Opinion Focus

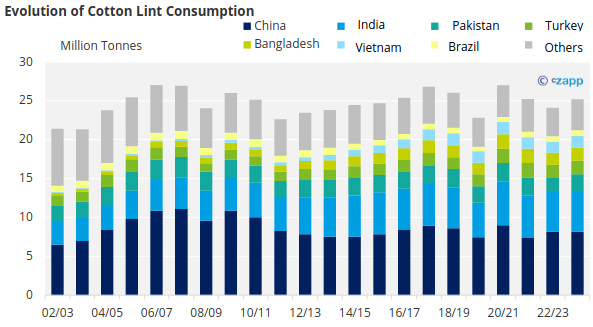

- World cotton consumption is around 25.2m tonnes each year.

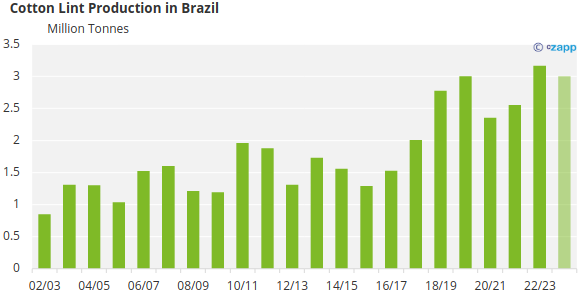

- Brazil should produce almost 3.2m tonnes of cotton lint in 22/23, up 24.3% year on year.

- Global cotton chain invests in sustainability.

From clothing to cosmetics, cotton is present in more products than you might imagine. The list is long. It ranges from essential items such as soap to paper money and biofuel, to name just a few examples.

Source: USDA

Global demand for cotton has been broadly stable for the past 2 decades, at around 25m tonnes a year.

Brazil is one of the major suppliers of this demand. It should make almost 3.2 million tonnes of cotton lint this year, 24.3% more than in the last harvest. Since 2009/10, Brazilian cotton production has increased by 166%.

Source: USDA

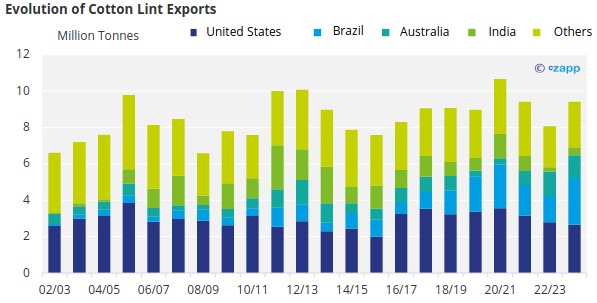

The outlook is also positive for foreign sales. Brazil is set to become the largest exporter of cotton bales in the world, surpassing the United States.

In 2023/2024, Brazil should export almost 2.57 million tonnes of cotton lint. The United States, in turn, is expected to ship around 2.66 million tonnes, a tight difference compared to Brazil – and unprecedented.

To give you an idea, in the previous season, American foreign sales were almost twice those of Brazil, in a trend that had been repeated over the years. So what’s changed?

One of the main factors concerns the weather conditions in the main American producing state, Texas, which suffered from a prolonged drought this year. Cotton crops in the coming years will continue to face, to some extent, production and quality challenges due to the heat wave that American plantations have recently experienced.

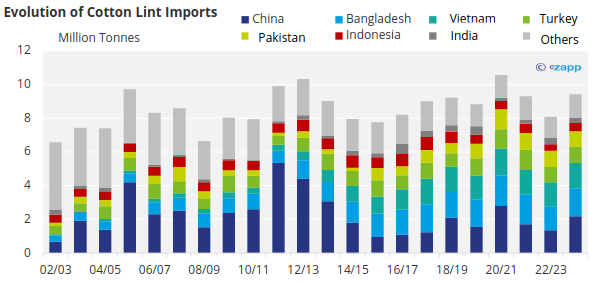

At the same time, the world’s largest producer (and consumer) of cotton also suffered from adverse conditions this season. A severe drought has hit Xinjiang province in China, the main cotton-producing region in the country, increasing demand for imports. And, in this sense, Brazil is well positioned.

Today, Brazil represents around 30% of China’s cotton imports, compared to less than 10% five years ago, stealing market share from the United States, Brazil’s main competitor. In the coming years, Brazilian exports to China should surpass American ones, for reasons ranging from quality to price and geopolitical issues, with a greater rapprochement between China and Brazil.

