Insight Focus

As the tariff situation drags on, nobody is winning. Both the US and Chinese economies are feeling the impact of the decoupling and freight rates continue to fall. Meanwhile, wheat supply from the Black Sea could be in jeopardy and the latest earnings reported by major food and beverage companies indicated some key trends to watch out for.

Tariffs Update

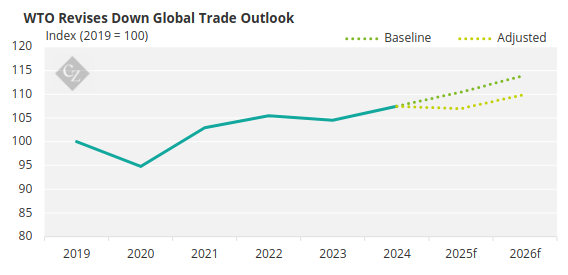

The general consensus is that there is a huge cloud hanging over global trade in the form of tariffs. The WTO now expects world merchandise volumes to decline by 0.2% in 2025 – 3 percentage points below the baseline scenario, it said in a recent report.

Source: WTO

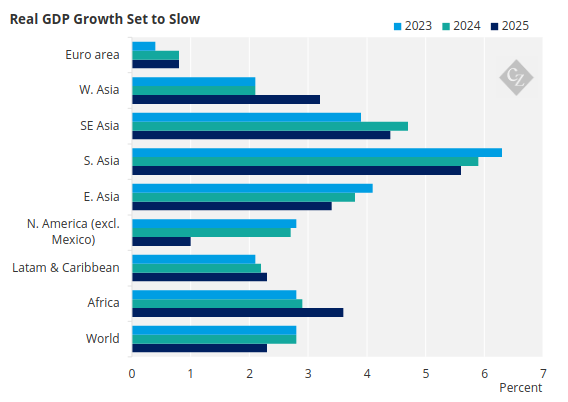

Similarly, UN Trade and Development (UNCTAD) painted a bleak picture in its recent “Trade and Development Foresights 2025” report, with the news that the world economy is entering a “recessionary phase.”

Source: UNCTAD

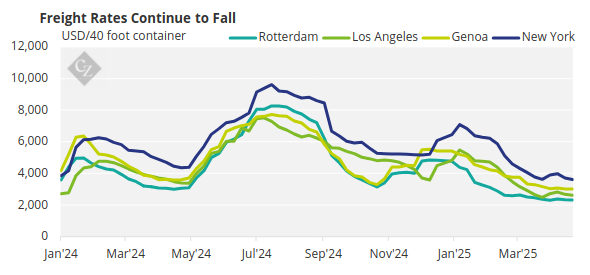

The report also highlighted an increase in economic policy uncertainty, a rise in the investor “fear index” and a drop in container freight rates – which points to a slowdown in trade.

Source: Drewry

For shipping consultants Drewry, global container volumes are set to fall by 1% due to US trade policies – which is a steeper dip than even in 2020 during the COVID pandemic. Assuming that two-thirds of current tariffs remain in place, the consultancy predicts that US imports from China could fall by 40%.

China-US Tariffs a Lose-Lose

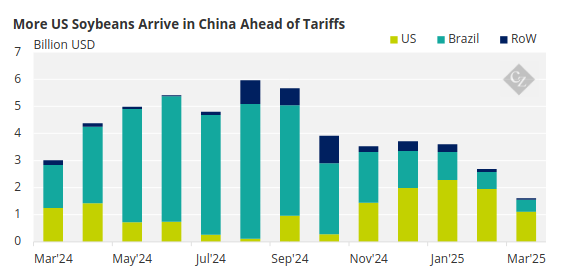

Already, there are signs of changing trade flows. Since November’s election results, Chinese imports of US soybeans have been significantly higher than the previous year as crushers rushed to clear customs ahead of a potential trade spat. There have also been logistics issues in Brazil causing a decline in Chinese imports of the Brazilian product.

