Opinion Focus

- Today there is a truck drivers’ s strike scheduled in Brazil.

- So far there is no indication of this becoming a large-scale event as we saw in 2018.

- However, we do not disregard the potential of this gaining strength and shutting down Brazil once again.

Strike Scheduled for 1st November

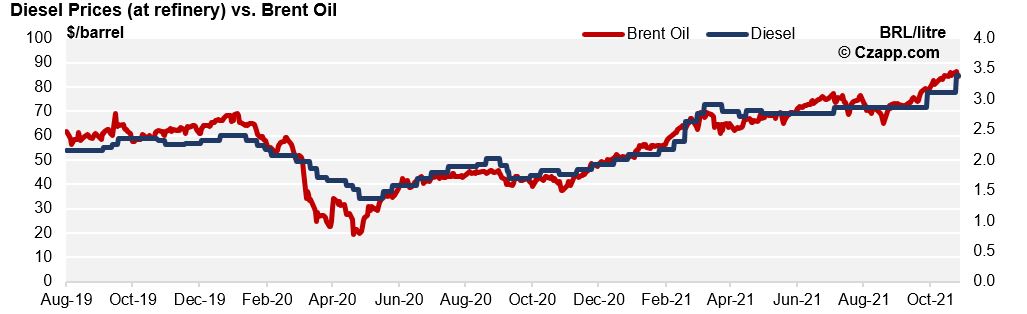

- This year, truckers have complained constantly of high diesel prices.

- Despite significant pressure, Petrobras remains using international fuel prices as benchmark.

- With oil price strength and Brazilian Real weakness, adjustments have mostly been upwards.

- Diesel prices at the refineries are now 63% higher than they were in January, at around BRL 3.4/litre – the highest on record.

- Furthermore, low demand for road freight means freight values are not rising enough to offset the hike in costs for drivers.

- Several strikes attempts and threats were registered so far this year, but with no major adherence.

- However, the strike scheduled for today seems to have more strength than the one attempted in August.

- Despite efforts of the government to ease the tensions, like promising a sort of Diesel Aid, truckers remain unhappy and said will go forth as planned.

What are the Impacts?

- Despite of the strike taking place, there are 2 positive notes:

- Unlike in 2018 (see last session of the report), major logistic companies are not on board.

- So, this means that most of the truckers are autonomous and could lack the strength to become a large-scale movement.

- Second, they have said they will not form roadblocks so this means that services and goods can still circulate in the country.

- The last time Brazil was held hostage by the situation, the country stopped for ten days, and the impact was 1 percentage point of GDP growth lost.

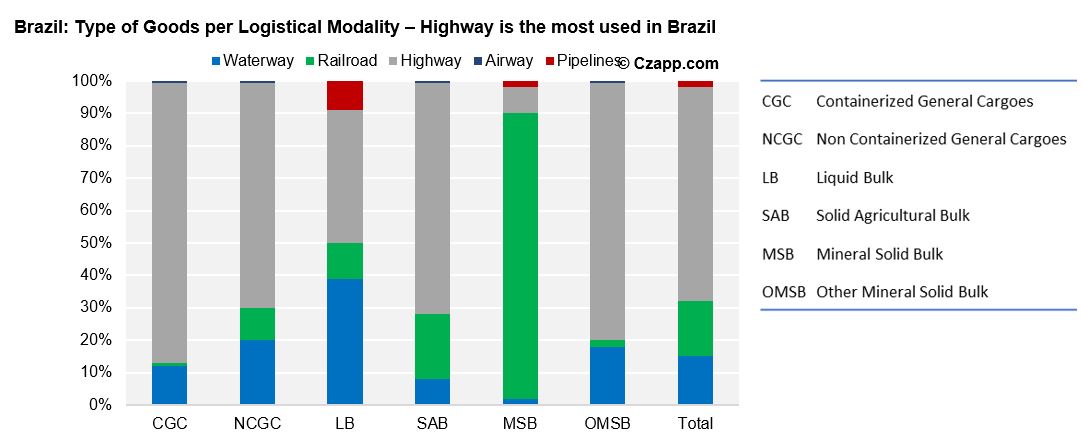

- Given that goods in Brazil are mainly distributed via roads (over 60%), meaning trucks, an impact could be seen in all the supply chain – from the production to the final consumer.