If the climate continues to favor Brazil (and harm the United States), as has been the case, there may be more chances for Brazil to consistently take the lead in cotton exports in the coming years.

Source: USDA

Another important point concerns Brazil´s investments in productivity. After a crisis in cotton cultivation in the past, in which several Brazilian farmers went bankrupt or had considerable losses due to tropical pests and management difficulties, the producers that remained (generally large farmers) began to invest more in technology and cotton cultivation programs. Various pest control and management initiatives have been conducted by research institutes and the government.

With all this, productivity increased, as did interest in greater investments in sustainability.

Now, Brazilian farmers are more excited than ever. The increase in production and the expectation of increased exports have encouraged Brazilian producers to invest in increasing the planted area. In the 2023/2024 harvest, area should increase 8.4%, reaching 1.81 million hectares.

In the current cycle, productivity should also grow, reaching around 1.93 thousand kg/hectare, a result 21% higher than that obtained in the previous season, according to Abrapa (Brazilian Association of Cotton Producers).

“Here, cotton is generally cultivated on a large scale by large rural producers, who also plant soybeans, with contributions in new seeds and techniques that help increase productivity”, says Marcio Portocarrero, CEO of Abrapa.

It is worth remembering that, in this aspect, Brazil differs from other major global producers, such as India, that has the largest cotton cultivated area in the world, corresponding to around 12.6 million hectares (four times more than countries like the United States and China).

But India´s yield is much lower than that of other countries, including Brazil – in this harvest, the USDA expects a yield of 446 kg/hectare. In India, farmers usually leave wider gaps between rows of plants to allow for pest control and for bullocks to traverse, which harms yield.

To make matters worse, production in India is expected to be the lowest in the last 15 years, also

affecting quality. The weather also didn’t help; India, the third exporter globally, that was affected by El Niño.

In this context, the price also ends up being impacted, with less promising estimates for the United States, Brazil´s main competitor. American cotton is unlikely to gain traction this year. In October, prices were around 87 cents per pound, much less than in previous harvests (preliminary estimates indicate that the drop could reach up to 40% in relation to 2022 values).

Cotton. Credit: iStock.

There is another factor that contributes to the attractiveness of Brazilian cotton on the international market. Today, around 84% of Brazilian cotton is sustainably certified, according to Abrapa.

If sustainability is valued in the domestic market, in the foreign market it has practically become a prerequisite, especially in sales to large companies in the clothing sector such as Adidas and Nike, as well as retail brands. In the case of Brazil, around 70% of cotton goes to other countries, with emphasis on China, Bangladesh, and Pakistan — these last two have stood out in clothing production.

Source: USDA

Brazilian farmers began to focus on issues related to sustainability a long time ago. “There was a cloud of threat over cotton exports due to irregularities in the use of labour and chemical products. Brazilian producers were aware of this trap and decided to invest in sustainability so as not to lose market share”, says Portocarrero.

In Brazil, cotton production went through several ups and downs until reaching its current levels. In the 1980s, the boll weevil insect severely damaged plantations in the Northeast, which was an important production hub. Economic crises and the country’s opening to imports of textiles and other products also ended up impacting farmers. Just over twenty years ago, there was a resumption of production, with large farms in the Midwest growing cotton in crop rotation with grains.

At the same time, concern about ESG initiatives began to increase. In 2010, Brazil became a partner in the Better Cotton program, a global sustainability initiative in the cotton chain. The country is considered a leader in the sector, alongside Australia, Greece and Israel, with 370 registered farmers.

Sustainability actions are also gaining ground, extending to other crops. Czarnikow’s VIVE , a continuous improvement program for the ingredient supply chain, has partners in more than one hundred countries, including large companies and rural producers from different countries, including Brazil.

The cotton chain, however, is not immune to challenges. Increases in production require better logistics to get the cotton to the ports and onto the world market. The good news is that investments in port terminals and railway branches promise to alleviate bottlenecks in the near future – this is what cotton producers and the entire agribusiness chain in Brazil hope for.

The use of cotton seeds to manufacture biofuel and other products, such as oil for the production of cosmetics and flour for the manufacture of animal feed, has also stimulated producers. Production, however, is destined for the domestic market.

Globally, although there are indications of a small increase in cotton production until 2030, supply is expected to remain relatively stable. Even with the world population growing and a greater need for cotton to manufacture a series of products, competition with synthetic fibers, used by the clothing industry, has been holding back the expansion of demand. “Nothing indicates, so far, that there will be significant changes in the foreign market”, says Portocarrero.