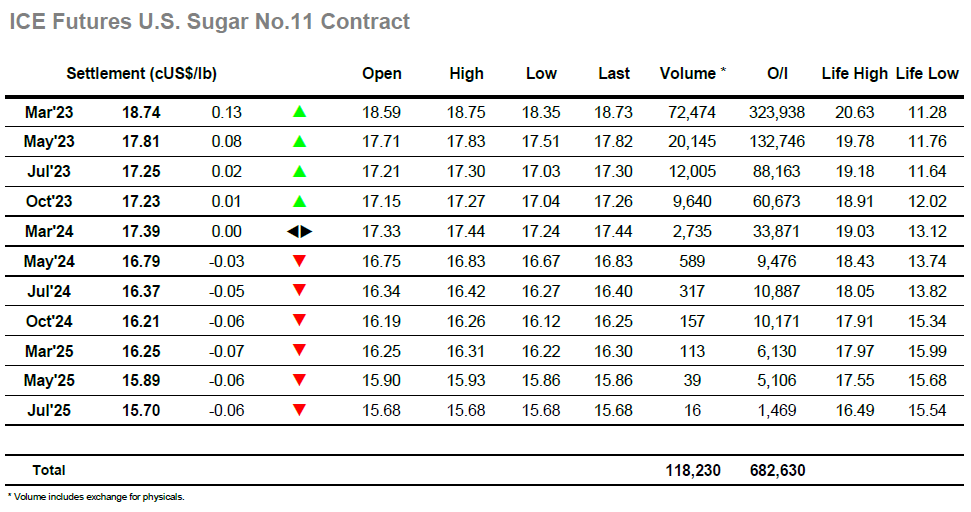

Recent gains have been built upon spec short covering into a thin market environment, however yesterday showed that there is a little more producer pricing beginning to appear as we near 19c which has resulted in some long liquidation/profit taking. That sentiment continued through this morning with March’23 following a generally lower macro to slip down through the range to reach 18.35 before encountering some consumer interest which provided a modicum of support. Still, it was not until the Americas day kicked in that we found meaningful buying interest to continue the recovery and leave prices back in marginal credit by mid-afternoon. Additional momentum was generated by the publication of UNICA numbers for the second half of September, showing cane production of 25.287mmt / Sugar production at 1.700mmt / Mix at 45.42% / ATR 155.30 kg, lower numbers than had been anticipated though not a complete shock given recent rains. The climb was gradual but steady to reach highs at 18.75, with prices then remaining firm throughout the final hour to settle only just beneath at 18.74. This reinstates the positivity following yesterdays decline from the highs though should specs push toward 19.00 some heavier producer prising would be anticipated to emerge.

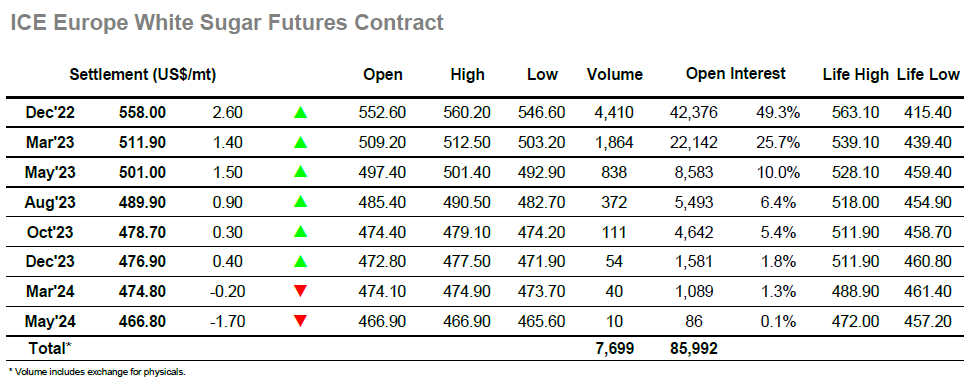

There was a negative leaning to the market this morning as Dec’22 gave back a little more of the recent gains to be trading around $550.00. Small sell stops were then triggered midway through the morning to send prices lower still however from a low at $546.60 the market regathered itself and returned to the $550 area ahead of the Americas day getting underway. A more familiar pattern followed through the afternoon as specs returned to push prices back up through the $550’s, largely uninhibited by selling with few resting orders being seen as we retraced through yesterday’s range. Mid-afternoon saw the UNICA numbers provide a small boost to prompt No.11 values, but despite their more positive prognosis the whites failed to follow suit and in fact proceeded to retreat into the range over the following hour. This narrowed the white premium values (March/March’23 back to $98.00 from a morning high at $102.00), while also sending the Dec’22/March’23 spread back from $47.10 to be trading at $42.80. Defensive buying then re-emerged from specs across the final; hour to drive prices to new daily highs at $560.20 and ensure a settlement level at $558.00, though the rest of the board did not keep pace with spreads widening because of the continuing spec focus on the front month.