- We are less than 15 days from the official start of the 21/22 crop of the Center-South and some topics call our attention this week.

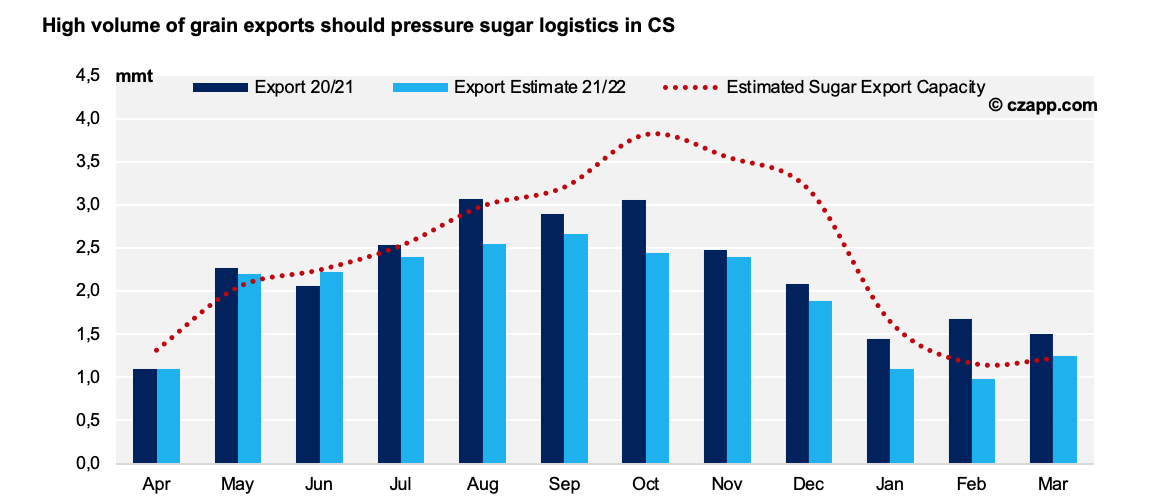

- With the delay of the record soybean crop, how is the logistical pressure on sugar?

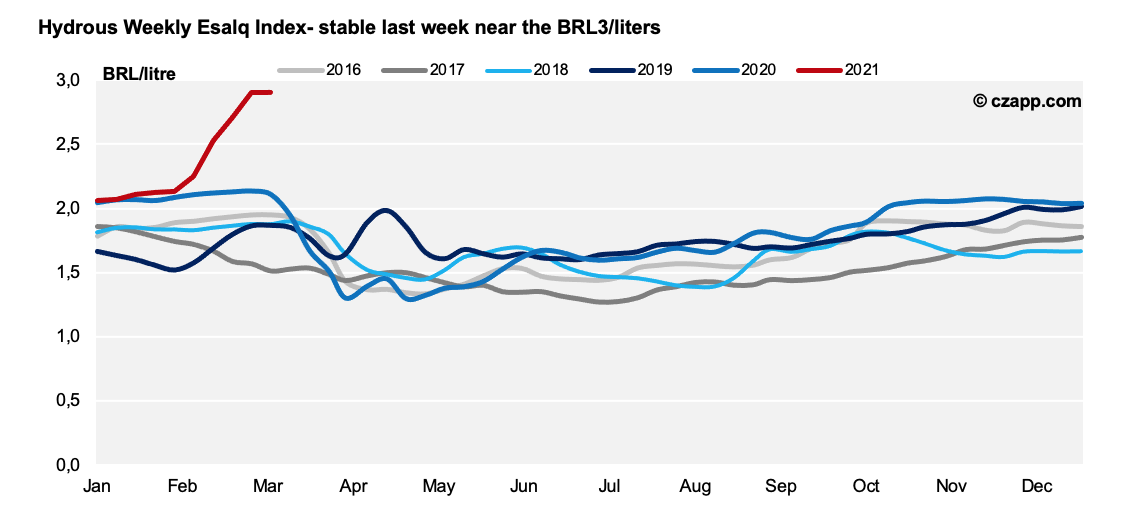

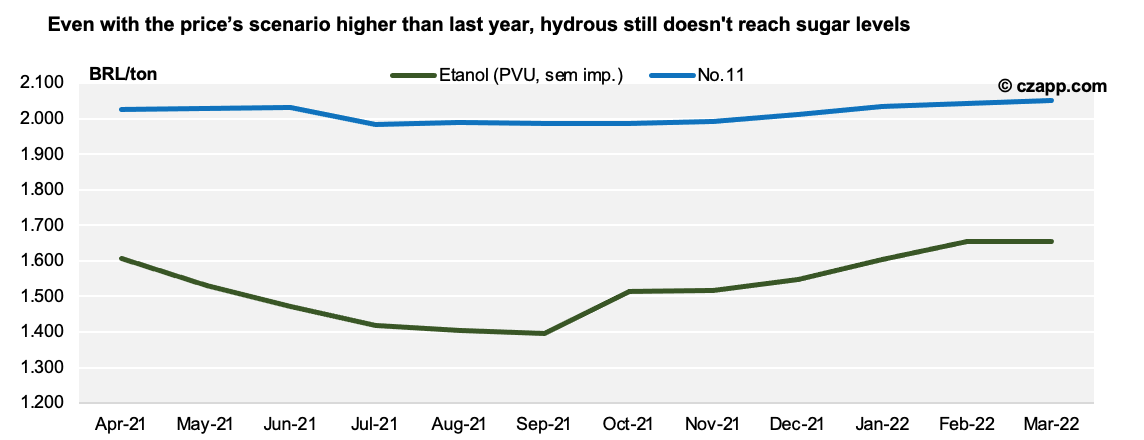

- Could the record ethanol prices change the production mix decision?

