Insight Focus

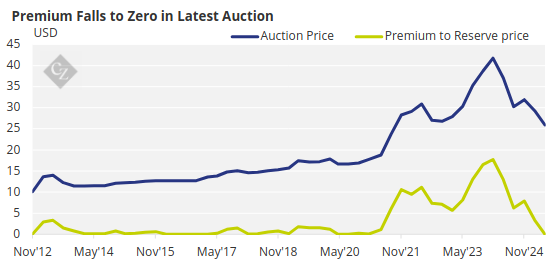

The latest quarterly permit auction cleared at the reserve sale price. Previous sales had returned a hefty premium of up to USD 17/tonne. All eyes are now on Washington, with the Attorney General set to report on efforts to halt state carbon markets.

Carbon Auction Disappoints

President Donald Trump’s effort to halt California’s 13-year-old carbon market had its first significant impact last week, as the latest quarterly auction fell short of expectations.

The auction, which offered more than 51 million 2025 vintage allowances, cleared at the reserve price of USD 25.87/tonne on May 21, the first time in nearly five years that an auction has not produced a premium over the reserve.

Source: California Air Resources Board

In addition, the sale failed to sell all 51 million allowances, with successful bids only accounting for just under 44 million permits – again, the first time an auction has failed to sell out since 2020.

As recently as February last year, auctions cleared as much as USD 17/tonne above the reserve price but since then, a series of procedural delays in the process to reform the market for its next phase after 2030 has steadily drained the market of positive sentiment.

Trump Order Rattles Market

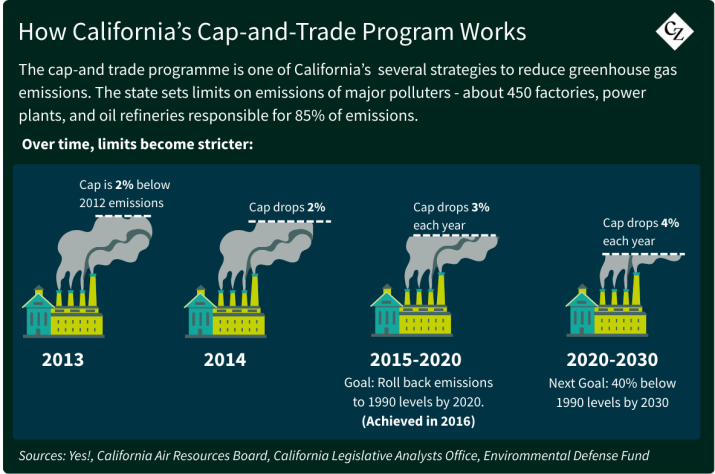

President Trump issued an Executive Order on April 8, targeting the cap-and-trade system and claiming that the market “punishes carbon use by adopting impossible caps on the amount of carbon businesses may use, all but forcing businesses to pay large sums to ‘trade’ carbon credits to meet California’s radical requirements.”

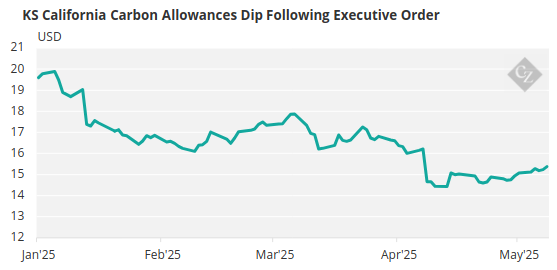

The Order required the Attorney General of the US to report on progress to stop the market within 60 days by June 7, which could lead to a slowdown in market activity as traders wait for news on how the federal government will proceed.

Since the auction took place, secondary market prices for December 2025 California Carbon Allowance (CCA) futures have drifted from USD 27.49/tonne to as low as USD 26.26/tonne, reflecting investors’ steady liquidation of long positions and a slow build-up in short holdings, as the ongoing uncertainty around the market hurts sentiment. The market had briefly touched a low of USD 22.50/tonne in the after-market after the April 8 publication of the Executive Order.

Source: Barchart

California political leaders have remained defiant, with state governor Gavin Newsom pledging to pass legislation extending the market beyond 2030 and targeting a net zero date by 2045, but stakeholders are also awaiting updated regulations governing the market’s cap throughout to 2030.

A mid-May proposal to rebrand the cap-and-trade program as a “cap-and-invest” system was seen as an attempt to draw attention towards the economic benefits of the carbon market and to downplay the economic efficiency of a marketplace for allowances.

All eyes will now be on Washington DC at the end of the week, when Attorney General Pam Bondi is expected to issue a report on how the federal government plans to halt state-level cap-and-trade markets, which also include systems operated by the state of Washington and by 10 states in the northeastern US.