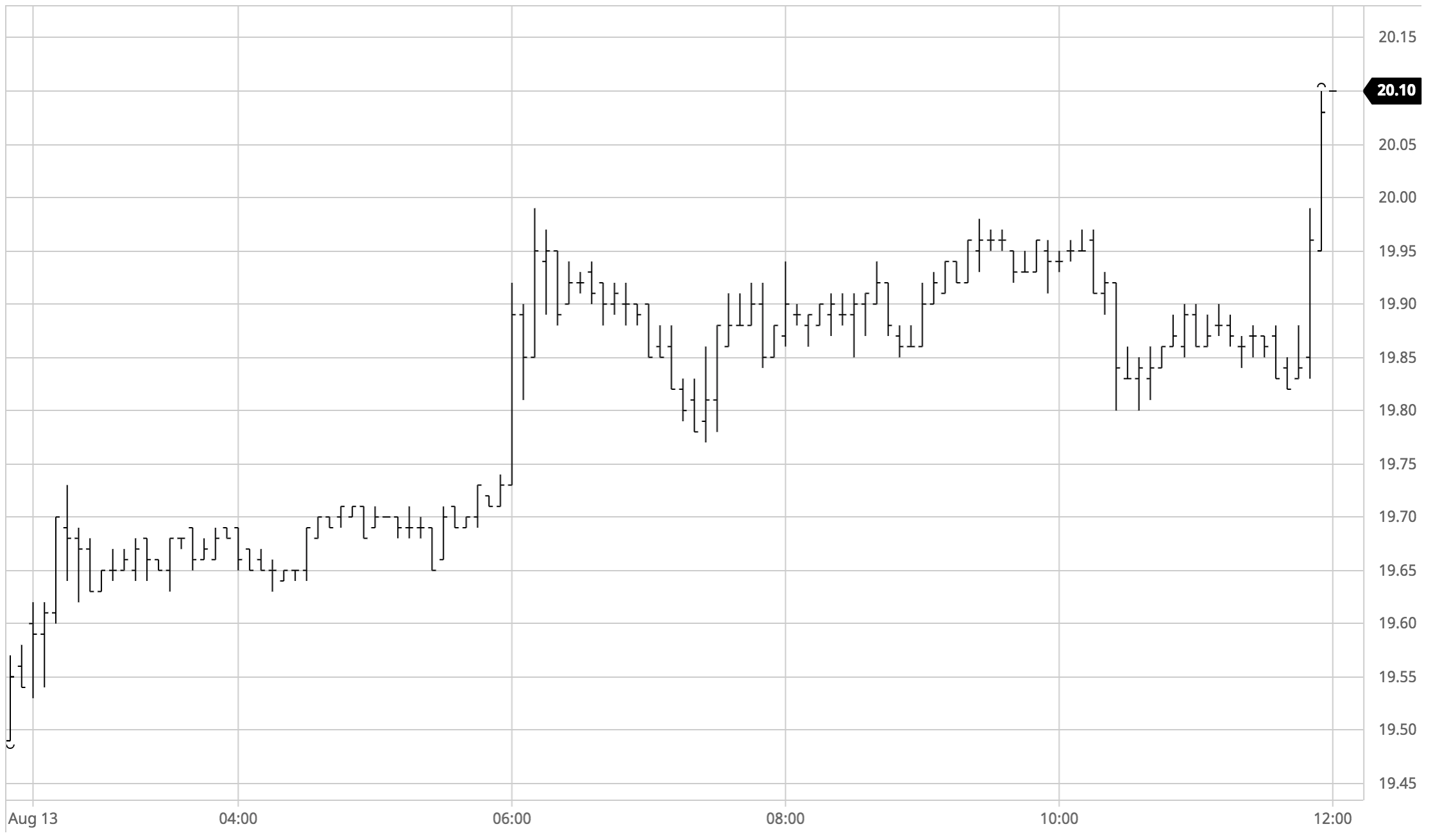

Sugar #11 Oct’21

The market continues to find speculative buying and push upward with the day commencing on a firm footing once again as Oct’21 traded up to 19.73 initially before consolidating a small way beneath this level. The remainder of the morning proved to be remarkably calm until right on noon at which stage an aggressive punch through 19.84 triggered off some buy stops and sent the front month onward to 19.99 before pausing, no doubt frustrating those desperate to see an elusive 20c spot market. There followed a small degree of long liquidation however in the main we remained positive, falling back no lower than 19.77 throughout the afternoon as bulls looked to ensure the technical strength was maintained into the weekend. Most of the support was naturally seen for the front two months which led but to make spread gains against the rest of the board, though the Oct’21/March’22 remained stubborn and by late afternoon was a point weaker at -0.58, a continuing contrarian signal. During the course of the final hour there was a final pre weekend push from the specs which sent Oct’21 through the previously elusive 20c mark to a a new life of contract high at 20.10, before pre-weekend position squaring sent the price back and we ended at 19.95. This still provided a strong conclusion to a week of spec led buying and eyes now turn to tonight’s COT report to see just how much had been bought by that sector as at last Tuesday with the 250,000-260,000 lot area having presented as a top over the course of the past year.

