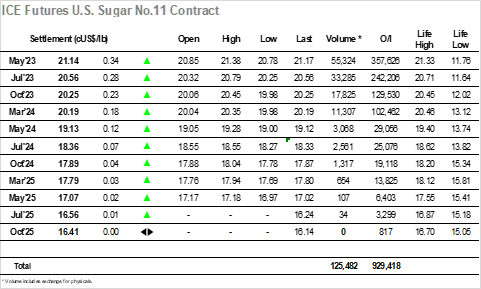

A quiet opening saw the market trading marginally higher, however the picture was soon enlivened as a drive to new contract highs from the white’s market pulled in spec buying to No.11. The gains were modest in comparison to the whites as May’23 extended to 21.10, however it did serve to renew spec interest with their continuing support extending the move into the mid-teens over the course of the morning. We awaited the start of the US morning to see how the wider spec/fund community would react, and they duly emerged with fresh buying to send prices upward to challenge contract highs in a move which seemed unlikely just 24 hours ago. The move paused briefly in the upper 21.20’s before a sharp prod higher saw a new contract mark establish at 21.38, however with the larger funds still holding back the move then stalled and prices retreated to the 21.20’s. A further washout of longs saw May’23 back to 21.09 soon after though once that was concluded things settled with the final few hours seeing some tedious sideways movement. With some more producer prici98ng filtering in overhead there was a reluctance for today at least to follow the white’s higher, and the closing stages saw no fresh movement with May’23 ending at 21.14, a strong showing though one that still suggests a reluctance to move significantly higher while hedge funds remain aside and simply sit on existing holdings.

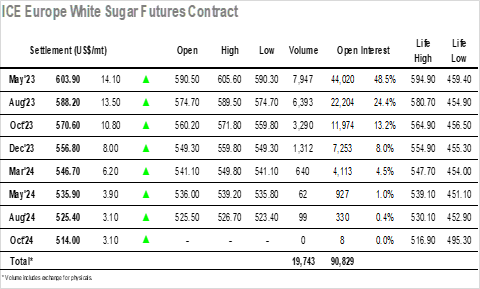

Buying was evident from the start today as specs looked to push the market and challenge the $594.90 contract high mark. Within 10 minutes this level was firmly in sight and a quick push followed to trigger off some buy stops that sent the market rapidly up to trade above $600 for the first time since last September when prices spiked ahead of the Oct’22 expiry. The sharp nature of this rise widened the nearby spreads and white premiums significantly with May/Aug’23 trading to $18.90 and May/May’23 to $138.00, a mighty rise which left the market looking a little overdone in the context of No.11 and the wider macro. News soon emerged of a 3-month export ban from Egypt as the catalyst for the move, and through the rest of the morning prices consolidated comfortably above $599.00 though both spread and premium returned some of their gain. The arrival of US traders brought some better buying to the No.11 which further narrowed the premium to $132.00, though some fresh momentum was garnered to take May’23 to a new high at $604.30, in the process filling the continuation gap to $603.00 which had established when Dec’22 took over at the front of the board. With technical targets achieved some profit taking set in from longs, though support remained around the market to ensure values continued above $600 through most of the afternoon. This presented a great opportunity for longs to push the close and another set of highs were registered at $605.60 heading into the call to ensure that the picture remained firm. May’23 settlement was made at $603.90 with the white premium at $138.00, concluding a strong showing that left the whites well ahead of its sector peers.