It rained heavily in Centre-South (CS) Brazil in the second half of September. CS Brazil is the world’s largest cane growing region and sugar exporter, accounting for more than half of the world’s raw sugar supply at this time of year.

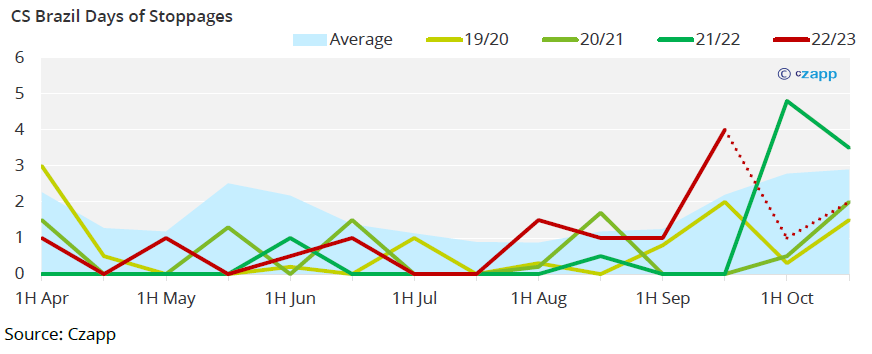

The rains meant that cane harvesting machines were not able to access fields to avoid compacting the soil and damaging the cane – harvest in the region is 98% mechanized. As a result, sugar production for the region was 600k tonnes lower than it would have been if the weather was normal.

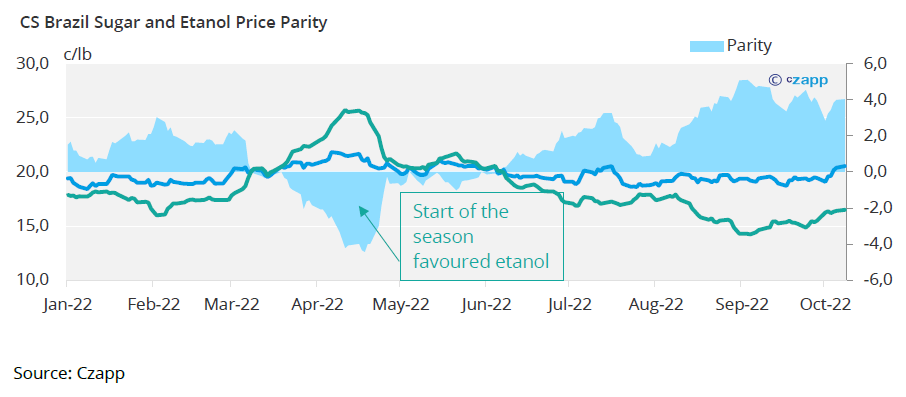

This is a problem because the cane harvest in CS Brazil is already running behind schedule. Mills started crushing late in Q2’22 to allow the cane more time to develop. Additionally, early production was focused towards making ethanol, not sugar, as the fuel was paying higher returns thanks to high energy prices.

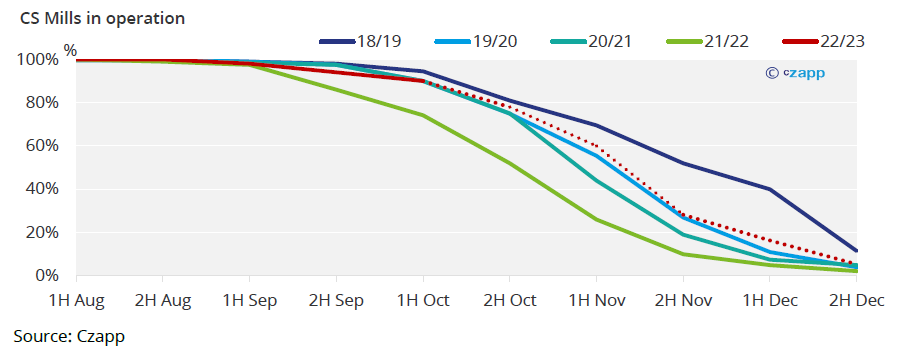

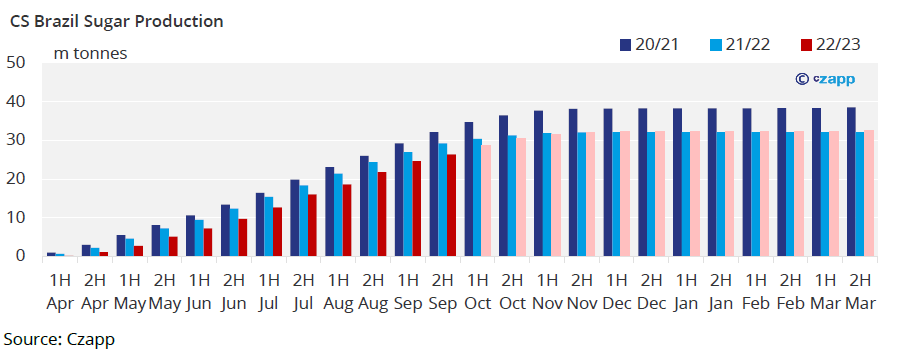

The region has made 2,8m tonnes less sugar than it did this time last year and may only surpass last year’s production as late as November. Even this isn’t guaranteed: mills are relying on the weather in Q4’22 being in line with historical averages or drier than usual. Many mills will also extend their cane crush deep into December, when the rainy season is underway.

To add to the risks, Brazil is under the La Niña effect which causes rains above average in some areas of Centre-South.

Whatever the mills’ intentions might be, above-average rains from now on would not only hinder operations but would also decrease sucrose (ATR) levels in the cane. This might force mills to allocate more cane towards ethanol once more as poor-quality cane is more suited to making ethanol than sugar.

We believe the downside risks are sufficient to justify a downgrade to our sugar production forecast, which we have revised from 33.2 to 32.5m tonnes. This is sugar that now will not be available to the export market.

Other Insights That May Be of Interest…

Market View: Sugar Benefits From Energy Bounce

Is Brazil’s Cane Sector About to Expand?

Explainers That May Be of Interest…

Czapp Explains: The Impact of El Niño and La Niña in Each Region of Brazil