Main Points

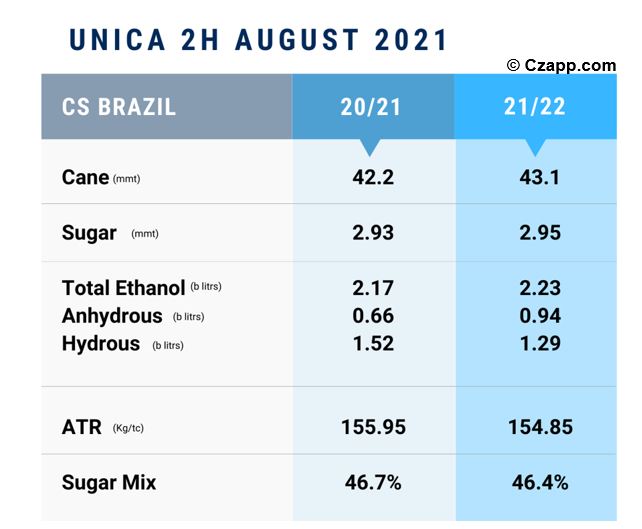

- 2H August numbers came out as expected: agricultural productivity weak vs ATR strong.

- As a result, we continue with our estimates for crushing 520mmt of cane and 32.5mmt of sugar for the 21/22 crop.

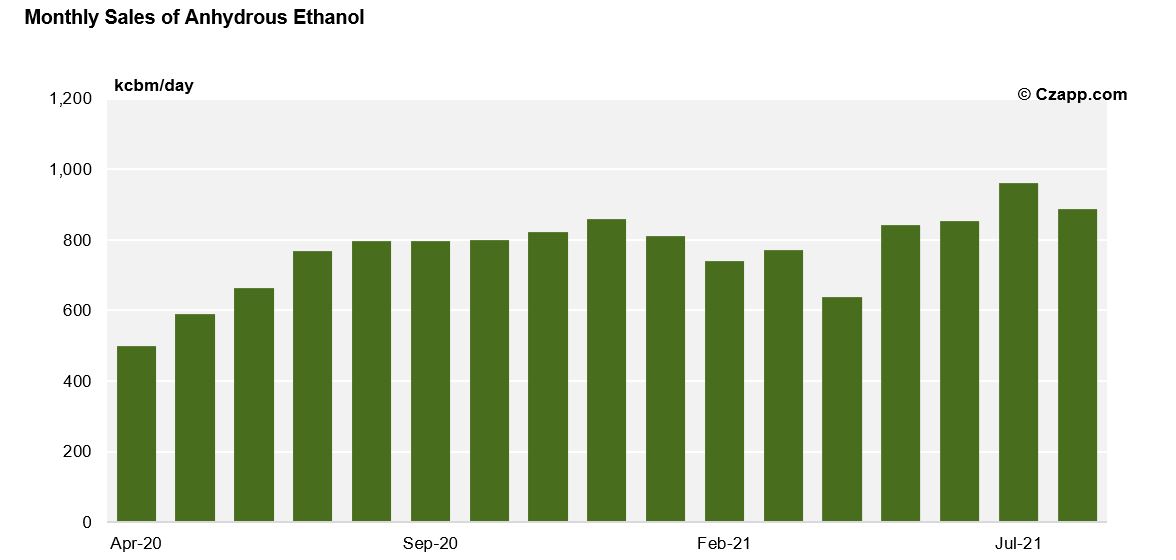

- Anhydrous sales in August reached 887 million liters.

Crop 2021/22 – 2H August

Fast Harvest – 43.1mmt

- As expected, 43 mmt of cane were processed in the fortnight, an increase of 2.08% over 20/21

- The accelerated pace is a result of the harvest schedule adjusted by the impact of the frost.

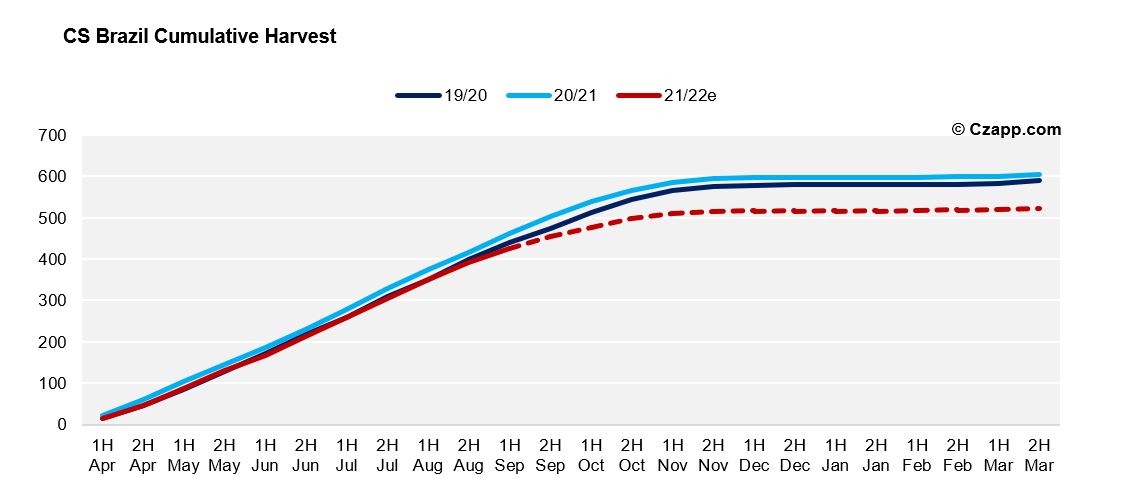

- According to Unica, the harvest is already in its final stages with many mills expected to close their operations at the end of October.