Logistic Pressure

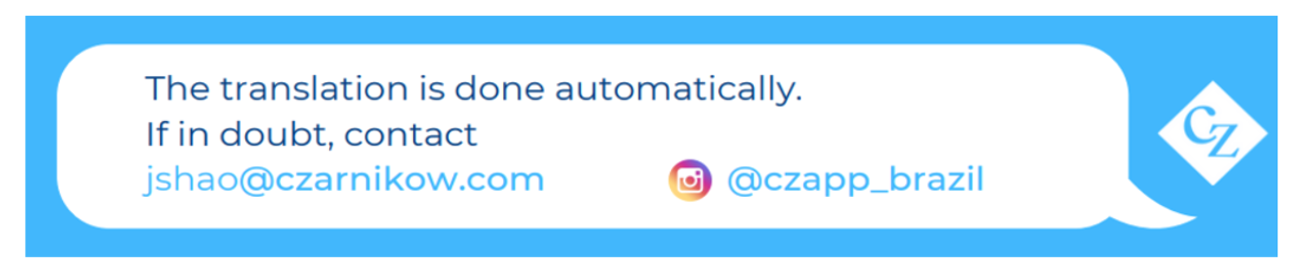

- As it was expected, the soybean export flow was affected by the delay on the planting in last year crop.

- In January, no volume went to Santos.

- On the other hand, the March nominations exploded and are already record for the month.

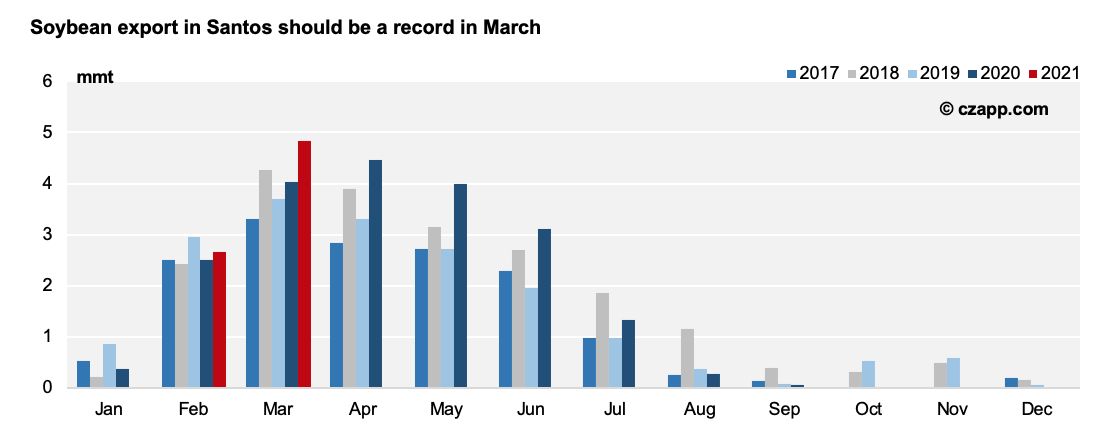

- That increase in the grain’s flow caused the sugar terminals to increase their capacity for grain:

- Given our estimates of allocation of the capacities of the terminals for sugar, we see a possible logistical tightening from April through August.

- Of course, this can change depending on how the terminals decide to handle each product.

- But that pressure has already begun, with mills reporting difficulty in finding truck freight due to competition with grains.

- The interesting thing is that it is not in in specific points, but many regions of CS reporting this problem.

- And in addition to the difficulty, the freight’s price also increased significantly from one month to here.

- On average, we have seen an increase between 30-40% in the freight to Santos.

What should the start of the 21/22 crop be like?

- In the latest report regarding the second fortnight of February, UNICA released its survey of intent of the beginning of the crop.

- According to them, by the end of this month 50 mills are expected to be harvesting vs. 87 reported in the same period last year.

- Let’s remember that even though March is accounted as crop 20/21, this is actually the mills powering their machines for the new cycle.

- These mills should take advantage of the high hydrous prices, as even if they try to produce sugar the lack of logistics could hinder the commercialization of this additional volume.

Doubts around the production mix

- Already for April, the estimate is 124 mills in operation in the first fortnight of the month-in comparison, on the same period last crop it had more than 170 mills harvesting.

- Could the behavior of the ethanol price have these mills review their mix of the beginning of the crop?

- Even with an expected start with strong prices, ethanol still doesn’t pay more than sugar-which follows offering unprecedented returns on a BRL/ton basis.

- And even thinking about mills that could consider washout operations, the bill still doesn’t close.

- The sugar would have to fall at least 300pts at the same time as ethanol remain near the BRL3/liters.

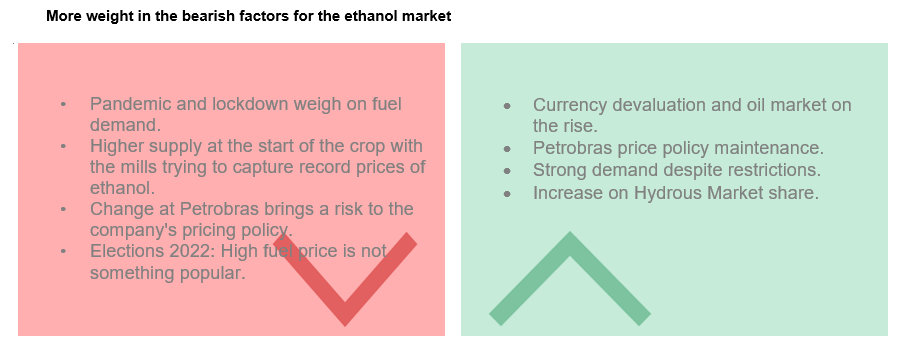

- And today we know that it has more bearish factors weighing on the ethanol market than fundamentals that endure prices at current levels.