Insight Focus

- Brazil is heavily reliant on Russian fertiliser.

- With Russian supply limited, Brazil is scrambling to fill the gap.

- Its National Fertiliser Plan doesn’t offer a short-term fix, and organic methods are of limited help.

Brazil Relies Heavily on Russia for Fertiliser

Brazil is the fourth-largest fertiliser consumer in the world, behind China, India, and the USA. However, it imports around 80% (33m tonnes) of what it consumes, leaving it vulnerable to shortages when supply is disrupted.

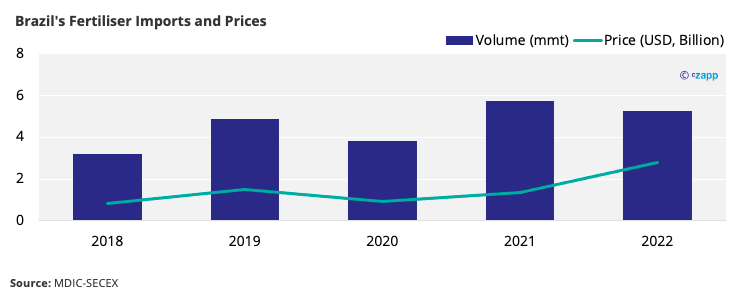

Climbing fertiliser prices were a worry for Brazil last year, with the market bracing itself for high prices in 2022/23, but the situation worsened when Russia invaded Ukraine.

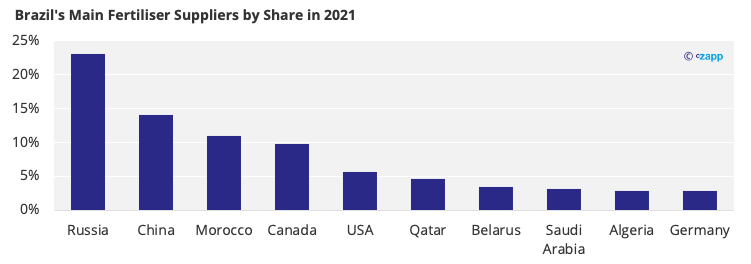

Russia is the fourth-largest fertiliser producer in the world, so the concern is no longer just about prices, but about supply risk as well. Around 23% (9.8m tonnes) of Brazil’s supply came from Russia in 2021.

Everything therefore suggests that disruption to trade with Russia will reduce fertiliser availability, with Brazil most affected.

In January-February, Brazil’s fertiliser imports dropped by 8.2% to 5.2m tonnes with prices up 130% year on year.

How are CS Brazilian Producers Handling the Situation?

Talking to Centre-South Brazilian cane farmers, access to fertiliser varies by region and supplier. Whilst some may struggle to source a given product, others can find it, provided they are able to pay higher prices.

Despite the varying situations, though, most were uncertain about supply in the immediate term. Many are therefore looking to reduce applications and increase their use of organic compounds and industrial sugarcane by-products. Some farmers are boosting applications of poultry litter, vinasse, and filter pie, all of which can be used to as organic fertiliser.

Whilst these alternatives can help somewhat, they can’t replace fertilisers completely and must be complemented with other sources of nitrogen and phosphorus.

Fortunately, though, fertiliser is usually applied to sugarcane during the planting season and after the harvest, meaning most of the cane farmers we spoke to were not worried about 2022/23 production. They were, however, concerned about what high prices and tight supply might mean for production in 2023 24. According to the National Association for the Diffusion of Fertilisers, Brazil has enough fertiliser for around two months.

How is the Brazilian Government Handling the Situation?

On the 11th March, the Brazilian government launched its National Fertiliser Plan, under which it plans to produce at least 60% of consumed fertiliser by 2050. As the plan only offers a long-term solution, the current picture for Brazilian fertiliser supply still looks uncertain.

Concluding Thoughts

- CS Brazil is heavily reliant on Russia for fertiliser.

- Supply is down since Russia invaded Ukraine.

- Brazil’s National Fertiliser Plan should mean it’s more self-sufficient by 2050.

- In the meantime, the government is looking to strike deals with other potential suppliers.

- Farmers are currently using a mix of organic and chemical methods as a short-term fix.

- Cane producers are relaxed about this season’s production but are more worried about 2023/24.

Other Insights That May Be of Interest…

Brazil and US to Boost Fertiliser Output on Russian Invasion

Fertiliser Importers Caught in Russia-Ukraine Crossfire

Going Organic Could Curb Fertiliser Price Rise

Brazilian Soybean Plantings to Hold Firm Despite Fertiliser Limitations

Explainers That May Be of Interest…