- Brazilian gasoline prices are at record highs, but the oil price, a falling real should mean a further rise

- In this week’s Ask the Analyst, we discuss why this hasn’t happened yet.

- If you’d like us to answer one of your questions, please email will@czapp.com

What is happening with Brazilian Fuel Prices?

This week Brazilian state-controlled oil company Petrobras raised diesel prices by 8.9%. However, there is so far no sign of the company changing its ex-refinery gasoline prices.

Some oil experts say the gasoline price will not be adjusted in the short term because of high volatility in the real against the dollar and benchmark Brent crude futures. They believe the company will wait for the prices to calm down before making any changes.

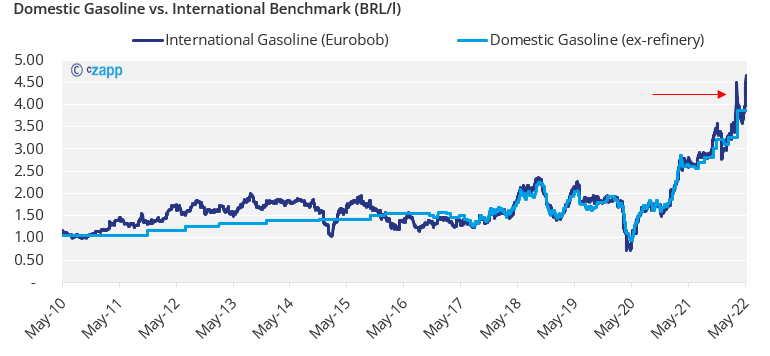

This all means current oil prices and the forex rate aren’t yet reflected in Brazilian gasoline prices:

Now the domestic gasoline price at the refinery gate is around14% lower than on the international market.

If there was an adjustment to close this gap, the ex-refinery price would have to rise to BRL4.47/l. compared with the current BRL3.86/l.

Assuming a pump parity of 70% and the real at 5 to the dollar, that would mean ethanol could reach a theoretical parity with sugar around 22.9 cents/lb on a New York No.11 basis – with ethanol at 3.75/liter, excluding the PVU tax.

The Election Factor

With a presidential election set for October, fuel prices have become a political football.

However, the risk of political interference is growing, with inflation rising and the election drawing ever nearer.

On top of that, after the diesel price hike President Jair Bolsonaro replaced energy minister Bento Albuquerque with high-ranking Economy Ministry official Adolfo Sachsida.

All things considered, we do not rule out the risk of political interference in Petrobras’ pricing policy as inflation becomes a central issue in this year’s presidential election.