Insight Focus

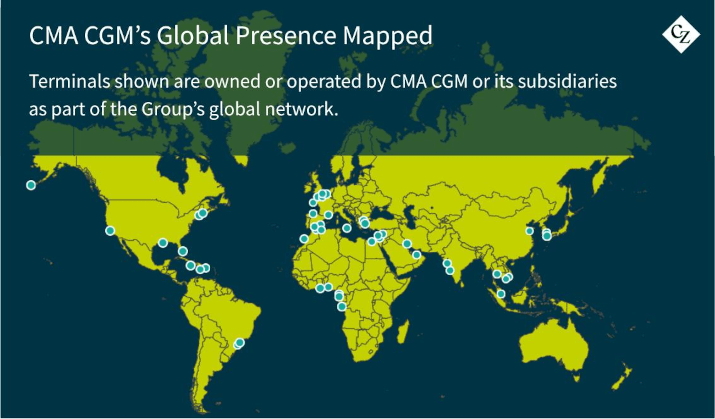

CMA CGM operates global ports through CMA Terminals Holding. Its subsidiaries manage 62 terminals, including key transshipment hubs. Recent investments expand reach while supporting France’s strategic interests.

CMA CGM Group, one of the world’s largest container shipping companies, operates a significant port and terminal division through its dedicated subsidiary, CMA Terminals Holding.

While best known for its expansive liner services, the French shipping giant has steadily built a strong global presence in port operations, investing heavily in both established gateways and emerging markets.

CMA Terminals Holding

CMA Terminals Holding is a key player in the global port sector, serving as an investor, developer, and operator of container terminals. The group’s portfolio includes 62 terminals worldwide—55 currently operational and seven under development.

Among these are seven major transshipment hubs strategically located along key global maritime trade routes:

- Malta

- Kingston, Jamaica

- Algeciras, Spain

- Tangiers, Morocco

- Rotterdam, Netherlands

- Kribi, Cameroon

- Singapore

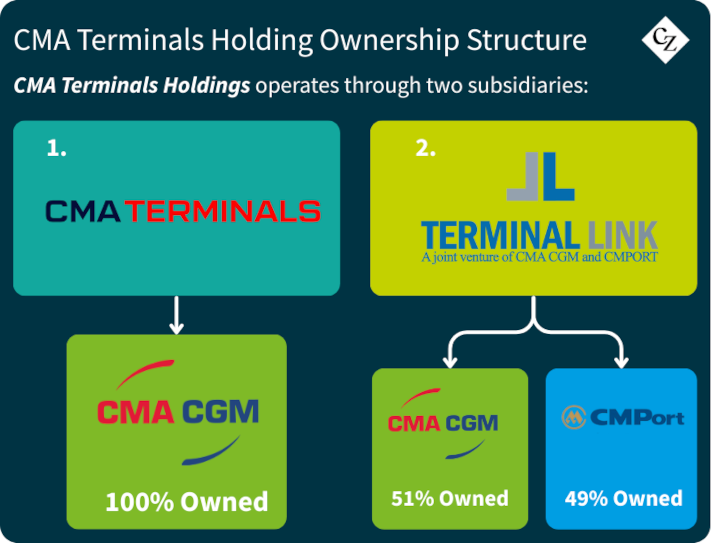

A notable feature of CMA Terminals Holding is its dual operational structure, comprising two subsidiaries: CMA Terminals, which is wholly owned by CMA CGM, and Terminal Link, a joint venture in which CMA Terminals Holding holds a 51% stake, with the remaining 49% owned by CM Port Holdings.

CMA Terminals

Established in 2012, CMA Terminals is responsible for terminal development, design, construction, acquisition, and operations.

The company operates 41 terminals worldwide and handled over 17 million TEUs in 2024, with a presence across 20 countries. In addition to its strong footprint in major global hubs—such as Santos (Brazil), Port Liberty (USA – New York and New Jersey), and CMA Khalifa Port (Abu Dhabi)—CMA Terminals has made strategic and forward-looking investments in emerging and niche markets.

These include key facilities like Gemalink (Vietnam), Lekki Freeport Terminal (Nigeria), Nhava Sheva Freeport Terminal (India), and Mundra CT4 (India), among others.

Terminal Link

Founded in 2001 and headquartered in Marseille— also home to CMA CGM—Terminal Link operates 21 terminals across 16 countries.

Its network spans key shipping regions including the Far East, Northern Europe, the Mediterranean, West Africa, and North America. In 2024, Terminal Link handled approximately 29 million TEUs, underscoring its significant role in global port operations.

