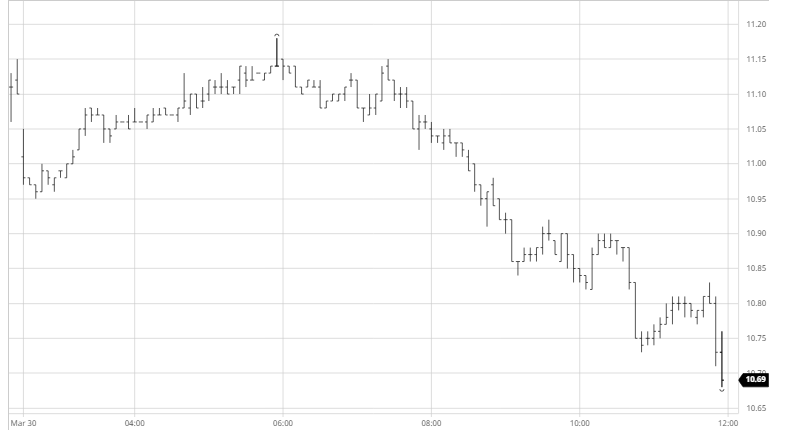

A weaker start to the week in Asia had set a negative tone and we commenced a little lower in reaction to the macro. Fridays COT report had brought few surprises in showing that specs had sold a little more over the reporting period to turn marginally short, though expectations are that this “neutral” stance will be maintained for the short term. Prices did pull back up through the rest of the morning to be positive though this may have been in reaction to the continuing stability of May’20 whites where the ongoing concerns over the forthcoming delivery have seen a squeeze in recent days, today reaching a widest $21.90 for May/Aug’20 while the May WP was trading above $121 during the afternoon. It was during the afternoon that macro pressures took over to once again dominate the No.11 performance, adding to this WP dynamic. With WTI and Brent crude down 7% and 12% respectively and the USDBRL at 5.17 we also received news that the two largest fuel distributors in Brazil have declared force majeure on ethanol purchases from mills. This combination of factors sent May’20 all the way back to 10.68 at the end of the session, virtually erasing the recent recovery and placing us back towards the recent lows once again.