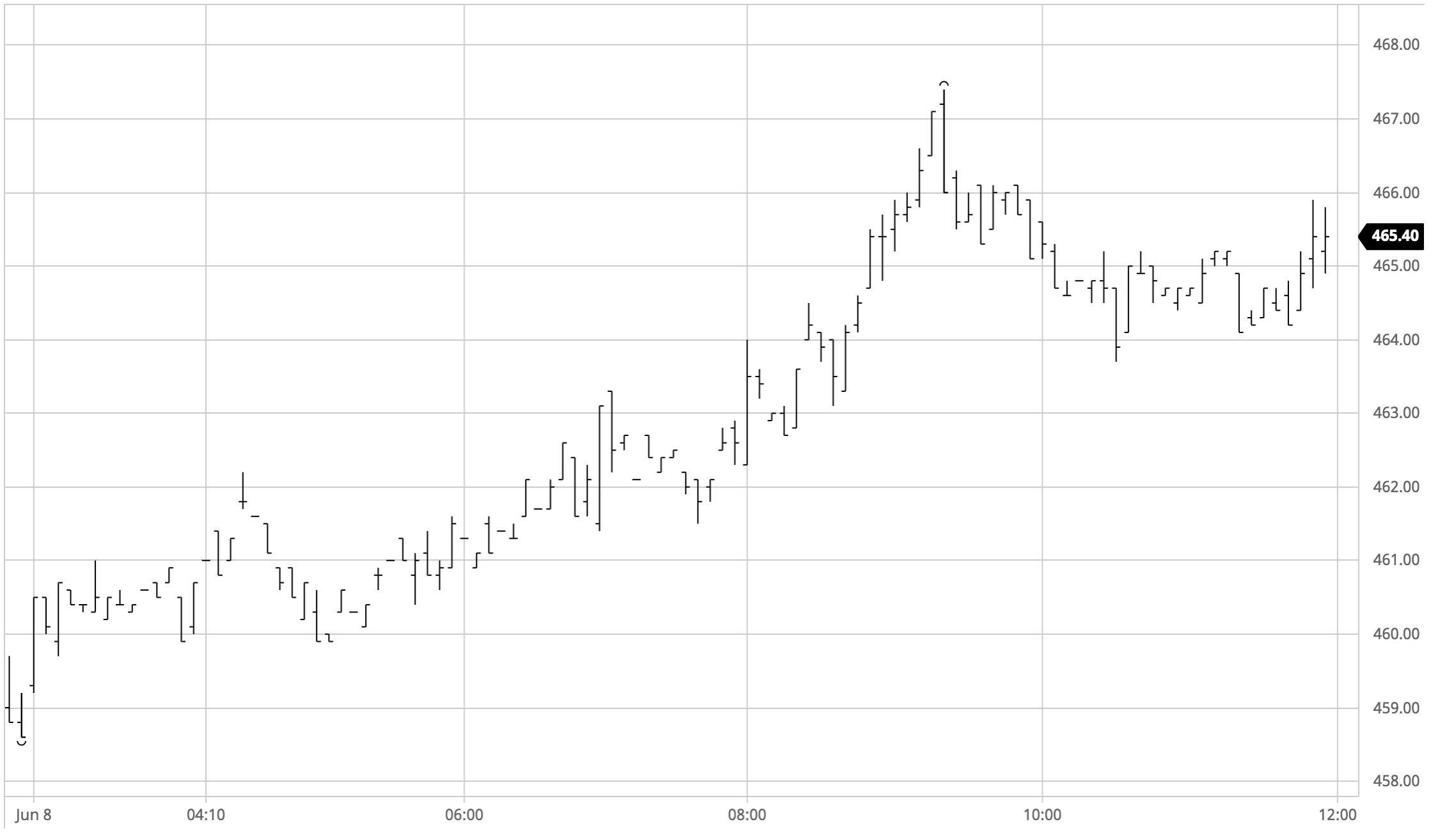

Sugar #5 Aug’21

Having fallen back to the lower end of the past weeks range last night the market found some morning buying to place things on a slightly firmer footing back above $460. From this start the market was well positioned to try and recoup yesterdays losses and the early afternoon saw sufficient buying continue to trickle in that we were able to extend further upwards. The macro picture was proving decidedly quiet with the CRB virtually unchanged but that did not deter specs from pushing up to $467.40 midway through the afternoon, though a pullback followed when profit taking emerged as profit taking emerged once the move had halted. Having firmly established what was to prove to be an inside day the final couple of hours saw volumes reduce back to minimal levels, edging sideways until some MOC buying appeared to ensure additional positivity to a settlement level established for Aug’21 at $465.50.