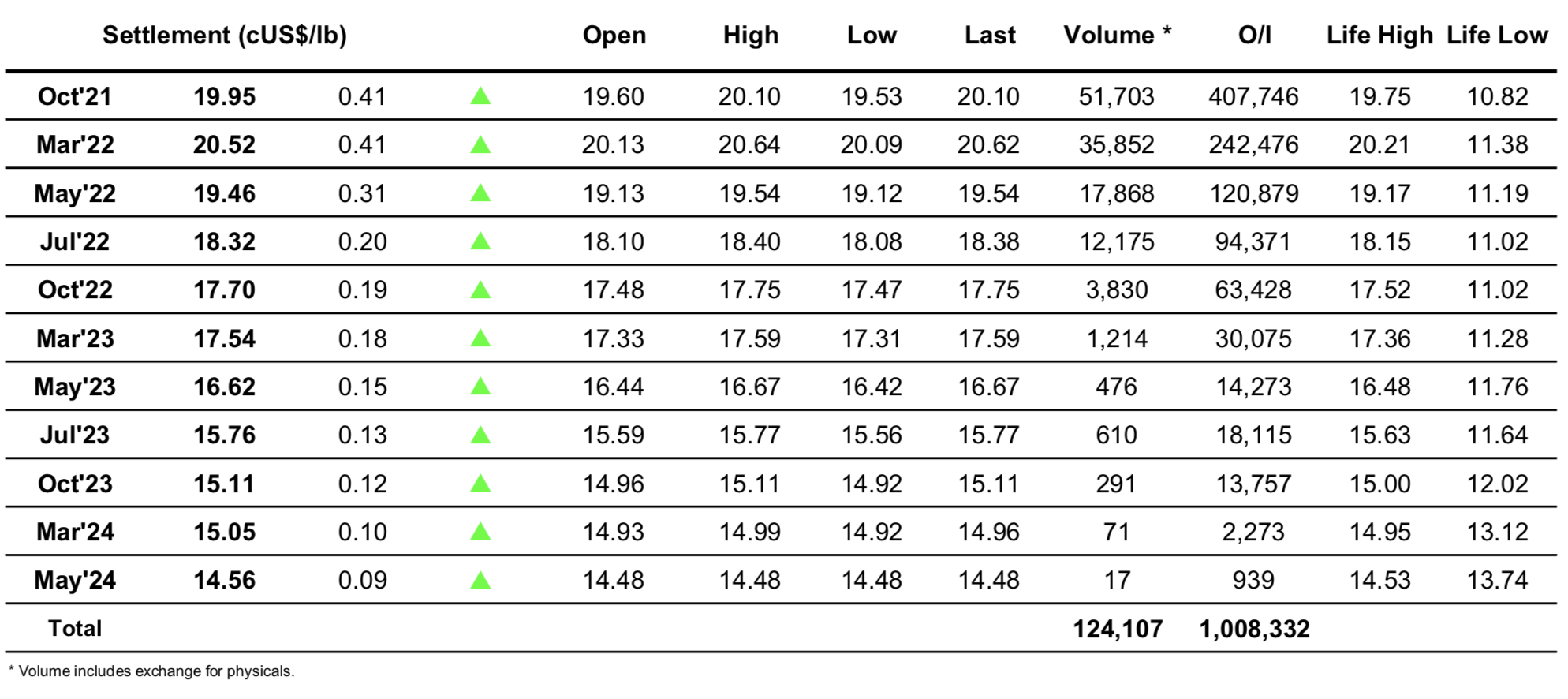

ICE Futures U.S. Sugar No.11 Contract