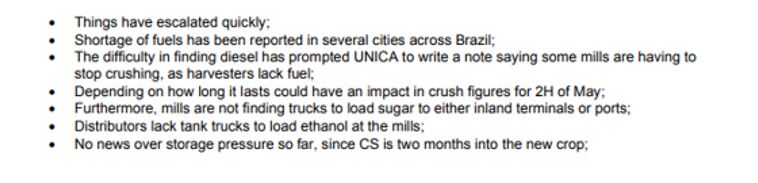

- For sugar specifically, could mean issues in transporting the sweetener to the ports causing loading delays and, depending on the length of the strike, even physical differential could suffer in the short term.

- As for sugar production, even though the crop is at its end, a shortness of fuel could mean unwanted harvest stoppages.

- Unfortunately, we will only know the potential effects the day after. By then we will be able to understand how much of the truckers have joined the strike and how long it could last.

Remember 2018?

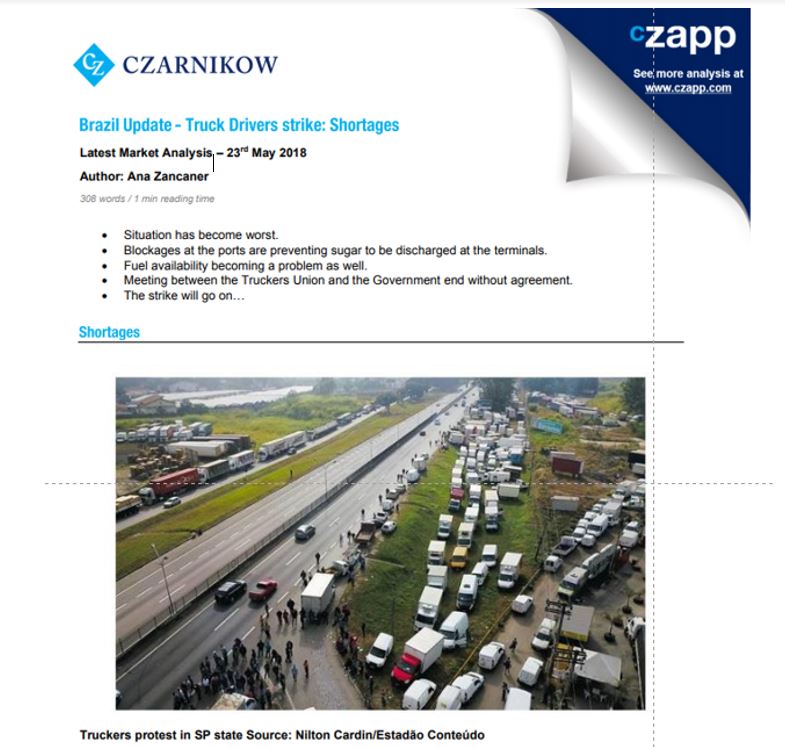

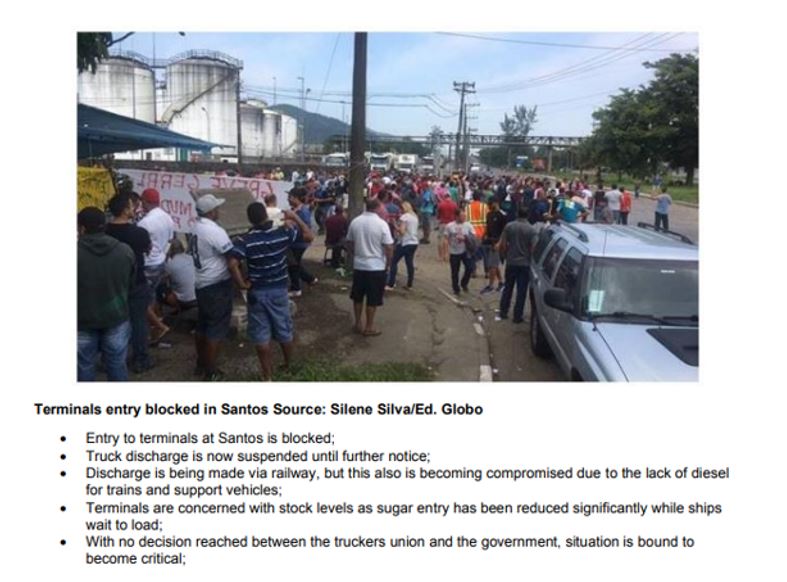

- The truckers strike lasted 10 days in 2018, leadin’g to problems from fields to the ports, to fuel shortages, cancelled flights, to name a few.

- Below we added one of the reports we wrote back in May 2018, so you can revisit the impact of those stressful days…

Other Reports You Might Find Interesting: