- Brent prices keep falling;

- However, hydrous demand 1.5bi litre higher yoy while output is only 0.31% above the same period is causing a stock drawdown;

- The outlook for ethanol remains positive, despite the possible rally cap.

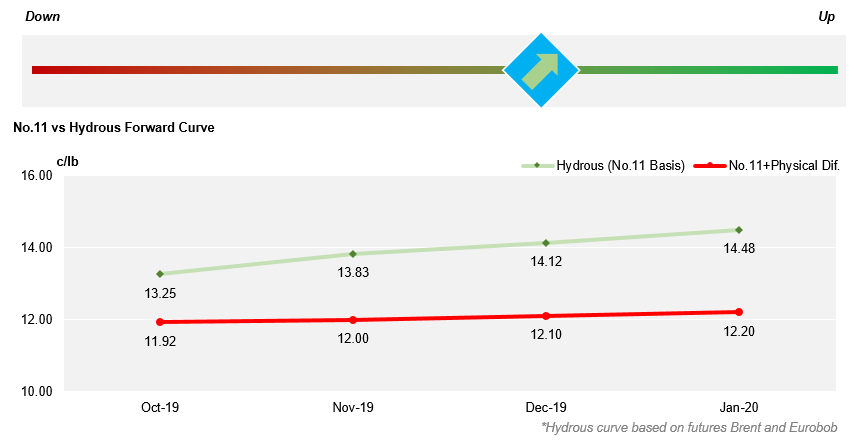

Centre South Brazil Ethanol Price Trends

- The weakness in the oil market is persisting, increase in US oil inventories and evidence of a global economic slowdown are behind the behaviour of the commodity this week;

- Although this could put a cap on hydrous offseason rally, the outlook for hydrous price behaviour is still positive.

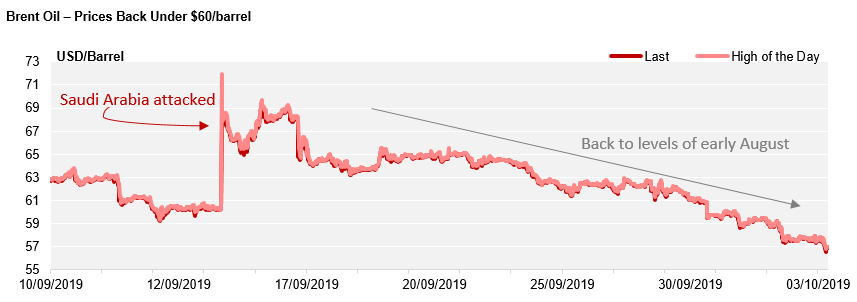

Recession Fears are Back at It

- It has not been a positive week for the oil market;

- After the attack on Saudi Arabia oil infrastructure, the output has been normalized and with it fears of a supply interruption;

- Additionally, bearish data disclosed in the past days has added a negative feeling for oil prices:

- WTO has reduced its global growth forecasts due to rising trade tensions and global macroeconomic risks that are tending to the downside;

- US oil stocks inventories this week showed an increase to 422.6mi barrels from 419.5mi barrel the previous week – the opposite of what the American Petroleum Institute (API) was expecting;

- US manufacturing report down to a 10 year low;

- More analysts point that the weakness in Brent values is here to stay, but the question remains if prices will normalize under or over $60/barrel…

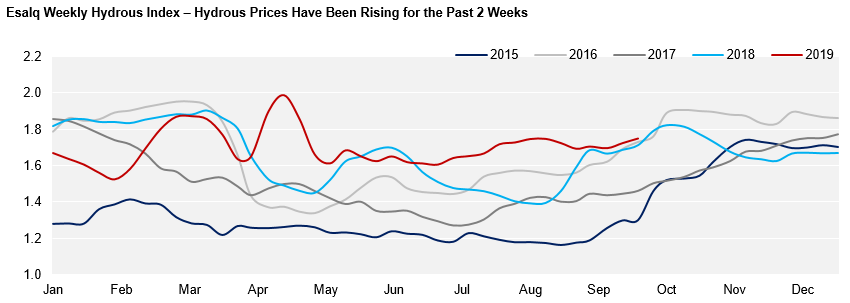

The Opposite Direction

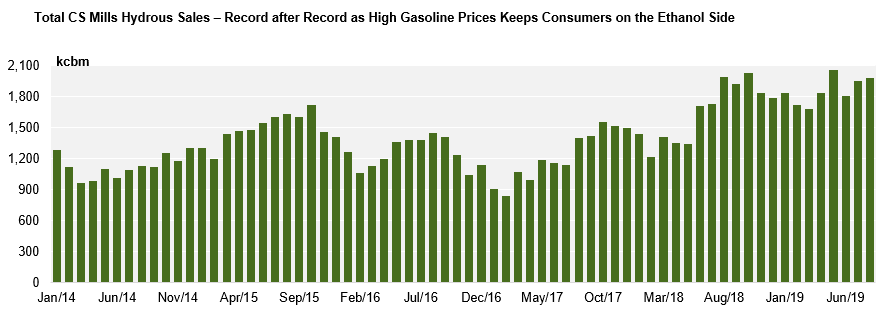

- Despite record hydrous output, hydrous prices have been rising for the past 2 weeks;

- Latest sales data showed that total hydrous volume traded in the 1H of September reached 912mi litres;

- On a cumulative basis, this is 1.5bi litres above so far this season, while production has been only slightly higher;

- Consequentially, stocks are around 12% lower yoy which has been offering support despite the weakness in the oil market;

- From October onwards, the stock drawdown is expected to intensify and with it the climbing of hydrous values;

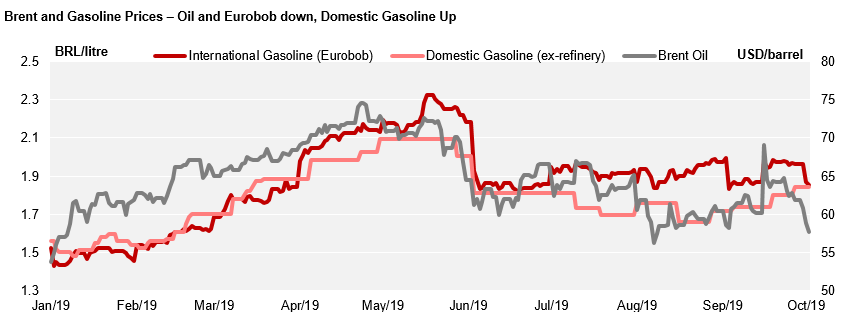

- Another variable offering support is domestic gasoline prices;

- The last adjustment made by Petrobras increased the domestic gasoline price up by 2.5% on the 27th of September –despite the opposite movement from Brent and Eurobob (international gasoline benchmark);

- With ex-refinery gasoline averaging at BRL1.79/litre, pump prices should remain closed to BRL4.1/litre, which is extremely positive for ethanol demand.

A reminder – Why Oil and Hydrous Price?

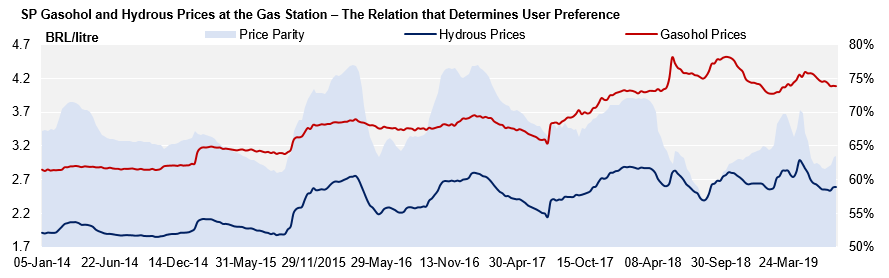

- Brent prices affects international gasoline prices directly;

- In Brazil, the bi-weekly readjustments of the domestic prices follows the international trend;

- Therefore, the higher oil prices are the higher gasohol pump prices in the domestic market will be;

- Since consumers in Brazil can choose to fill their cars with either gasohol or hydrous ethanol directly (due to the Flex Fuel Vehicles), the higher the fossil fuel price is the more consumers start to switch to the biofuel;

- Another aspect is the price parity: if hydrous prices are 30% or more cheaper than gasohol, it is worth to use ethanol rather than gasoline due to the energy efficiency;

- Due to this relation, hydrous prices can rise without affecting consumer preference;

- Gasoline prices have been over BRL4/litre (SP basis) since January last year, while parity remained under 65% for most of the period;

- The consumer response towards hydrous ethanol has been astounding, with record sales almost every fortnight.