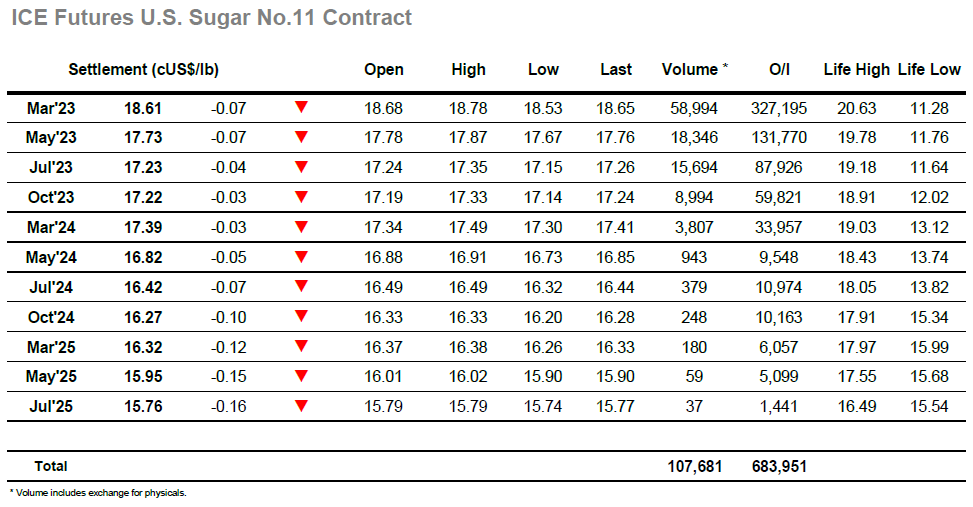

The market maintained its positivity on Friday to record the highest levels seen since 21st July and having broken from the range there was some desire showing to hold onto the gains. Following higher opening prints the market dipped back to 18.56, however this was soon picked up and while the rest of the morning was spent in debit the losses were minimal and provided a platform to potentially continue ahead. Fridays COT report showed that the spec short had reduced to -10,412 lots, a number which has likely turned mildly positive across the subsequent 3 sessions as the market rallied, with the question now being posed as to how long the specs may be prepared to go with the fundamental outlook little changed. An early afternoon push up to 18.78 told us that they are not yet finished with their efforts, though this was followed by some rapid liquidation as day traders flipped back out, a sign that recent pace will be tough to maintain at these higher levels. The rest of the afternoon then played out within the established parameters on lower volumes, with the close providing a welcome relief to the quiet environment with March’22 settling a touch lower at 18.61.

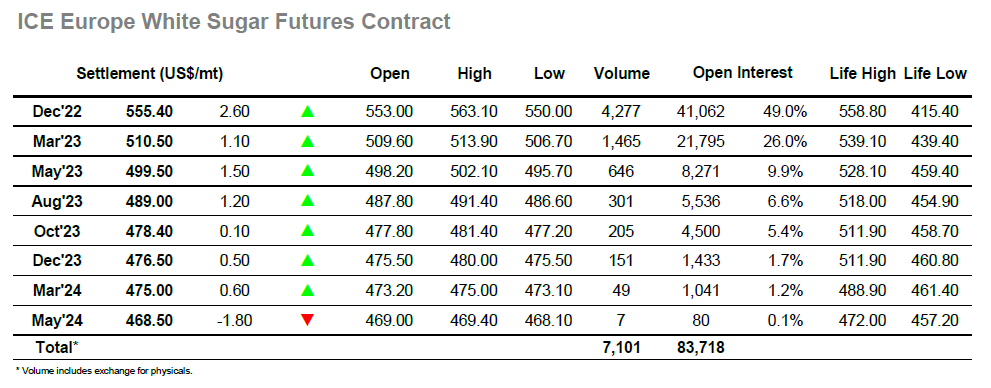

Since trading as low as $523.00 just last Tuesday the Dec’22 contract has made remarkable gains and following a slightly shaky start the market soon resumed this trend with mid-morning highs at $556.00 placing it less than $3 shy of the $558.80 contract high. Prices then meandered along quietly for the next few hours until the US Day brought with it the laste3sst wave of spec led buying, enabling new highs to be made as the market quickly pushed through whatever scale selling there was. A new life of contract high level for Dec’22 at $563.00 was recorded before some long liquidation kicked in, while the outright strength also hauled the Dec’22 spread prices higher, seeing Dec’22/March’23 record a widest trade at $49.90. As with recent days the gains for 2023 prompts were more limited and when a small burst of liquidation kicked in, we suddenly saw the board offered back into the red once more. Values floated around within the lower half of the range through the remainder of the session with some defensive buying late on ensuring that Dec’22 held onto moderate gains and settled at $555.40.