Main Points

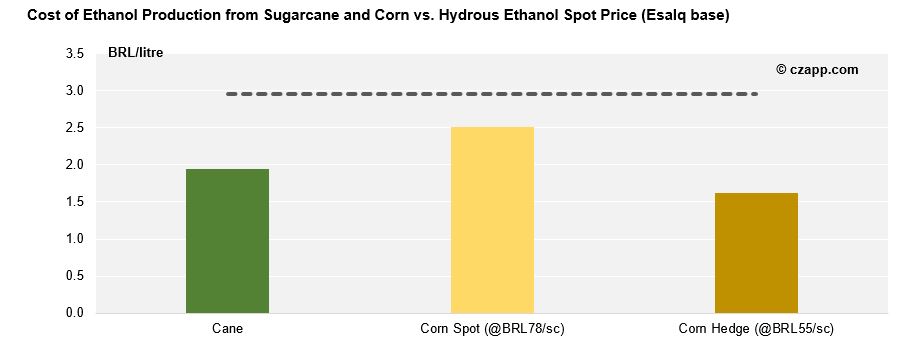

- Despite the increase in the corn price, the persistent increase in the price of ethanol still generates positive returns for corn ethanol mills.

- As a result, we have seen an increase in the supply of ethanol from corn, which brings relief from the tight fuel balance.

- However, the dry weather limits grain production, leading to questions about the future availability of ethanol supply from corn

Corn Ethanol Mills with Positive Margins

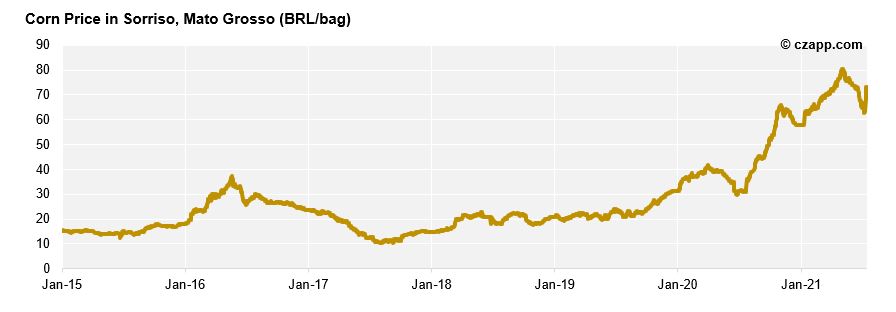

- Domestic corn prices have strengthened in the last year – 140% increase

- This leads to an increase in the cost of production from corn ethanol.

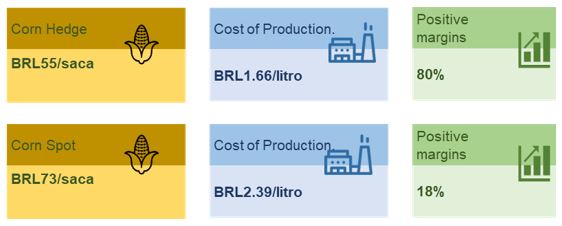

- A bag of corn represents approx. 90% of the cost

- Strong international demand combined with the devaluation of the currency push exports and the price up – spot market at BRL73/sc.

- Today the bag of spot corn is around 73 reais.

- Even with the valuation of the main input in the spot market, the mills have positive margins.

- Result of the good prices of ethanol and DDGS (by-product of the production of ethanol for animal feed) that offset the high production costs

- However, to avoid being exposed to high prices, mills tend to anticipate corn purchases by making hedge operations, ensuring financial predictability and cost control.

- In this case, when the mill manages to buy corn in advance, mill margins can go up from 18% (at spot price) to 80% (considering the bag at BRL55/sc).

- The positive biofuel environment resulted in the expansion of the corn ethanol production capacity, currently with 17 mills in operation and 23 in project.

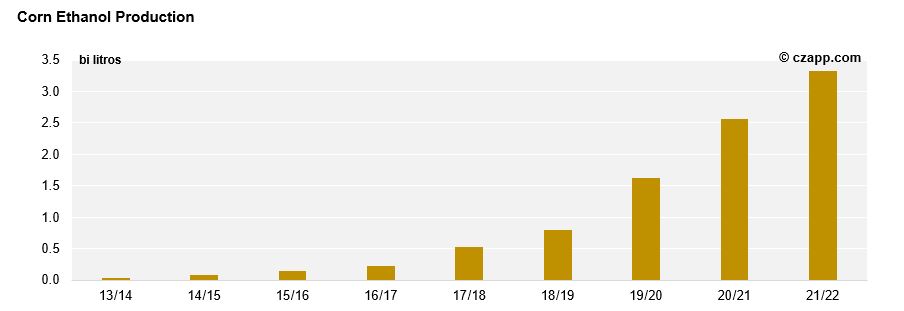

- In the last two years, corn ethanol production has expanded by more than 200%

- jumped from 791 mm liters in the 18/19 crop to 3.33 billion liters forecast for this season

- and according to Unem, until the 2027/28 cycle, the volume is expected to reach 8 billion liters

- On the other hand, we must not fail to point out the risk for the coming cycle.

- The outlook for corn prices remains high, which makes production costs high and, depending on the price of ethanol, could eat up a large part of the expected margins

The Smallest Ethanol Supply of the Decade

- With the drought negatively impacting sugarcane and the maximization of the production mix for sugar, the sugarcane ethanol supply should be the lowest in the decade.

- We estimate that the production of hydrous from sugarcane should reach 15.5 billion liters and anhydrous 9 billion liters – a decrease of 18% and 0.6% yoy

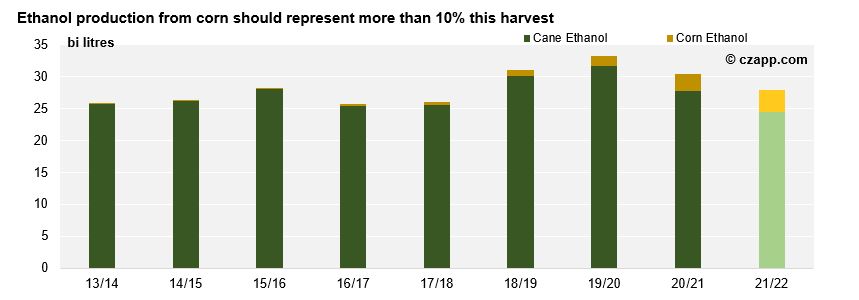

- In order to meet demand, we believe that corn ethanol has an important role in the balance, but its market share is still small:

- In this crop, corn ethanol should represent 10% of Brazilian ethanol production

Corn Crop Failure May Limit Ethanol Output

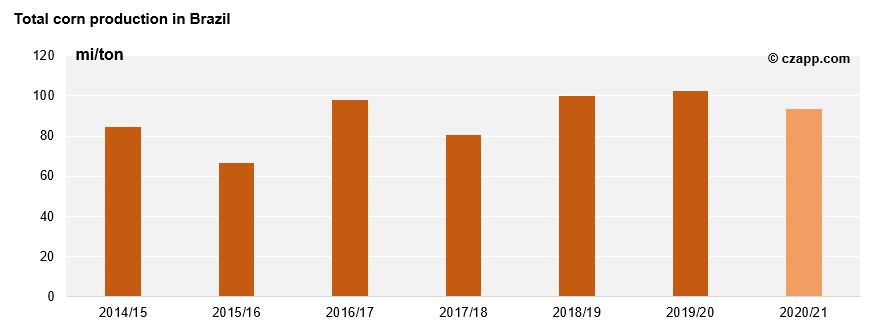

- Like sugarcane, the second corn crop will have a drop in productivity due to the dry weather.

- With adverse weather, most of the grain was planted outside the ideal window, leaving crops more vulnerable to weather problems.

- With the incidence of frosts, the conditions of corn plantations worsened, especially in Paraná, which is the second largest producing state in Brazil – only behind Mato Grosso

- For the time being, the estimate is for a drop of almost 10% in the total corn crop, taking production to 93mmt – with a potential drop depending on the impact of frosts on Paraná’s crops.

- Although many mills have cereal stocks and hedge their purchases through the futures market, we do not rule out an impact on corn ethanol production if the corn crop failure becomes more pronounced.