The negative conclusion to yesterday’s session was soon forgotten as we followed the macro upwards on this morning’s opening, the initial buying sufficient to see October swiftly working back above the former 11.40 support level. While the rally was not rapid the initial push and macro support was sufficient to stem the spec liquidation that occurred over the past couple of sessions, encouraging support around the 11.40 once again during the morning. A sharp rally up to 11.58 followed in reaction to a sharp surge in the London whites, where light buying into the Aug’20 contract ahead of tomorrow’s expiration sent that contract up by almost $15, dragging the rest of the whites board and in turn the No.11 upwards to a lesser degree. This in turn provided a higher platform for further consolidation and while stability elsewhere in the commodity/equity world was helping Sugar was in many ways going it alone as a push to 11.68 sent No.11 to the top of the daily gains in the CRB. The turnaround became even more remarkable as fresh spec and algo buying sent the price soaring as we approached the final hour, with more than 8,000 lots trading between 11.68 and 11.90 in a matter of minutes to suddenly leave us back in the middle of the broad range that has played out since early June. These gains were maintained through until the close with settlement at 11.82 making yesterday’s poor technical performance a distant memory and showing that hopes of a break from the range were clearly premature. Moving forward the pattern of producer selling above 12c and consumer buying below 11.50 seems likely to be maintained, making it hard to see a meaningful break from the status quo happening soon with the pattern of spec and algo activity within the range likely to continue.

SB Oct – Sugar No.11

ICE Futures U.S. Sugar No.11 Contract

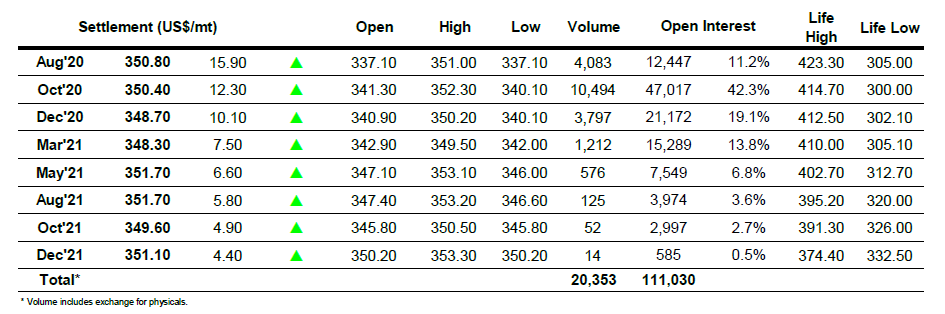

ICE Europe White Sugar Futures Contract