Carbon offsets represent reductions in greenhouse gas emissions made through investments in clean technology and practices, ranging from building wind turbines to replace fossil fuel power to protecting and planting forests.

Carbon offsets are popular because they represent reductions that are cheaper to achieve elsewhere than within a company’s own operations. It may often be cheaper to buy carbon offsets from a forestry project in central Africa than to cut emissions from a glass factory in Europe.

Carbon offsets can be purchased and retired to neutralise an entity’s carbon footprint, that is, the emissions of greenhouse gases which that entity is directly and even indirectly responsible for, either through its direct emissions (from a power plant or an industrial process, for example) or from consumption of goods and services that also emit greenhouse gases, such as delivery vehicles or staff travel.

Offsets are generated by altering industrial processes to emit less CO2, such as making steel using renewable electricity, changing land use practices or switching from carbon-intensive fuels to more efficient and low-carbon energy sources.

In most cases, these carbon reductions are calculated against a business-as-usual scenario, rather than measuring an outright lowering of emissions. Some emerging technologies actually capture CO2 from the atmosphere and store it permanently; this is known as carbon removal.

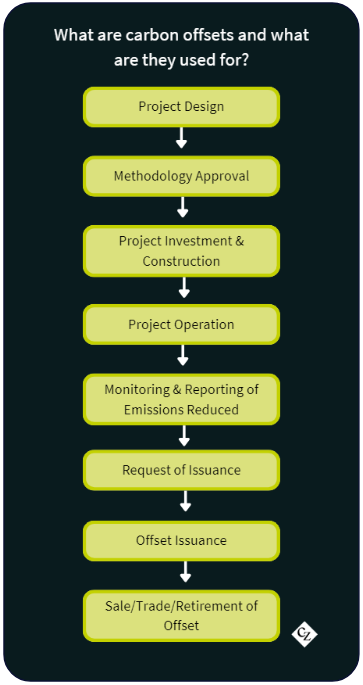

As an example, a factory that takes electricity from a coal-fired power station can invest in wind turbines or solar panels, reducing its use of fossil-generated power. The lower carbon emissions from this investment, or project, can be verified and issued to the investor in the form of carbon offsets.

Similarly, planting new forests or protecting existing ones from deforestation enables atmospheric carbon to be removed and stored in trees. Accurate measurement of the forest cover enables carbon savings to be calculated and verified, and issued as carbon offsets.

Offsets form only a part of the required response to climate change. Most experts agree that the world needs to reduce its emissions as much as possible, then remove as much CO2 from the atmosphere as can be stored, before offsetting any remaining hard-to-abate emissions to achieve “net zero”.

“Net zero” is taken to mean reducing and removing emissions to the levels required to keep global temperature increases to less than 2 degrees Celsius above pre-industrial levels. Any and all remaining unavoidable emissions will need to be offset by equivalent removals.

“Net zero” is often confused with “carbon neutrality”, which merely implies offsetting existing emissions, without necessarily reducing direct and/or indirect emissions.

While carbon offsetting itself is therefore not the entire answer, it is helping thousands of companies to understand their carbon footprint and study ways to reduce their impact on the climate. It’s the first, and most important step on the journey towards net zero, the goal for the middle of this century set down in the 2015 Paris Agreement.