- So far, they have been processed in CS 392.6 mmt – a drop of 5.8% compared to the previous year.

- Therefore, according to the organization, there are only four fortnights left for the end of the 21/22 crop.

- The crushing pace should remain accelerated on the range of 30/40 mmt.

- For now, we maintain our perspective that CS will process 520 mmt.

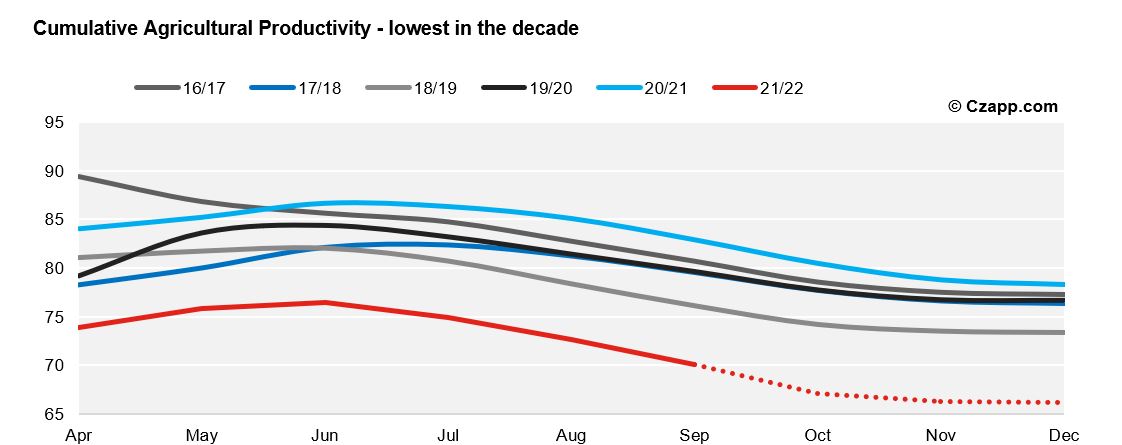

- The lower volume of available sugarcane is a direct consequence of the lowest TCH in the last 10 years.

- In Unica’s sampling, the accumulated agricultural productivity registered a decrease of 14.3% in relation to the past season: 85 t/ha against 72.9 t/ha.

- This was mainly a result of severe drought and frost events.

ATR

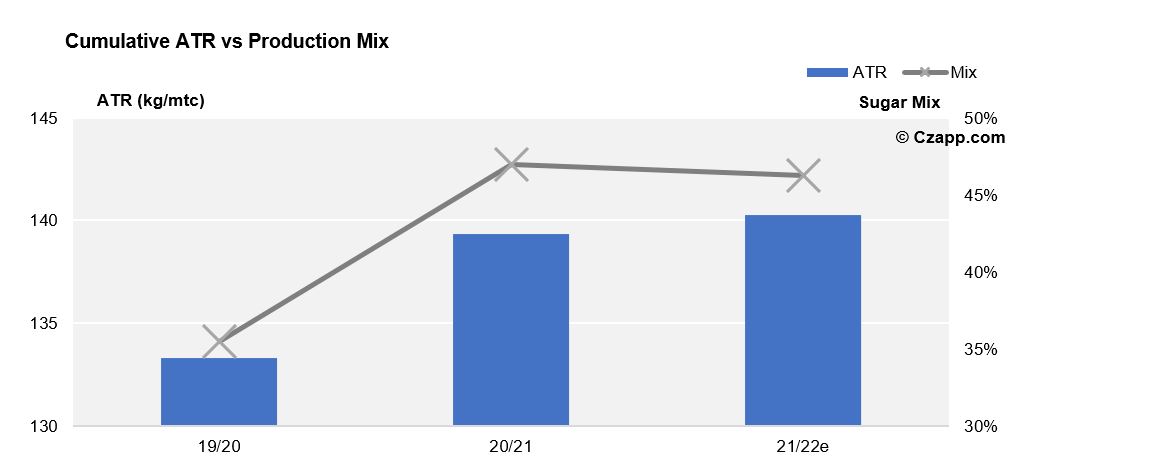

- On the other hand, the plant’s high sugar concentration helped to mitigate part of the effects of low agricultural productivity.

- Until the second half of August, the accumulated ATR registered was 140.26 kg/tc (+0.65% in relation to the 20/21) cycle.

- With a production mix still focused on sugar, CS has so far produced 24.3mmt of the sweetener.

- The sugar mix is due to the need for mills to honor their sales commitments.

- With the crop failure, the expectation is that this trend will continue until the end of 21/22.

Ethanol market – anhydrous continues with advantage

- Anhydrous continues as a priority in biofuel production given the favorable parity for gasoline (77.3%)

- In August, 887.10 million liters of anhydrous ethanol were sold – 11.4%, higher than 2020

Reports that you might like:

Dashboards that you might like: