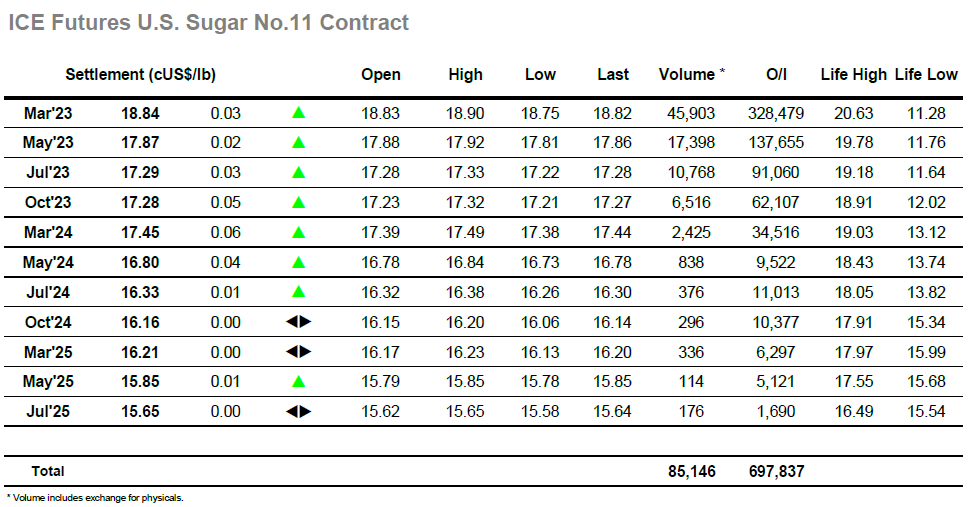

There was an air of consolidation around the market this morning and having printed up a little to 18.88 the market settled into a narrow 5-point range, maintaining the moderate gains with relative comfort. Inevitable there was a little more movement at the start of the US day which saw the price pushed back to 18.75, however with the macro now pushing lower there was a disconnect as sugar quickly pulled back to once again sit in the 18.80’s. Over the course of the afternoon a couple of efforts were made to force the price higher though these merely extended the range to 18.90, but with the macro by now a sea of red we were standing resolute with the specs happy to hold longs given that overhead selling was confined to scales and no pressure was being exerted. Spreads were mostly flat on the day and so we edged along quietly to the close within the range. There were no significant movements heading into the closing call, and the day ended with March’23 settling a mere 3 points higher at 18.84 to leave current parameters and expectations unchanged.

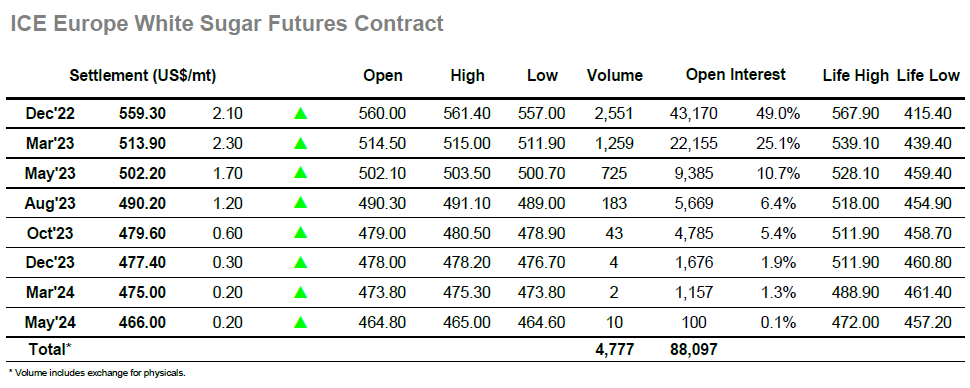

Recent sessions have provided a good deal of volatility, even when the volumes have been low, and so it was unusual to find the market holding a relatively tight band this morning. Having initially failed to maintain gains, the Dec’22 contract gathered itself to sit juts ahead of $560.00, reaffirming the positive sentiment and intention for the whites without threatening to take off and challenge recent highs. The resilience of the whites was shown through white premium values which continue to maintain positivity, Dec’22/March23 trading above $144.00, though spreads were subdued. As the day progressed, we remained confined to the narrow range, a rather tedious way to conclude the week yet a solid showing in the context of the macro which was seeing losses across all sectors of the commodity world. Dec’22 settled at $559.30, modest gains which leave the picture unchanged.