Financial Information

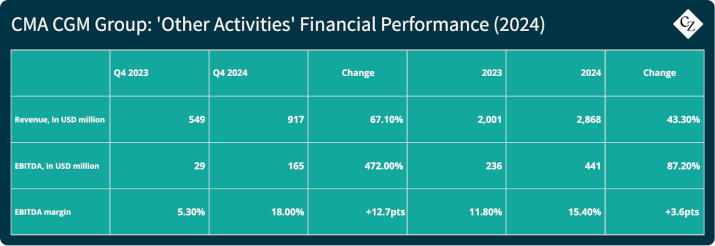

Although CMA CGM Group does not disclose detailed financial results for its port operations division, its 2024 Financial Report provides insight through the performance of its “Other Activities” segment, which includes terminals, the air cargo division and media business.

This segment generated revenue of USD 2.868 billion in 2024, marking a 43.3% year-on-year increase, while EBITDA rose sharply to USD 441 million, reflecting an 87.2% growth, with the EBITDA margin improving from 11.8% in 2023 to 15.4% in 2024.

Source: CMA CGM

Latest Investment Deals

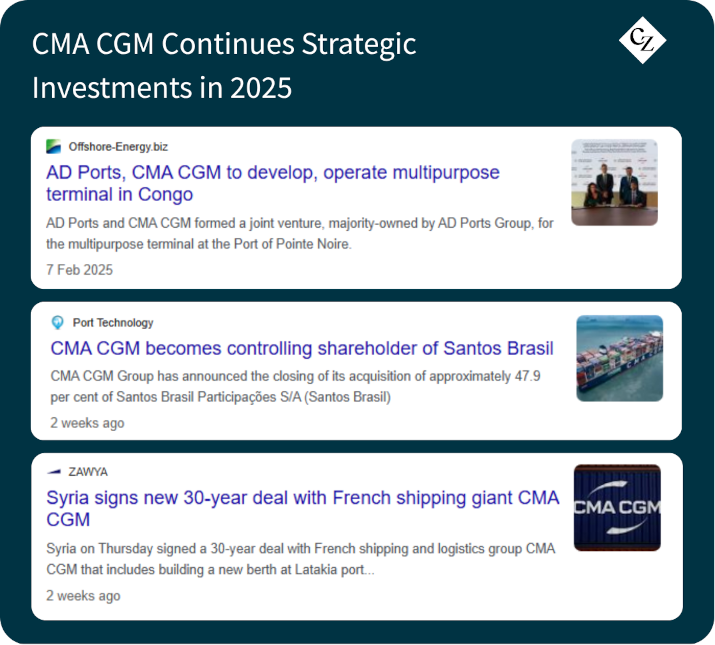

Like many container shippers, CMA CGM has been highly active in port investments in 2025, announcing several new agreements for both concession renewals and new terminal developments.

In February, through its subsidiary CMA Terminals, the French shipping giant entered into a joint venture with the UAE’s AD Ports Group to develop, manage and operate the New East Mole multipurpose terminal in Pointe-Noire, Republic of Congo. Under this arrangement, CMA CGM will serve as a minority shareholder in the terminal, which will handle container, general, breakbulk and various other types of cargo at the country’s main Atlantic port.

In April, CMA CGM expanded its presence in South America by becoming the majority shareholder in Santos Brazil, a leading multi-terminal operator that owns the largest container terminal on the continent, located at the Port of Santos.

Most recently, in May, CMA CGM signed a 30-year agreement with the Syrian government, including the development of a new berth at the Port of Latakia and an additional USD 260 million investment over the course of the partnership. The company has been operating the Latakia container terminal since 2009 under a previous agreement signed during the presidency of Bashar al-Assad. That contract was renewed in October 2024, again under Assad’s regime.

However, following Assad’s ousting in December 2024, the newly established Syrian authorities launched a review of the agreement. The revised deal was formally signed on May 1, 2025, by representatives of CMA CGM and Syria’s port authority.

CMA Terminals Extends France’s Global Reach

While CMA Terminals may not yet match the scale and development of major competitors like Maersk’s APM Terminals or China’s COSCO SHIPPING Ports, it plays a strategic and complementary role within the CMA CGM Group. As an integral part of the French shipping giant’s global operations, CMA Terminals serves not only commercial interests but also broader geopolitical objectives.

Given CMA CGM’s close ties with the French government, the group is often viewed as contributing to France’s broader global economic and strategic interests. In this context, CMA Terminals Holding plays a crucial role—acting as a vehicle for establishing and maintaining France’s influence and that of its allies in key regions around the world through strategic port investments and partnerships.