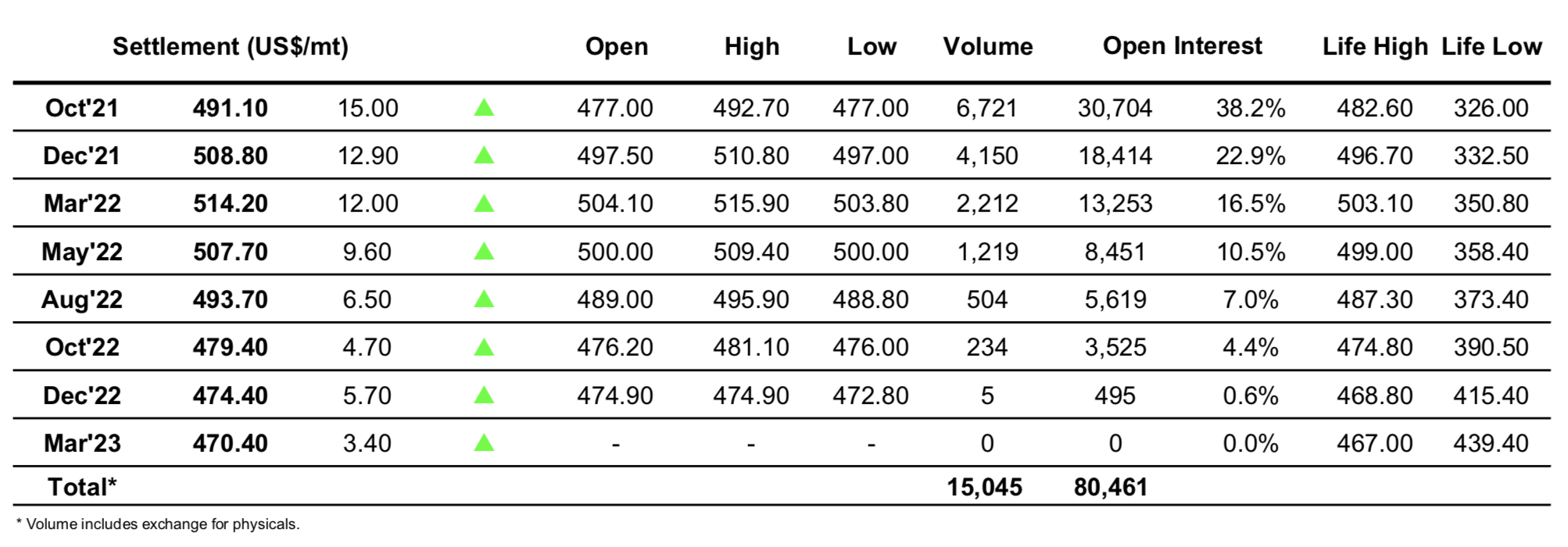

ICE Europe Whites Sugar Futures Contract