At noon on February 20 every year, shipowners, operators and charterers renew their P&I Club coverage. This is a critical requirement for the shipping sector to ensure they are insured against adverse events such as spills, collisions and seafarer injuries. But what can the P&I Club tell us about the main risk factors in shipping today?

What is a P&I Club?

Shipping is a risky business and incidents are expensive. These incidents can include collisions, damage, cargo loss and even injury to crew. That is why P&I Clubs are particularly attractive.

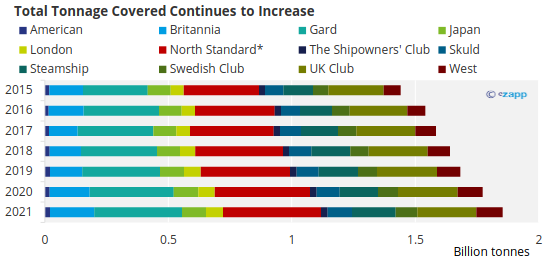

A P&I club will cover a group of eligible companies, allowing them to pool together resources to cover shipping liabilities. There are currently 12 P&I Clubs that serve the global shipping industry, after the recent merger of North and The Standard Club to create NorthStandard.

These 12 clubs represent 90% of the world’s ocean-going tonnage. Participation is not mandatory, but all ships do need some form of insurance coverage. Without coverage, ships will not be allowed entry into ports, and they won’t be able to trade.

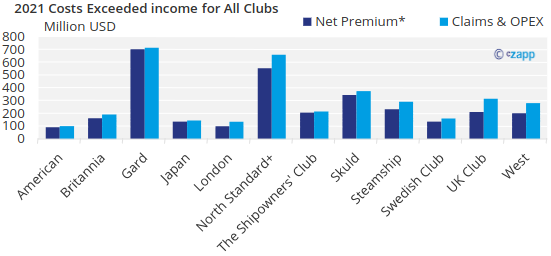

*Formed after merger of North and The Standard Club

Source: AON

How Does it Work?

P&I Clubs are independent, non-profit associations and their activities are overseen by elected boards or committees. Day to day legal, regulatory, technical and insurance work is carried out by subcommittees and working groups.

The point of the P&I Club is for companies to share liability and pool resources. The group also shares research, knowledge and expertise on key issues. Clubs also help with claims handling, advice on legal issues and loss prevention and response to maritime casualties.

All the clubs are incorporated under one group – the International Group of P&I Clubs.

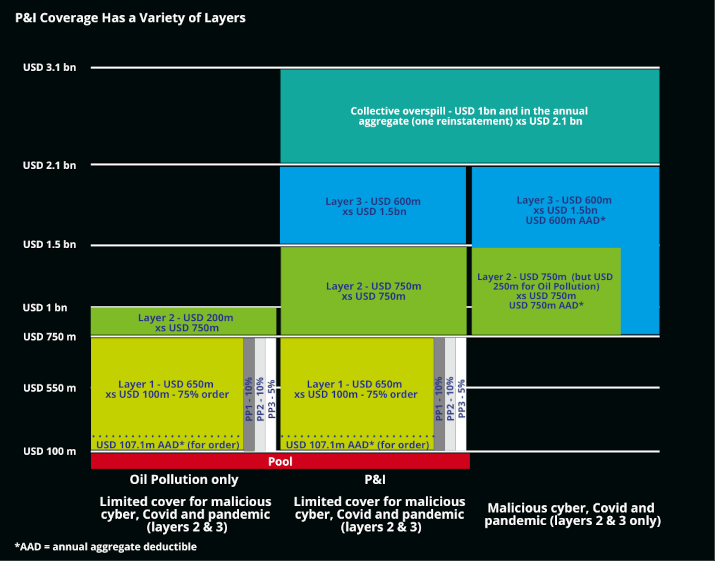

Each club has a claim limit of USD 10 million. Anything that exceeds this is pooled across the 12 clubs. The pool is reinsured for claims in excess of USD 30 million.

Source: IGP&I

The committees and subcommittees therefore need to spend a lot of time defining scope, rules and guidelines for claims.

Who Decides on the Premiums?

The process of deciding premiums is driven by both the clubs and the shipowners. The first step is for clubs to assess risk approaching the end of the year. The board will then decide on the next year’s premium.

Negotiations with shipowners then start at the end of the year and some easy deals can be made before Christmas. The months of January and February are generally the busiest for P&I Club renewal. This can be complicated, particularly for Asian P&I Clubs, since delays are often experienced over Lunar New Year celebrations.

Although P&I Clubs are non-profits, they do need to bring in enough money to fund operations. They need to ensure they cover accrued and potential investment losses.

Source: AON

Higher risk over the years have seen income plateau while claims values rise. This is despite rising premium rates over the past four years. This year, the premium was raised by up to 10%.

How Does This Impact Shipping Rates?

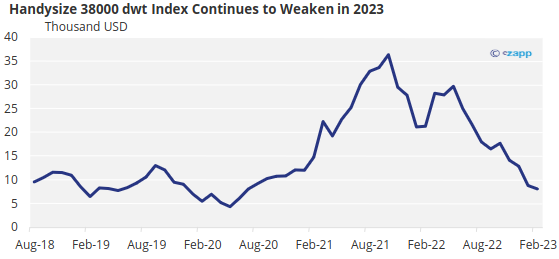

Ultimately, higher risk equates to higher insurance costs, causing rate hikes for shipowners. Shipowners, operators and charterers are also contending with weak freight rates.

Ultimately, though, insurance coverage is vital for shipowners and delays in negotiations can be costly. Documentation is needed on board any vessel before the February 20 deadline or port entry can be denied. This means that ships that are scheduled for voyages over the renewal period need to conclude negotiations even earlier.

And while the clubs don’t have any direct impact on shipping rates, the key themes that are discussed during the renewal period can be an excellent barometer of the challenges faced by the industry.

What Can We Expect Next Year?

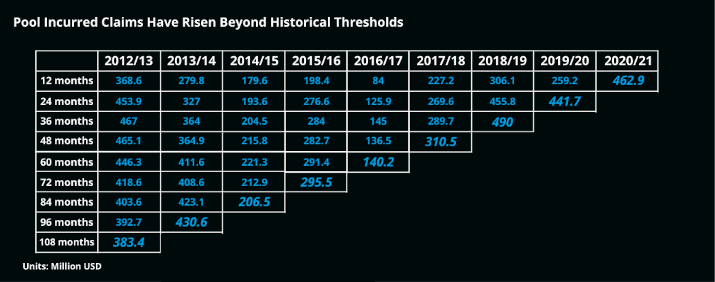

This renewal round has been described as particularly painful by many shipowners. While many entered the negotiations aware that a general uplift would be expected, after three successive years of high value pool claims, balancing the books this time has been challenging.

When negotiating reinsurance for the 2023/24 period, the premiums were increased due to several factors. First of all, the Russia-Ukraine war has made a significant impact to the risk profile of the shipping industry.

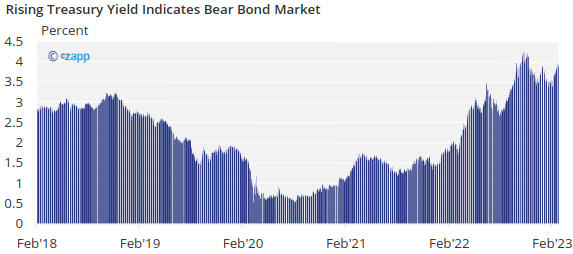

Not only has it impacted reinsurance premiums, but it has also destabilised the global economy – specifically the bond market. According to The Lloyds List, clubs typically allocate 30% to 40% of their investments in bonds.

Source: St Louis Fed

There is also the threat of credit rating downgrades. As of the end of 2022, ratings agencies have downgraded almost all P&I Clubs or placed them on a “Negative Outlook”. Credit ratings impact an organization’s ability to obtain credit.

In the next few years, high value pool claims and, by extension, continued hikes in premiums should be expected. This will allow clubs to continue to provide insurance pool services to a more volatile shipping industry.

+ Formed after merger of North and The Standard Club

* Includes reinsurance costs

Source: AON