Source: Chinese General Administration of Customs

But looking ahead, the expectation is that China will reduce reliance on US imports and shift focus to Brazil and Argentina instead. According to the Wall Street Journal, US pork purchases by Chinese buyers are 72% down on the prior week.

And, according to freight group HLS, more than 80 China-US sailings have been blanked in recent weeks as ocean carriers try to balance out their capacity in expectations of a slowdown. Hapag-Lloyd also told Reuters that 30% of shipments from China to the US have been cancelled and volumes are instead shifting to Thailand, Cambodia and Vietnam.

In some cases, China has slashed imports of US products to zero, including LNG and wheat. But local manufacturers are reluctant to stop selling goods to the US despite encouragement from Beijing given that they can achieve a premium on the export market, especially given weak Chinese demand. There has been speculation that a stimulus might be needed. China is reportedly giving some tariff exemptions to companies in key industries.

US Economy Feels Tremors

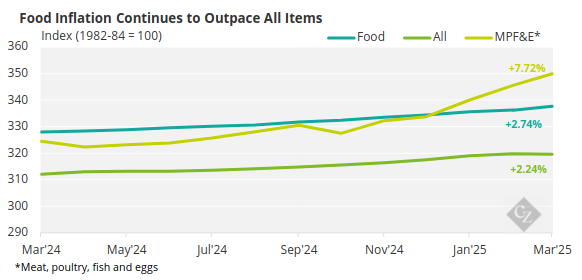

Despite President Trump’s campaign promises to reduce consumer costs, inflation continues to rise – particularly for food. Data from the St Louis Fed shows that CPI for food in March continued to climb, and year on year growth has so far outpaced inflation for all items.

Source: St Louis Fed

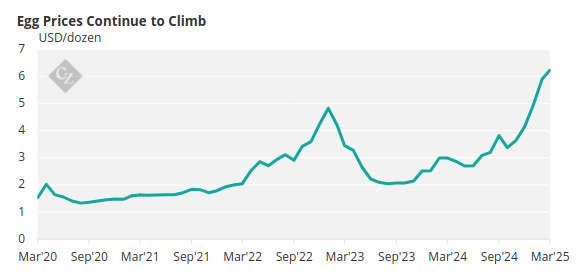

The price of eggs, particularly, has come under the spotlight as it continues to soar. In March, the average cost of a dozen eggs in US cities was USD 6.22, up from USD 2.99 a year earlier.

Source: St Louis Fed

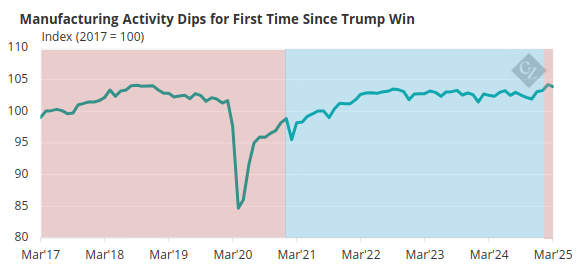

And March also saw discouraging US manufacturing data, with the index dropping for the first time since President Trump’s election in November.

Source: St Louis Fed

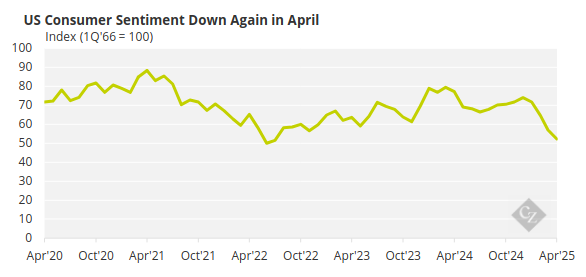

And more bad news came as consumer sentiment took a tumble again in April. The index is now at 52.2 — its lowest level since July 2022.

Source: St Louis Fed

Economists are now warning of the increasing prospect of a US recession if the trade war persists. Meanwhile, Republican Representative Mike Lawler of New York told Bloomberg he expects Congress to step in if the trade war drags on for much longer.

Asian Rice Uncertainty

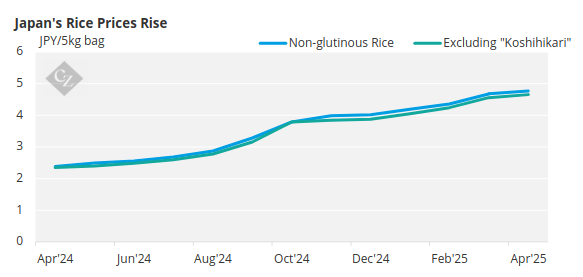

Danger signals are also flashing in Asia as Japan experiences a severe rice shortage. Rice is a basic staple for many, particularly in lower-income countries.

Source: Statistics Bureau of Japan

A poor harvest in 2023 and issues with distribution have caused the government to release emergency stockpiles, but prices are still rising. One solution being considered by the government that could kill two birds with one stone is to increase US rice imports as a way to reduce Japan’s trade surplus.

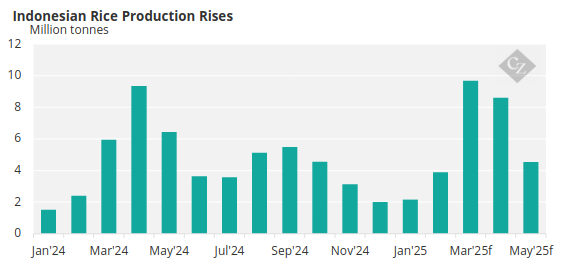

Meanwhile, the Indonesian government has allowed limited exports of rice in an about-turn on its normally strict export policy. After Agriculture Minister Andi Amran Sulaiman stressed the importance of preserving domestic rice, President Prabowo Subianto has permitted exports after record-high production has caused storage issues.

Source: Badan Pusat Statistik

Black Sea Wheat at Risk

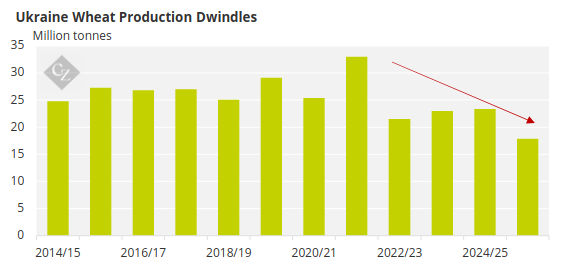

While some regions are facing rice challenges, the sustainability of the world’s breadbasket could be at risk. Russia and Ukraine have now been at war for over three years with no end in sight, and now it looks like it is starting to take a toll on wheat production. While Ukraine has been remarkably productive in recent years, the USDA’s latest production estimates for the 2025-26 crop are just 17.9 million tonnes, its lowest level in 13 years.

Source: USDA

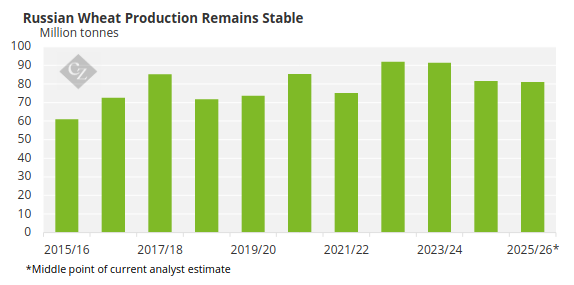

Wheat exports from Russia and Ukraine together account for nearly 30% of global supply. While Russia still predicts a strong harvest of between 79.7 million tonnes and 82.5 million tonnes, there could be less wheat coming from the Black Sea in the coming year.

Source: USDA

FMCG Companies Under Pressure

This earnings season hasn’t been an overly positive one for food producers. In its first-quarter earnings call, PepsiCo CFO James Caulfield blamed tariff headwinds as one reason for a downward revision in revenue guidance.

The press release explained that due to “expected higher supply chain costs related to tariffs, elevated macroeconomic volatility, and a subdued consumer backdrop,” the company expects earnings per share to remain flat on the year prior. It was previously predicting mid-single-digit growth.

The company also mentioned that it is pivoting to address GLP-1 consumers’ desire for higher protein and fibre products as their appetite for other products wanes. “Portfolio transformation, portion control, and the right offerings for those consumers will make sure that our brands stay relevant to those consumers,” said CEO Ramon Laguarta, stressing that participation of GLP-1 consumers is only around 7-8%.

Nestle, on the other hand, left its 2025 guidance unchanged even based on its assessment of the current tariffs but CEO Laurent Freixe stressed that the situation is volatile.

“The indirect impacts – on consumers and customers, as well as currencies and commodity prices – remain unclear at this stage,” he said.

In Unilever’s first quarter earnings call, CEO Fernando Fernandez said the impacts of the tariffs on the company’s portfolio are “limited and manageable”.

Food companies must also keep their eye on other policy decisions, including Health Secretary Robert F Kennedy Junior’s announcement that eight commonly used artificial dyes would be banned from US food.

Two petroleum-based dyes will be phased out in the next few weeks, while eight remaining synthetic dyes (FD&C Green No 3; FD&C Red No 40; FD&C Yellow No 5; FD&C Yellow No 6; FD&C Blue No 1; and FD&C Blue No 2) will be removed by 2026, Kennedy said on April 21.

In Other News…

Have We Reached Peak Alcohol?

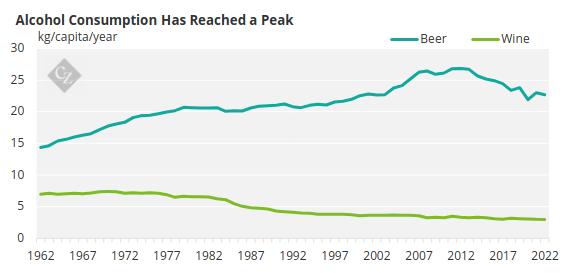

A new analysis by Bloomberg shows that the world seems to have reached peak alcohol consumption around the mid-2000s. But while per capita consumption is beginning to decline, alcohol spend continues to increase, indicating that we are paying more for premium beverages.

Source: FAOSTAT

UK Sugar Tax Expands

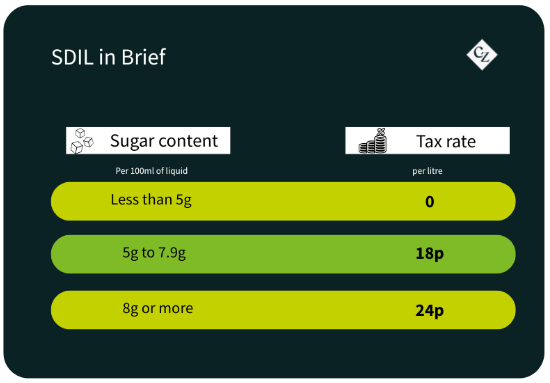

The UK government is reportedly considering including pre-packaged milkshakes and lattes in its soft drink industry levy (SDIL). These products have previously been exempted from the tax which is tiered based on sugar content. Drinks containing less than 5g of sugar per 100ml of liquid were previously exempt, but the government is mulling reducing this limit to 4g.

Trump Calls for Canal Rate Elimination

Maintaining his focus on the Panama Canal, President Trump believes that US military and commercial ships should get free passage through the key trade route, as well as the Suez Canal.

“I’ve asked Secretary of State Marco Rubio to immediately take care of and memorialise this situation,” he said.

This is the latest in a string of proclamations made by the US president, who wants to “take back” the canal.

Record Breaking Shipping Emissions

The shipping industry has an emissions problem. The latest data by Xeneta shows that emissions are at an all-time high, exacerbated by conflicts and geopolitics. Global container emissions reached 240.6 million tonnes in 2024, the report said, higher than the previous record of 218.5 million tonnes set in 2021.