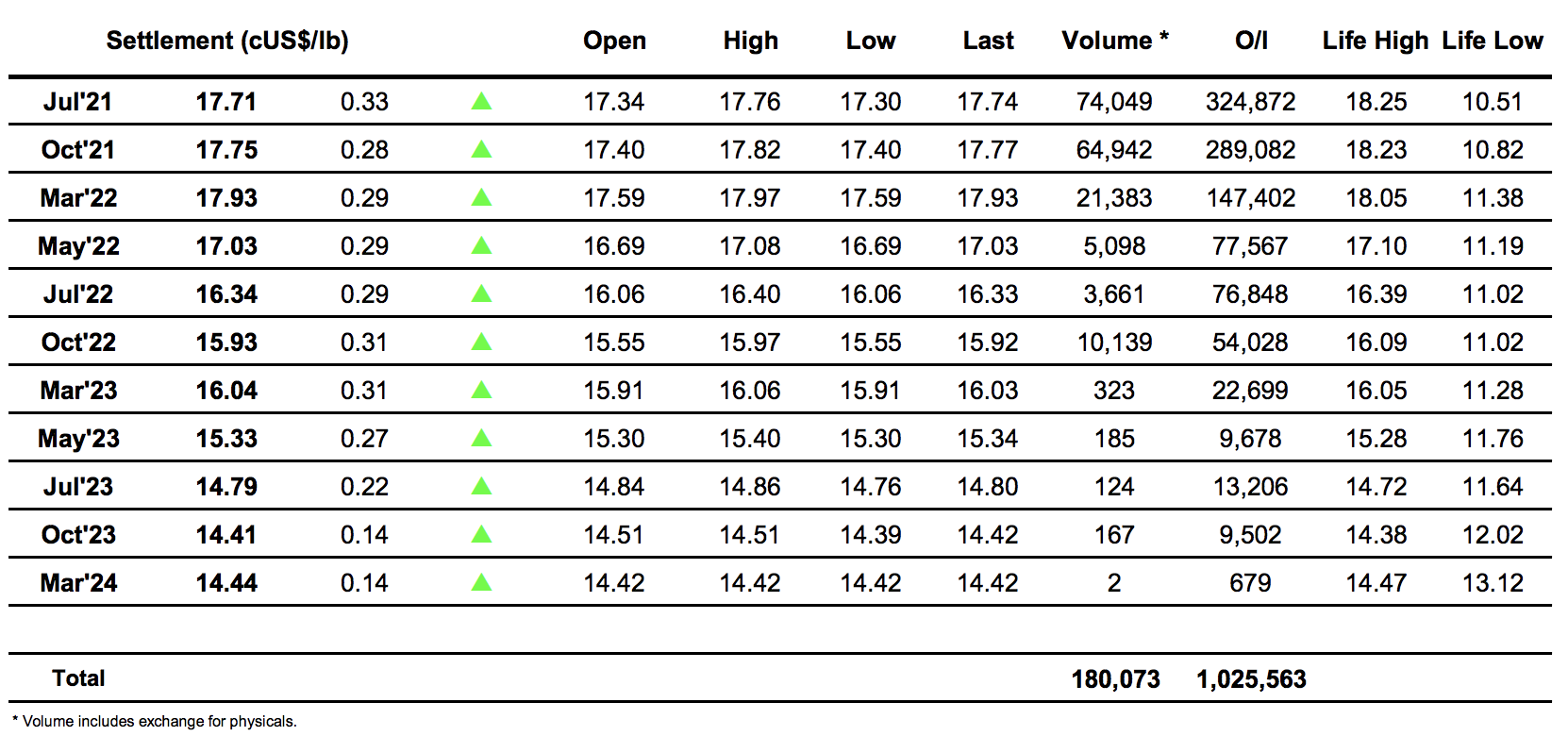

· A slow day for the white premiums saw values edge a touch lower across the board and we ended at $75.00 for Aug/Jul’21 with Oct/Oct’21 at $77.40 and March/March’22 at $79.70.

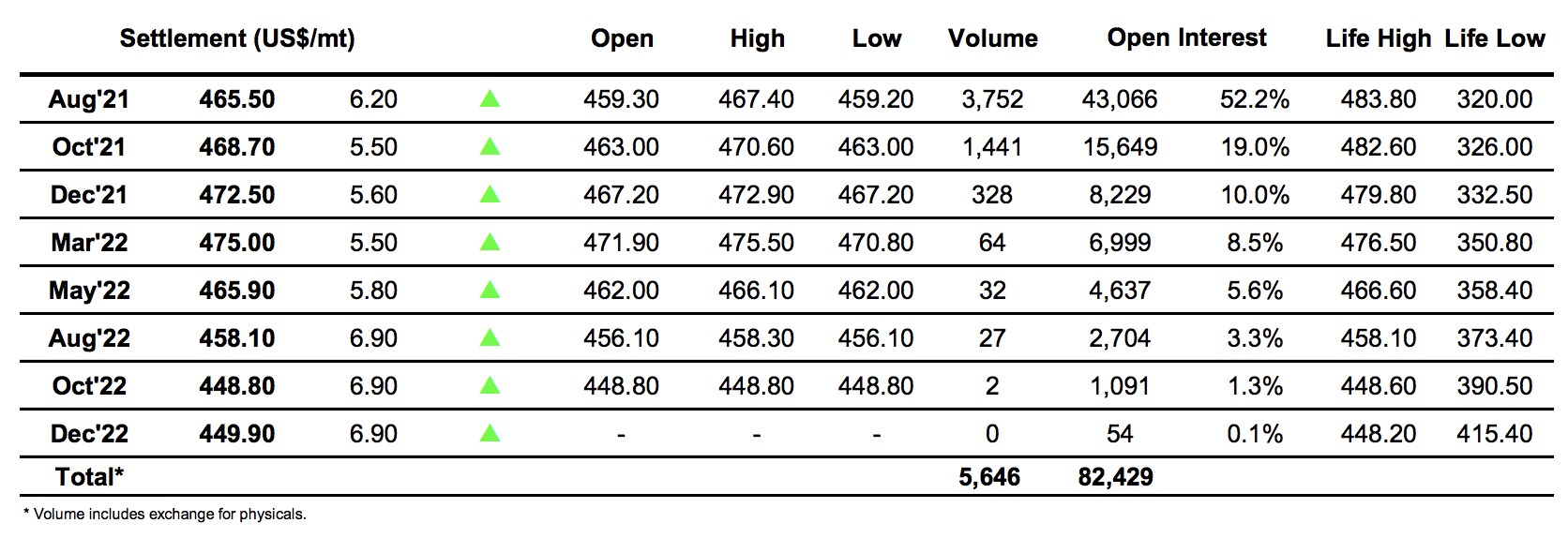

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract